Power Protocol Goes Live in 24 Hours: Unpacking $POWER Tokenomics and the Full Whitepaper

Power Protocol hits the market tomorrow—and its tokenomics blueprint just dropped.

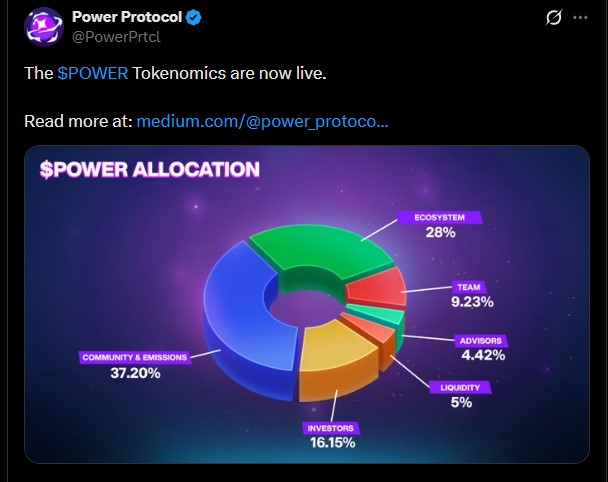

Tokenomics Breakdown: The Numbers Game

The whitepaper lays out the supply mechanics, distribution schedule, and utility hooks for $POWER. No vague promises—just hard allocations, vesting cliffs, and burn mechanics spelled out in cold, hard percentages. It's a masterclass in upfront transparency, or a meticulously planned liquidity trap, depending on which side of the trade you're on.

Why This Launch Matters

Forget 'revolutionary'—this is about execution. The protocol bypasses traditional governance bottlenecks and cuts settlement times. It uses active staking rewards to secure the network and distributes fees directly to holders. The model incentivizes early participation while theoretically preventing the classic pump-and-dump—a tale as old as crypto itself.

The Finance Sector's New Challenger

Power Protocol isn't just another DeFi project; it's a direct shot across the bow of legacy finance. It automates roles typically guarded by fund managers and custodians, all while offering a yield structure that would give a traditional compliance officer heart palpitations. It’s the kind of efficiency that Wall Street brochures dream about but their legal departments nightmare over.

The Verdict: Watch the Tape, Not the Hype

The whitepaper is solid. The tokenomics are aggressive. The launch is imminent. Success now hinges on one thing: whether the market treats $POWER as a functional asset or just another speculative token to be flipped before lunch—because in crypto, even the best-laid plans often meet the brutal reality of the 24-hour chart.

Eligible users can also claim their airdrop using Alpha Points once trading opens. With the whitepaper now live, the market is buzzing with fresh details about the ecosystem, $POWER tokenomics, roadmap, and expected listing price. Keep reading the article to know every detail about tomorrow's launch.

WhitePaper Live: Full Breakdown of Tokenomics for Traders

It is not just a regular token, it’s built to support a fully verticalized entertainment economy across games, infrastructure, and incubation systems. This is why the Power Protocol Listing on Binance is drawing major attention in the industry.

Here is the complete $POWER tokenomics structure, which investors are analysing before the listing:

-

Total Supply: 1,000,000,000

-

Community Rewards & Emissions: 37.2% (13.2% unlocked at TGE, rest across 48 months)

-

Ecosystem Fund: 28% (2.8% at TGE, vesting over 36 months)

-

Investors: 16.15% (0% at TGE, 4–12 month cliff, 6–36 month vesting)

-

Team: 9.23% (0% at TGE, 12-month cliff, 36-month vesting)

-

Liquidity: 5% (5% unlocked at TGE)

-

Advisors: 4.42% (0% at TGE, 12-month cliff, 36-month vesting)

Also, 4% of the total supply goes to Kingdom staking rewards. These balanced and fair whitepaper token distribution systems is the major major reason analysts expect strong launch performance.

As per my market research being a crypto analyst, leading investors like Spartan, Ronin, L1D, Delphi Capital, Arete Capital, and others are backing the project, boosting confidence ahead of the Power Protocol airdrop listing price debut.

Roadmap 2025–2026: What’s Next After Power Protocol Listing?

The team has revealed an exciting multi-phase roadmap pushing the price expectation even higher:

Debut + controlled liquidity + Staking + token sinks foundation

Builder toolkits, Reward-compounding rails, API + identity systems, and proving the protocol expands beyond one game

Labs expansion, Partner projects onboarding, and AI-powered adtech personalization

Non-gaming integrations, Large-scale user growth, and first mass-market partner with billion-dollar marketing budgets

Each milestone increases real utility, which may directly impact the token’s price in the long term.

Price Prediction: What to Expect at Tomorrow’s Launch?

To estimate the launch price, Top cryptocurrency market watchers compare the asset with Marina Protocol price, who has the same total supply. $BAY launched at $0.0994, peaked at $0.1886, and now trades around $0.0607.

-

Expected Launch Price: $0.50 – $0.85, because it has strong tokenomics, long term visionary whitepaper plan, and even stronger backing.

-

Possible First-Day High: Up to $1, depending on volume and exchange activity. If more top exchanges like OKX, MEXC, Bitget, Gate.io, Bybit, and LBank join after the Power Protocol Listing, liquidity could grow rapidly.

-

Long-Term Price Prediction: Up to $3, if market conditions stay positive, and the coin maintains its debut momentum. On the other hand if the crypto market crashes then it might pull back the price towards the $1.50 range.

These predictions are based on strong tokenomics, a clear roadmap, and real gaming adoption.

Final Thought: All Eyes on December 5

With the whitepaper live, VC backing, fair distribution, real gaming utility, and growing ecosystem interest, Power Protocol Listing is shaping up to be one of the biggest launches of early 2025.

The countdown is on, and the market is waiting to see how high the price can go.

Disclaimer: This article is for informational purposes only and not financial advice. Crypto assets are highly volatile. Always DYOR before investing.