Why Tokenized Equities Demand ADR-Style Safeguards for Investor Protection

Wall Street's digital revolution hits a regulatory wall—tokenized stocks are booming, but who's guarding the vault?

The custody gap no one's talking about

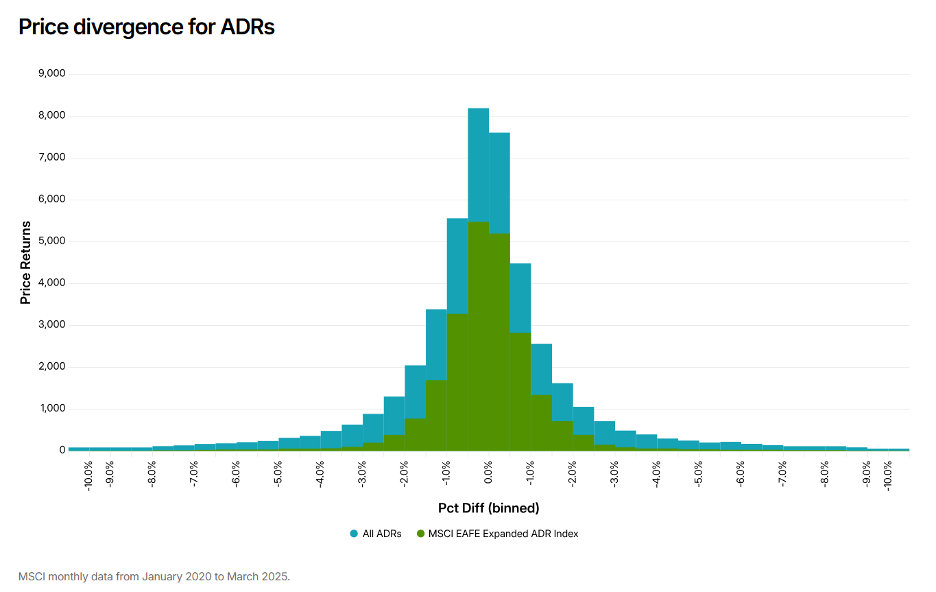

While blockchain purists cheer borderless trading, traditional finance veterans spot the flaw: zero standardized protections for cross-border tokenized equity holders. Unlike American Depositary Receipts (ADRs)—which bundle foreign shares with clear rights—today's crypto-equity hybrids operate in a legal gray zone.

Smart contracts ≠ shareholder rights

Platforms promise 24/7 trading of Tesla or Apple tokens, but skip the fine print: dividend distributions rely on issuer goodwill, corporate actions get messy, and good luck voting those shares. ADRs solved this decades ago with custodian banks and prospectus disclosures—solutions now gathering dust in the Web3 gold rush.

The coming reckoning

When (not if) a high-profile tokenized equity blows up, regulators will pounce. The irony? Crypto's hated intermediaries—banks—might become its necessary evil. Because nothing screams decentralization like begging JPMorgan to custody your blockchain stock certificates.

- Scalability

ADRs can be deployed by both stock issuers and secondary market participants, enhancing scalability and adoption — unlike on-chain issuance models reliant on issuer initiation and active maintenance.

Proven and fully integrated into global finance, applying the ADR structure to tokenized equities is a logical evolution.

As tokenization matures, this kind of innovation is critical to scaling adoption and trust. Just as SEC Rule 12g3-2(b) streamlined access to foreign issuers, a similar regulatory mechanism could unlock broader tokenized equity markets, enabling public companies to offer tokenized shares to U.S. investors in a compliant manner.

The path forward doesn’t require inventing a new wrapper — it requires adapting a proven one. In other words, the bridge between traditional finance and digital infrastructure already exists. It just needs to be thoughtfully crossed.