Tokenized Gold Market Nears $3B as Bullion Blasts to Fresh Record Highs

Digital gold meets physical metal in explosive market convergence

The Tokenization Tsunami

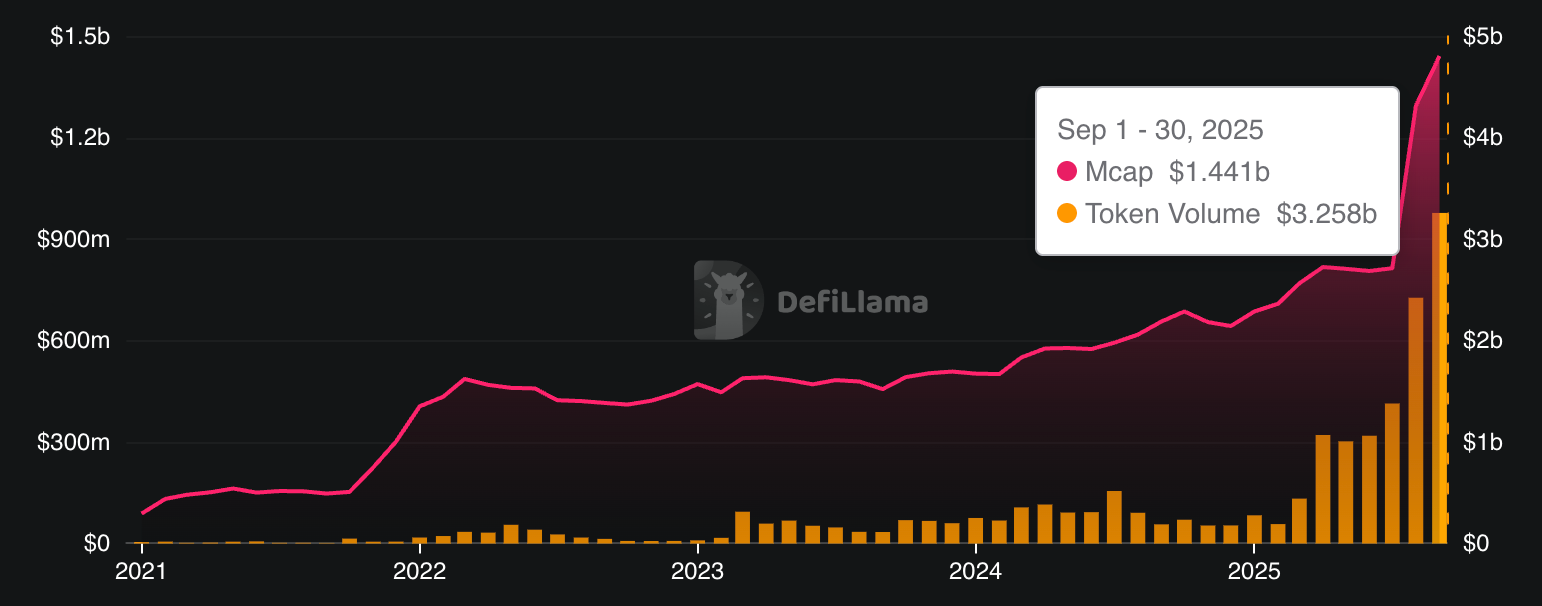

Tokenized gold platforms surge toward that psychological $3 billion barrier—proving even ancient stores of value need modern distribution channels. Physical bullion's relentless climb to unprecedented peaks creates perfect conditions for digital adoption.

Wall Street's Worst Nightmare

Traditional gold ETFs watch helplessly as blockchain-based alternatives capture market share. No storage fees, instant settlement, and global accessibility—everything physical gold promises but rarely delivers efficiently.

The Institutional Awakening

Major funds finally recognize what crypto natives knew years ago: digital ownership beats paper certificates. The $3 billion milestone represents just the beginning of capital migration from legacy systems to blockchain efficiency.

Because nothing says 'stable store of value' like needing digital intermediaries to access your physical asset—the financial sector's latest attempt to make gold interesting again actually works.

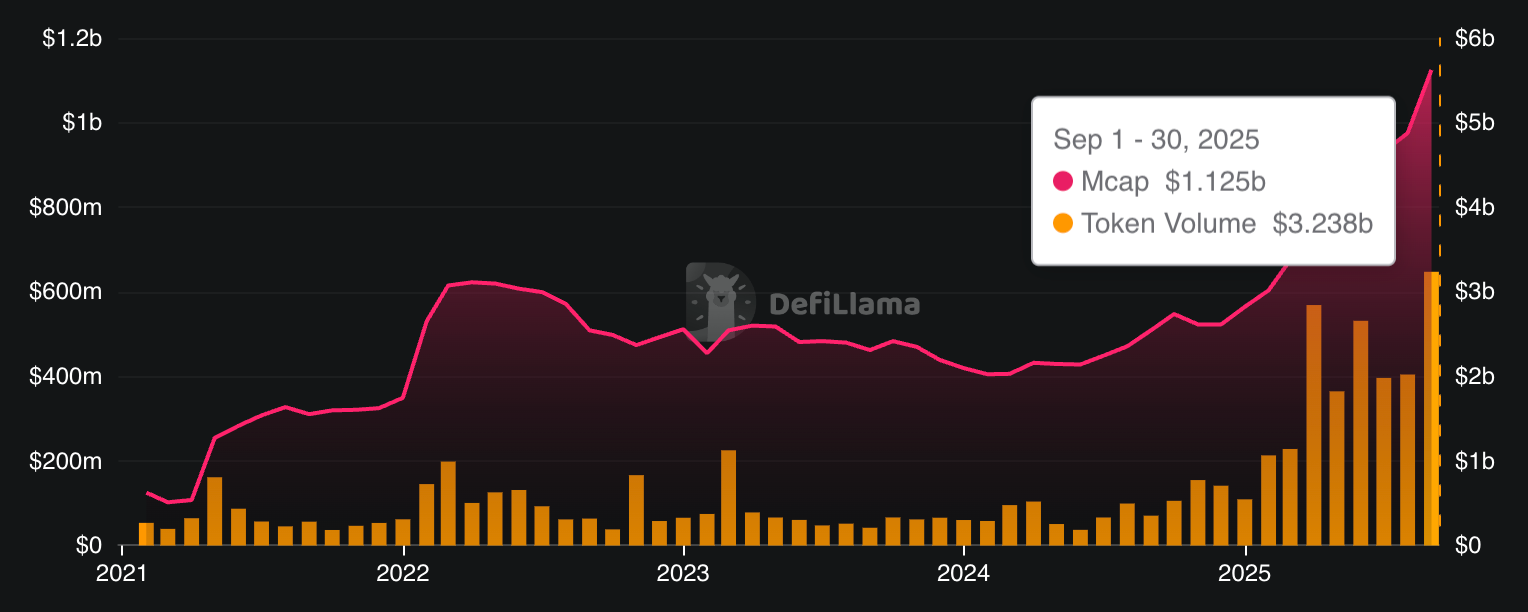

XAUT also posted a record $3.25 billion in monthly volume, per DeFiLlama. Meanwhile, the token's market cap growth came solely from the underlying metal's appreciation, as no new token minting happened this month after August's $437 million jump.

The tokenized gold market could continue gaining as macro conditions remain supportive for the yellow metal. Investors expectations mount for more Federal Reserve rate cuts and a softer U.S. dollar, while anxiety builds over a possible government shutdown in the U.S. Meanwhile, Bitcoin (BTC), often dubbed as "digital gold," is lagging behind gold with a 22% year-to-date return.