Bitcoin Prices Drop as Economic Indicators Weigh Heavily - Here’s What’s Really Happening

Bitcoin takes a hit—again. Economic indicators flash red, and crypto markets tumble in response. It's the same old dance, but this time feels different.

The Pressure Cooker

Forget the technical jargon for a second. When traditional economic signals—think inflation reports, central bank murmurs, employment data—start looking shaky, capital gets nervous. And nervous capital flees risk. Bitcoin, still painted with that 'speculative asset' brush by the suits on Wall Street, often gets sold first. It's a liquidity flush, plain and simple. The digital gold narrative gets tested every single time.

A Market Out of Sync?

Here's the provocative part: is this a fundamental re-evaluation of Bitcoin's value, or just automated trading algorithms reacting to headlines they don't understand? The crypto market's 24/7 nature means it absorbs global news in real-time, often overreacting before traditional markets even open. That volatility isn't a bug; for many, it's the terrifying, lucrative feature.

Look Past the Headline Noise

Sharp downturns create sharper conversations. They separate the HODLers from the tourists. While mainstream headlines scream about a crash, the core infrastructure—the mining network, developer activity, institutional custody solutions—keeps building. The price on a screen is just one metric, and often the noisiest, least informative one in the short term. Remember, the last person to panic-sell during a dip usually funds the next rally.

So, Bitcoin drops. The economic indicators weigh heavily. Traders sweat. And somewhere, a hedge fund manager just paid for his third yacht by shorting the fear—proving once again that in finance, the only true indicator is who's holding the bag when the music stops.

U.S. Economic Data and Interest Rate Cuts

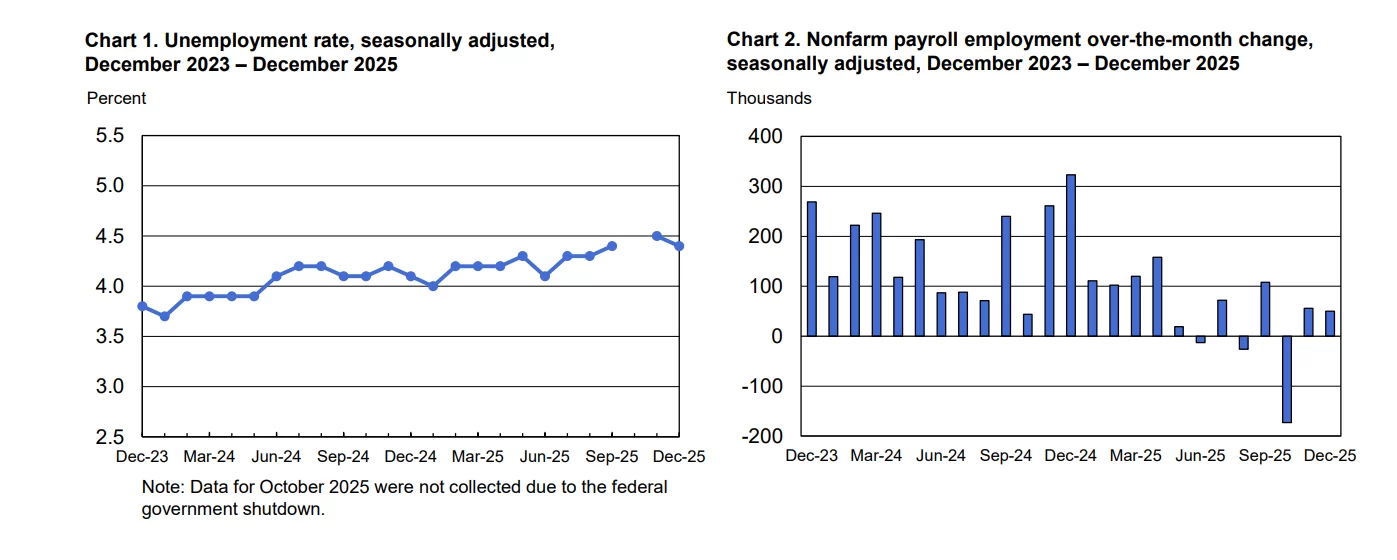

The expectation for a rate cut in January has nearly vanished. The unemployment rate came in below both expectations and the previous month’s figures. This lends some support to Federal Reserve members’ assertions that no significant collapse is happening on the employment front, aligning with their 2025 projection of three rate cuts. Consequently, market expectations for 2026 have now decreased to 50 basis points.

While TRUMP and his team anticipate a reduction up to 10 basis points, attention now turns to the upcoming inflation report. If next week’s inflation report matches or exceeds expectations, the Fed will have little reason for an imminent rate cut and might opt for a gradual policy approach for a soft landing.

Key points from the report:

- The Non-Farm Payrolls data for November was revised down by 8,000.

- Retail lost 25,000 jobs in December, with supermarkets and general stores accounting for a 19,000 reduction.

- The average hourly earnings for all employees on private nonfarm payrolls rose by 0.3% to $37.02 in December.

- Long-term unemployment (27 weeks or more) remained relatively unchanged at 1.9 million in December but increased by 397,000 from a year earlier.

- Average monthly employment gains in 2025 (49,000) lagged significantly behind those of 2024 (168,000).

Impact on Cryptocurrencies

The outcome for investors wasn’t unexpected; although BTC prices briefly rose by $200-300 after the report’s release, they soon retreated downward. It seems likely that bitcoin will fall below $90,000 in the coming hours as annual interest rate cut expectations are revised downward. In May, the Fed will be under the control of a Trump-appointed chair, but even with a new leader, it will remain bound by data and may not implement rate cuts if employment rebounds.

The December inflation report expected next week will provide clearer insights into this year’s interest rate cut trajectory. As of now, signals for “employment contraction,” which WOULD make rate cuts in the last quarter of 2025 mandatory, have weakened.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.