Brace Yourself for the Next Big Crypto Wave: The 2026 Bull Run Is Here

The institutional floodgates are open. Forget the 2021 hype cycle—this isn't retail FOMO. This is capital reallocation on a global scale.

The New Infrastructure Is Live

Layer-2 networks now process transactions at speeds that make legacy rails look like dial-up. Zero-knowledge proofs validate without exposing data—privacy meets compliance. The tech finally delivers what the whitepapers promised a decade ago.

Regulation: The Unexpected Catalyst

Clear frameworks from major economies did what no developer could: legitimized digital assets for pension funds and asset managers. The 'Wild West' narrative is collapsing under the weight of trillion-dollar balance sheets seeking yield. Funny how regulatory clarity arrives once traditional finance figures out how to profit from it.

DeFi Eats the Middleman

Automated market makers cut out the broker. Smart-contract loans bypass the loan officer. Tokenized real-world assets—from treasury bonds to carbon credits—flow on-chain 24/7. The infrastructure doesn't just disrupt; it replaces.

The Portfolio Rebalance

Allocations are shifting. What was a speculative 1% play in 2023 is becoming a core 5% holding. The calculus changed when correlation with traditional markets broke down. Digital gold narrative? Try 'digital infrastructure equity.'

The wave isn't coming. It's already cresting. The only question left is who built a boat—and who's still waiting for permission from their risk committee to get their feet wet.

Solana’s Market Position

The Supreme Court’s tariff decision has been postponed, with a possible announcement on Wednesday. The significance of the coming days is heightened due to impending inflation data. Investors might opt for caution as employment data has been unfavorable for risk markets. This indicates that substantial weekend surges in cryptocurrencies might not be seen. Currently, BTC maintains a position above $91,000.

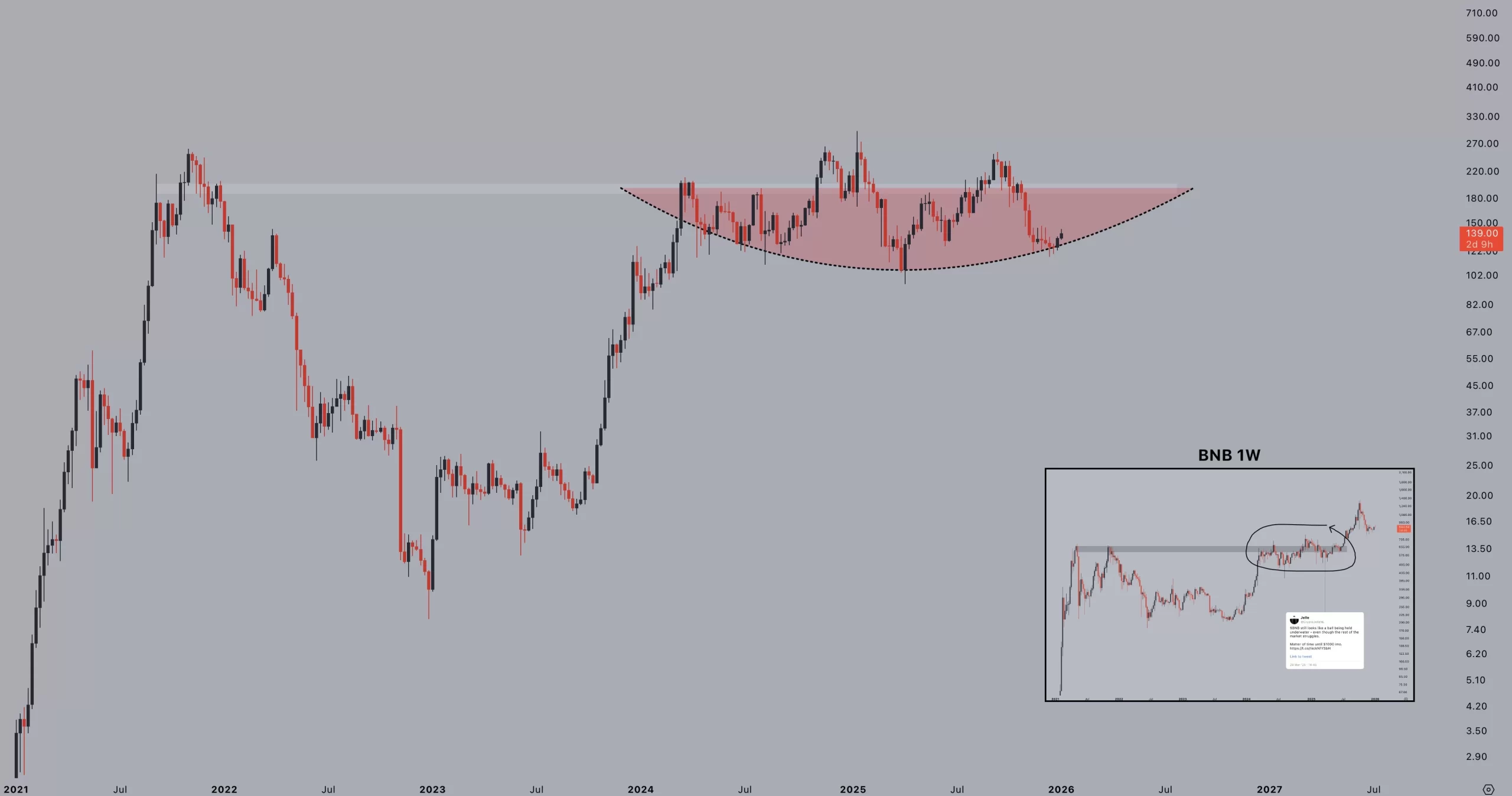

Solana (SOL) hovers around $138, exhibiting prolonged inactivity. Analyst Jelle commented, observing the parallels to BNB, suggesting that SOL might remain flat indefinitely before rallying unexpectedly. Jelle expects similar outcomes as he continues to hold his coins.

