Bitcoin Plunges to New Lows—Shattering Investor Optimism

Bitcoin's brutal descent continues, defying bullish predictions and testing the faith of even its staunchest believers.

The Unshakeable Downtrend

No major catalyst, no single piece of bad news—just a steady, grinding sell-off that's carving fresh trenches in the price chart. The 'digital gold' narrative is getting tarnished as it tracks closer to commodities in a fire sale than a safe-haven asset.

Hope Is Not a Strategy

Portfolios are bleeding. The 'buy the dip' crowd is running out of dry powder, and leverage is getting liquidated across the board. It's a classic market cleanse, flushing out the over-leveraged and the over-confident—a painful but necessary reset.

Where's The Bottom?

Technical supports have shattered like glass. Analysts are scrambling to redraw their lines, searching for a foothold in a market that's all falling knife. The usual cheerleaders have gone quiet, replaced by the sober hum of risk reassessment.

This is the moment that separates tourists from residents in crypto. The hype cycle is over; what's left is pure, unadulterated price discovery. Remember: the market can stay irrational longer than you can stay solvent—a timeless finance jab that hits different when your screen is a sea of red.

The Oracle’s Insights

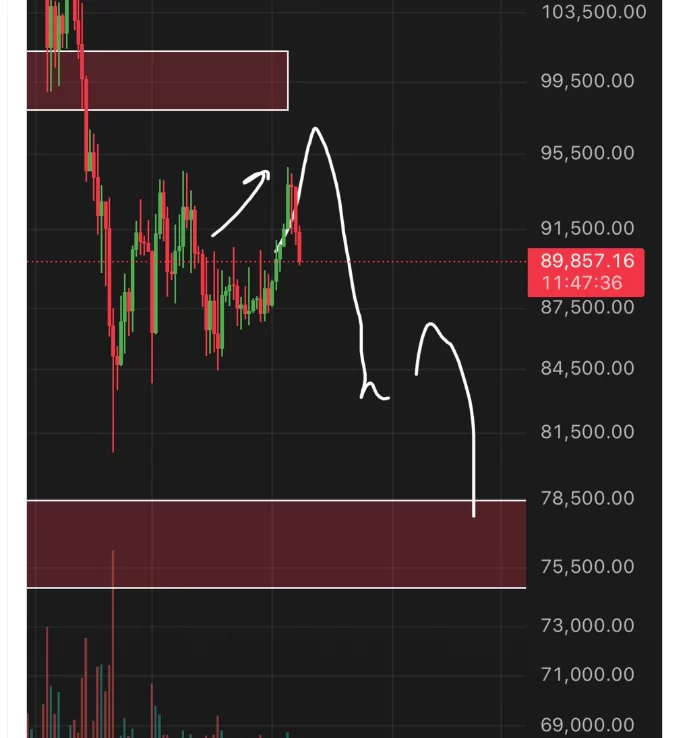

An analyst under the pseudonym Roman Trading, who made accurate predictions in the past two quarters, views each new rise as a selling opportunity. He had previously warned cryptocurrency investors when BTC was above $120,000, suggesting that the journey to $80,000 was imminent. Today, he shares a graph indicating that even the $89,000 level will be lost.

His target is $76,000 with an expectation for an extreme bearish dip around $56,000. He states, “Currently at the $89,000 level, I believe it will fall further. I still anticipate a drop to the $76,000 level and this lateral movement is merely a reset to reach there. I see no signs of a reversal and the high time frame remains significantly bearish.”

If Roman Trading proves correct, 2026 could be a period of destruction for cryptocurrencies, with altcoins potentially facing losses exceeding 90%. Nevertheless, the prolonged conditions of excessive selling suggest that at some point, a multi-week break is necessary, which may begin next week.

Significant Developments

At 21:00, announcements from the WHITE House spokesperson Leavitt are expected, with no other significant developments scheduled for later. Tomorrow, considerable volatility is anticipated due to both employment data and the announcement of the Supreme Court’s decision. If the court surprisingly rules in favor of Trump, it might ease risk markets.

The key developments from the last 24 hours are summarized as follows:

- Trump banned institutional buyers from purchasing homes, shocking the real estate sector and Wall Street, while removing dividend payments for defense companies but ensuring stock balance through promises of massive defense spending.

- China suspended H200 chip orders from Nvidia, exerting pressure on the AI supply chain.

- The Senate Agriculture Committee, alongside the Banking Committee, will hold a meeting on January 15 discussing the crypto market structure, with CLARITY progressing.

- Senator Cynthia Lummis indicated lawmakers are close to agreeing on US crypto market structure regulations.

- Trump-affiliated World Liberty Financial has applied for a banking license.

- Polymarket partnered with Dow Jones to provide prediction market data to WSJ, Barron’s, and IBD.

- Ripple announced it won’t go public, focusing instead on balance sheet strength and growth.

- Rumble enabled Bitcoin tipping for publishers through MoonPay.