21Shares Revamps Dogecoin ETF Filing: Lower Fees, New Custodians Revealed

Dogecoin's wild ride gets institutional polish as 21Shares refiles its ETF proposal with sharper terms.

Key updates:

- Fee structure slashed to compete in the crowded crypto ETF space

- Big-name custodians added to reassure regulators about asset safety

The move comes as traditional finance finally stops pretending memecoins are just a joke—while still charging you 2% for the privilege of taking them seriously.

The update news immediately pushed the coin's price above $0.15, rising more than 11% in the last 24 hours, as the momentum grew around its dogecoin ETF approval in December.

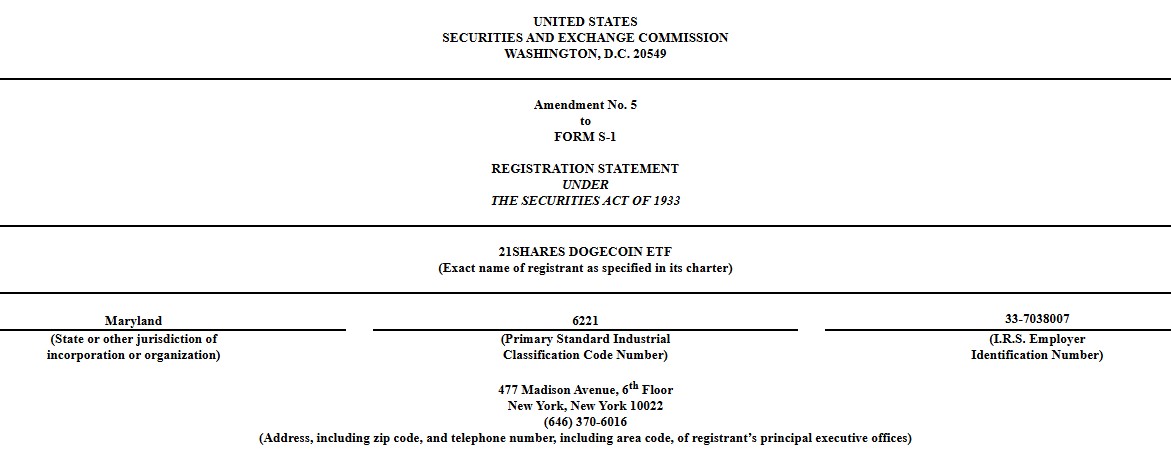

21Shares Updates the Fund's Application: Fee Set at 0.50%

The latest SEC submission marks the fifth amendment to the company’s S-1 filing. For the first time, 21Shares has outlined the ETF’s complete fee and custody setup:

Management Fee: 0.50%, charged daily and paid weekly in DOGE-coin

Administrator & Custodian: Bank of New York Mellon

Additional Custodians: Anchorage Digital Bank & BitGo

Trustee: Wilmington Trust NA

Marketing Agent: Foreside Global Services

Accounting Firm: Cohen & Company

The filing still includes a “delaying amendment,” which means the fund cannot launch until the SEC formally declares it effective.

Once approved, the TDOG ETF will directly hold DOGE and track its price using the CF Dogecoin-Dollar Settlement Index.

Growing ETF's Activity Fuels Dogecoin Momentum

This update lands during a busy month for DOGE-related ETFs.

In addition to 21Shares:

Grayscale recently converted its Dogecoin-trust into a spot ETF, GDOG.

Bitwise is launching its own Dogecoin ETFs under the ticker BWOW.

The wave of filings is creating increased confidence that DOGE ETFs may soon become mainstream investment products. Ahead of listing, 21Shares also plans to use $1.5 million in seed capital to purchase DOGE, signaling strong commitment to the launch.

DOGE Price Jumps as Traders Position for Approval

Dogecoin reacted quickly to the fund update, climbing to $0.1500 with a 9.43% 24-hour gain, with 40% up in daily volume to $1.8 billion. The price traded between a $0.1369 – $0.1519 range, supported by a breakout above a key trendline. With rising momentum, and increased derivatives activity, Doge is showing renewed strength ahead of potential exchange traded fund's approvals.

DOGE remains below its 50-MA and 200-SMA, but the breakout is offering fresh support

RSI at 45.19, signalling room for a further upside

Futures open interest (OI) increased 8% to $1.50B

Binance, OKX, and Bybit all show rising OI, indicating strong bullish sentiment among derivatives traders.

Why the Fee Update Matters for TDOG

The 0.50% fee puts TDOG in the middle range of spot crypto ETFs, more affordable than some, higher than others, but still attractive to mainstream investors seeking simple, regulated Dogecoin exposure.

The ETFs will hold the coin directly, without leverage, swaps, or complex strategies, making it a clean spot product.

This clarity in the filing signals that 21Shares is nearing the last steps before approval, though the final decision rests with the SEC.