Ethereum Sharks Drive ETH Back to $3,237 - Is $5,000 the Next Target?

Ethereum's price just surged back to $3,237, and the market's big players are behind the move. Forget retail sentiment—this rally has the distinct fingerprints of crypto sharks accumulating positions. Their buying pressure sliced through resistance levels that had stalled the asset for weeks.

The Anatomy of a Shark-Fueled Rally

When wallets holding 100 to 10,000 ETH start moving, the market notices. These aren't day traders; they're strategic accumulators with enough capital to shift momentum. Their recent activity didn't just nudge the price—it catapulted Ethereum past key psychological barriers, setting the stage for the next major test.

From $3,237 to $5,000: The Path Ahead

The $3,237 level now transforms from resistance into a potential launchpad. The narrative pivots to whether this whale-driven momentum can sustain a push toward the fabled $5,000 mark. It's a classic setup: strong hands lead, weak hands follow, and everyone watches the charts for confirmation.

Technical patterns align with the on-chain data, suggesting the rally has room to run. Of course, in crypto, a 'suggestion' is about as reliable as a traditional banker's promise—often made, rarely kept without a hefty fee attached.

Market structure looks primed. Liquidity pools above current levels are the obvious targets. If the sharks continue their feeding frenzy, each higher price point becomes a self-fulfilling prophecy of sorts, at least until the next macro tremor shakes the confidence out of everyone.

So, is $5,000 next? The whales seem to be betting on it. The rest of us just get to ride the wave they create—and try not to get washed out when they decide to take profits.

Sharks Buy 450K ETH as Ethereum Price Rally Reclaims $3,237

The turnaround began when shark wallets—those holding 1,000 to 10,000 ETH—flipped from heavy selling to strong accumulation. According to Santiment data, between October 5–10, these wallets dumped around 1.3 million ETH, triggering a sharp market pullback. But from November 18 to December 2, the same cohort bought back nearly 450,000 coins, reversing sentiment and igniting the current Ethereum price Rally.

This wave of accumulation pushed it back to $3,237, marking one of its strongest recoveries since mid-2025. Wallets holding 1K–10K ETH have now expanded toward 185K total addresses, reinforcing that smart-money confidence is returning to ETH.

At the same time, its network growth hit a stunning 190,000+ new wallets created in a single day—a five-month high and a powerful adoption signal that often precedes major rallies. Both fundamentals—wallet buying and user growth—are moving in the same bullish direction.

Whales Position for $3,500 Break as Fusaka Upgrade Boosts Hype

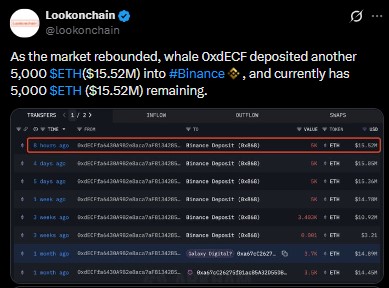

Lookonchain data shows whale 0xdECF deposited 5,000 ETH ($15.52M) to Binance during the recovery while still holding another 5,000 coins. Large inflows like this signal that whales expect higher volatility—and potentially higher prices—ahead.

A major catalyst sits just above current levels: if it touches $3,500, more than $5.8 billion in short positions are projected to liquidate. Traders now believe a short squeeze could be the next major trigger for the ethereum Price Rally.

Adding fuel to the momentum, the Ethereum Fusaka Upgrade is officially live. Developers describe it as the most impactful performance upgrade since Shanghai. Co-Founder Joe Lubin even claimed it could “100x from here,” creating a new wave of investor excitement—even though realistic math shows a climb to $50,000 is a more grounded ultra-bull scenario.

Ethereum Price Prediction: Path Toward $5K and Beyond

It currently trades NEAR $3,212, up 5.96% in the last 24 hours with a market cap of $387.48B and $31.13B in daily volume. The RSI at 52 indicates neutral but improving momentum, supported by a clear pattern of higher lows in December.

It may climb toward $3,600–$4,000 as the Fusaka Upgrade narrative strengthens and ETF flows stabilize. A MOVE above $3,500 could trigger a powerful short squeeze, unlocking rapid upside, though immediate resistance remains at $3,800.

ETH could extend toward $5,500–$8,000, fueled by rising staking demand, lower issuance, and continued Layer-2 ecosystem growth. The key barrier remains the $4,500–$5,000 zone, which must break for a confirmed macro trend shift.

It may realistically reach $12,000–$20,000, while an ultra-bull supercycle—backed by global L2 adoption—could push it toward $30,000–$50,000, assuming multi-trillion-dollar market expansion.

Conclusion

Sharks bringing it back to $3,237, whales preparing for a $3,500 short squeeze, and rapid network expansion together strengthen the Ethereum Price Rally. With the Fusaka Upgrade boosting confidence and 450K accumulating in two weeks, next breakout zone may come faster than expected—especially if volume continues rising.

This is for educational purposes only. Always do your own research before any crypto investment.