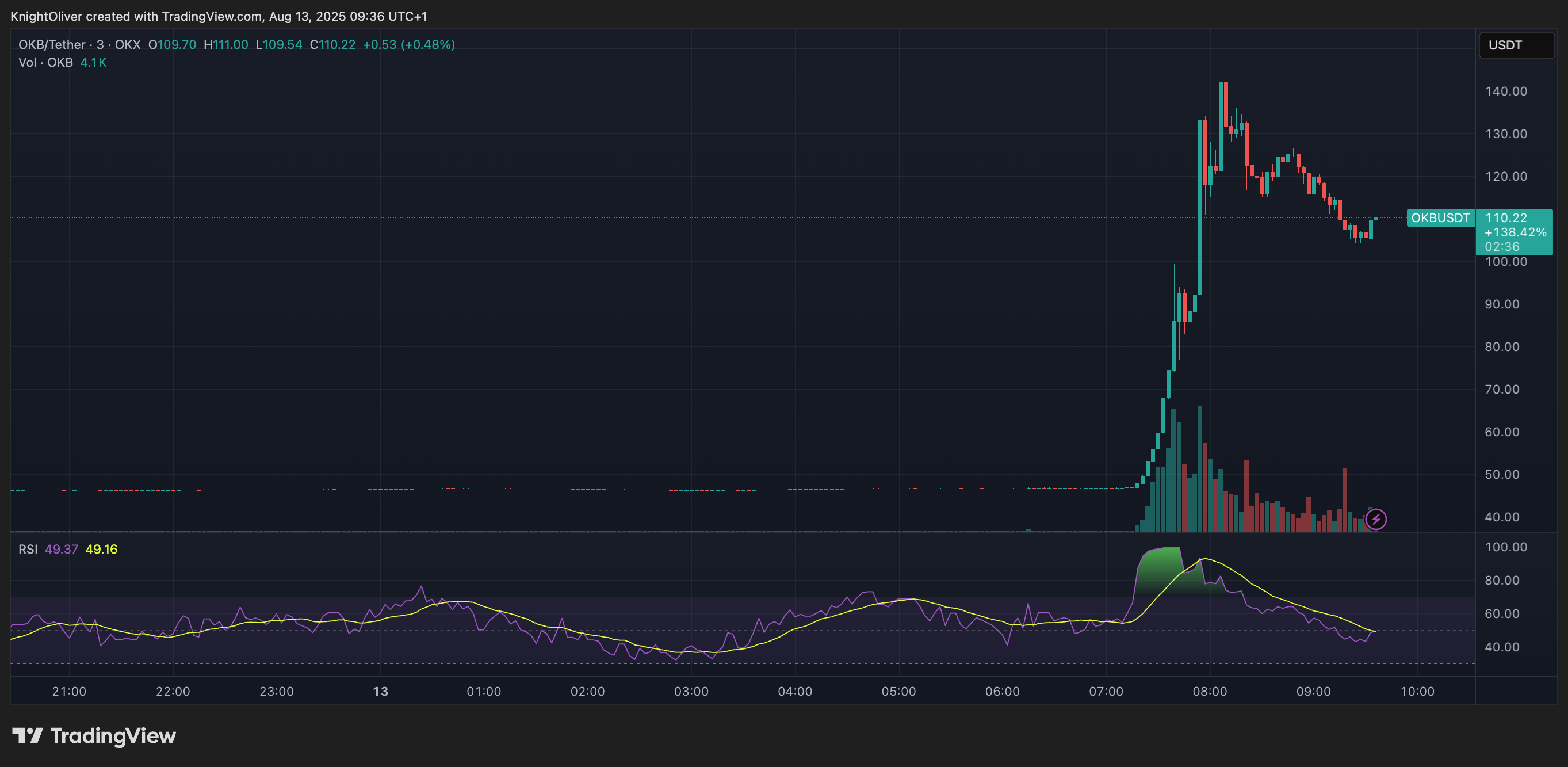

OKX Ignites Market Frenzy: 50% OKB Supply Burn Sends Token Soaring by $7.6B

OKX just pulled a deflationary power move—torching half of OKB’s supply in a $7.6 billion burn. Cue the price rally.

Supply Shock, Demand Spike

Scarcity 101: When you vaporize tokens faster than a meme coin’s credibility, markets notice. OKB’s price reacted like it just got a VIP pass to the bull run.

The Fine Print (Because Finance Loves Irony)

Another exchange, another token burn—because nothing says ‘value creation’ like artificially juicing prices. At least this one had the decency to deliver a double-digit pump.

The strategy mirrors that of BNB, the token of BNB Chain, which is associated with rival exchange Binance. That undergoes quarterly burns that often precede short-term rallies.

Supporting that narrative, OKB’s turnover ratio, a measure of trading activity relative to supply, spiked from 0.03 pre-announcement to 0.093, signaling heightened speculative and strategic positioning.

Sustained price momentum will depend on whether OKX can continue to drive adoption of its X LAYER blockchain, of which OKB is the native token. To that end, the exchange plans to increase transaction speed and reduce gas prices, according to a blog post. It will also be phasing out Ethereum-based OKB tokens, which can now be redeemed for X Layer versions.