The SOL Coin has seen over $10 million net inflows recently, generating positive interest with total assets approaching 1.5% of supply. Institutional expectations of a sudden move to $200 are likely. Solana has a strong chance of ranking as the third-best cryptocurrency due to its robust ecosystem. Despite competing for this rank with XRP Coin, Solana follows ethereum closely as a powerful layer-1 solution.

Crypto Tony shared the above chart, hinting at a promising outlook, suggesting new highs if BTC stabilizes.

Imminent Market Swing

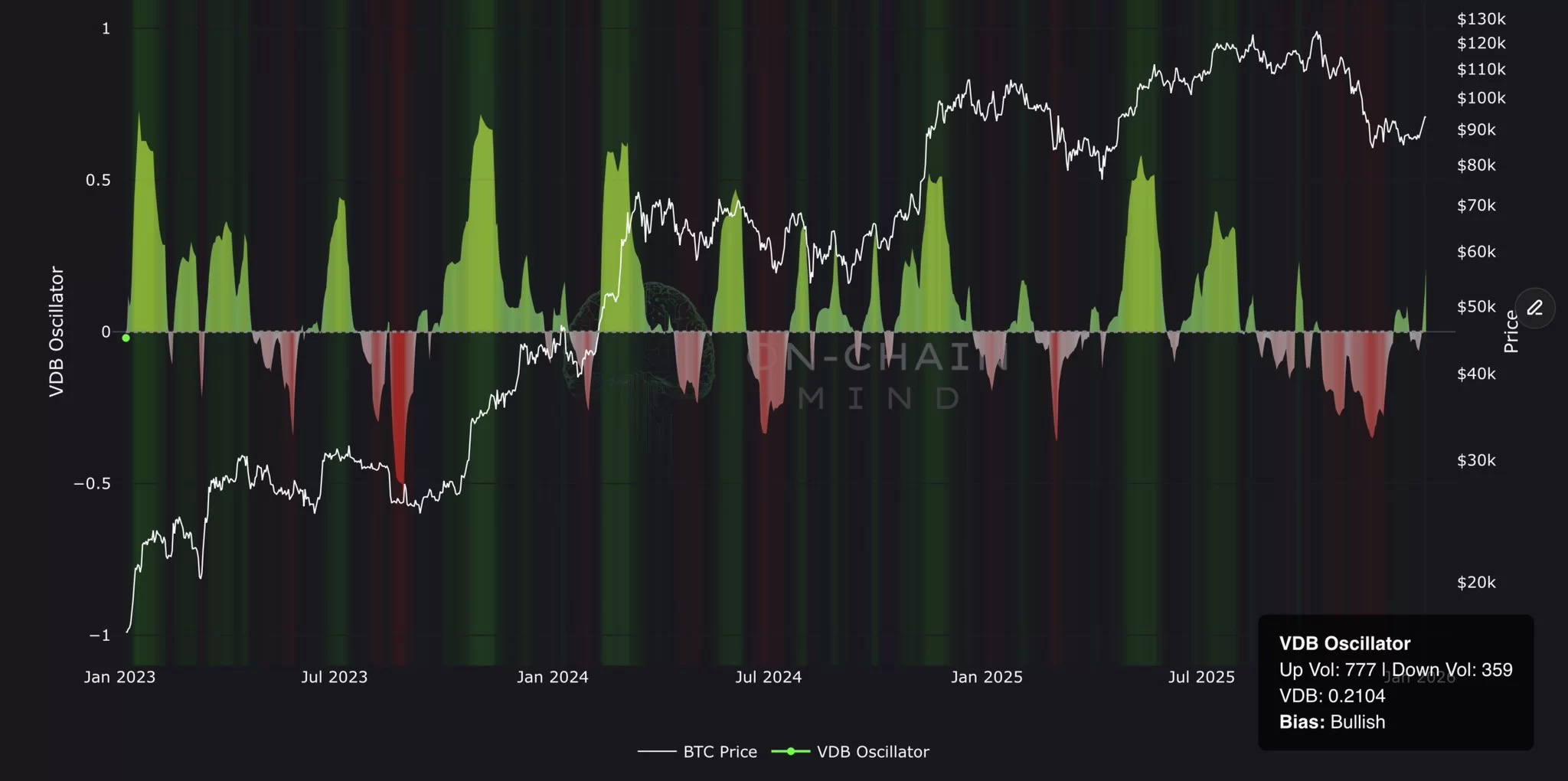

Current news streams suggest an imminent significant market swing. Besides the news, the VDB indicator hints at increasing volatility, though direction remains uncertain. On-Chain Mind concludes that there’s a slight edge towards bullish potential. Still, those familiar with the unpredictable nature of cryptocurrencies remain justifiably cautious.

In the event of an upward trend, a daily close above $94,000 could lead to surpassing the $98,000 threshold. Achieving the investor cost area WOULD keep participants engaged even if enthusiasm wanes, supporting a healthy continuation of the uptrend.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.