Roman Trading’s 2026 Altcoin Forecast: Bold Market Moves Ahead

Roman Trading just dropped a bombshell prediction for the altcoin market—and it's not for the faint of heart.

The Setup: A Market Primed for Shakeups

Forget the sleepy sideways action. Analysts are pointing to a convergence of technical indicators and on-chain metrics that suggest a major liquidity shift is imminent. It's the kind of environment where established narratives get flipped overnight.

The Play: Capital Rotation on Steroids

Watch for smart money to bypass the usual blue-chips and dive headfirst into high-beta, low-float tokens. The strategy hinges on capturing explosive, asymmetric moves—the kind that make or break quarterly returns. It's a high-stakes game of musical chairs, and someone's always left holding the bag (usually the retail crowd chasing last week's pump).

The Catalyst: More Than Just Hype

This isn't just about speculative fever. Real protocol upgrades, tangible adoption metrics, and regulatory clarity in key jurisdictions are providing fundamental fuel. Projects that actually ship code and generate revenue are separating from the pack of vaporware and memecoins.

The Bottom Line

Roman's call signals a potential end to the altcoin winter. It's a playbook for aggressive portfolio rebalancing, demanding deep research and even deeper conviction. In a market where most "financial advisors" are just glorified trend followers, this kind of forward-looking analysis cuts through the noise. Get ready for volatility—and opportunity.

Oracle’s Altcoin Recommendations

Roman Trading has earned his oracle reputation due to accurate predictions throughout much of 2025. However, as historical trends suggest, even acclaimed analysts like PlanB and Capo fell from favor as market conditions evolved since 2021. Roman Trading’s reluctance to accept changing market dynamics may also lead to a downfall. Followers risk significant financial losses by blindly adhering to his strategies.

Instead of copying trades, analysts’ evaluations should be used to gain diverse market perspectives. In today’s analysis, Roman Trading asserted that a historic purge must occur before a true altcoin bull run can happen. He claims that with over 30 million random coins, 99.99% are worthless. While the 30 million figure seems exaggerated, the altcoin market is largely constrained to assets on mainstream exchanges, numbering fewer than 800.

Roman Trading identifies three alternative assets worth considering:

- BTC: Many analysts stress maintaining a substantial portfolio weight in Bitcoin.

- ETH

- AI Altcoins: Solid, hyped cryptocurrencies with a strong foundation.

XMR and APT Coin Insights

ZEC Coin’s massive collapse and dethroning among privacy-focused altcoins benefit XMR. A complete team resignation compounded the internally driven decline expected in early 2025. An analyst known as CryptoBullet believes Monero (XMR) is an excellent alternative amidst this turmoil. Beyond technical analysis, various motivations drive investors using privacy altcoins to flee ZEC for XMR.

The chart indicates that the $460 target has been approached only three times in eight years, potentially unlocking significant gains. Buller perceives a $2,000 price mark as a plausible goal.

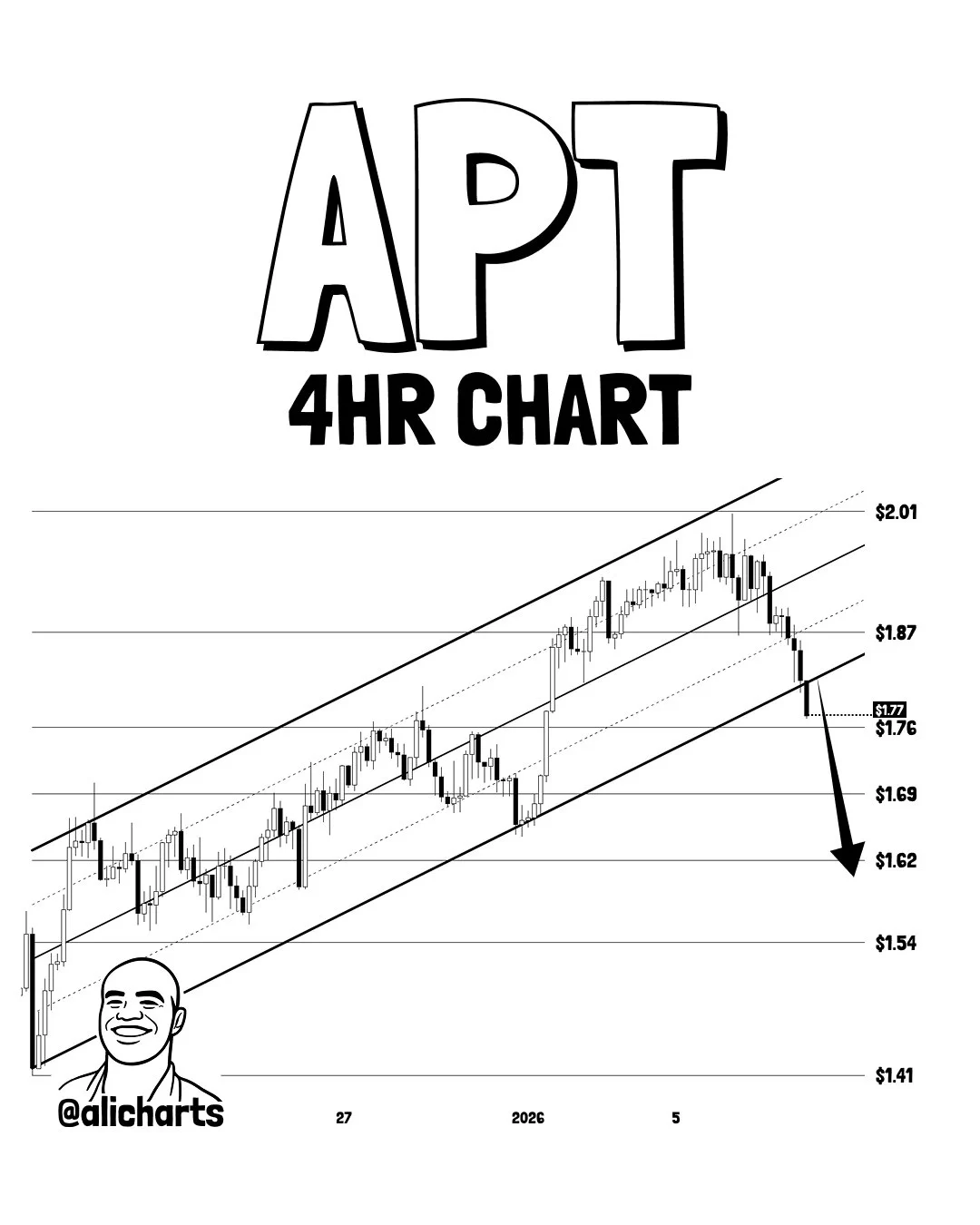

Regarding APT Coin, Martinez predicts a target of $1.62, with accelerations in sales anticipated.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.