India Crypto News: Will Teng’s Backing Propel It to APAC Dominance?

India's crypto scene just got a heavyweight endorsement. Binance CEO Richard Teng's public support for the nation's digital asset potential isn't just talk—it's a strategic bet on the world's fastest-growing major economy. Could this be the catalyst that vaults India past regional giants?

The Regulatory Chessboard

Forget the regulatory fog of the past. The landscape is shifting. While the Reserve Bank of India maintains its cautious stance, a more nuanced framework is emerging piece by piece. The real action isn't in blanket bans, but in the quiet establishment of tax reporting and compliance protocols—a classic move that often precedes broader institutional acceptance. It's the financial equivalent of 'measure twice, cut once,' albeit at a pace that tries the patience of every crypto-native trader.

A Market Primed for Takeoff

Look beyond the headlines. India's tech-savvy, young population represents a demographic tidal wave for crypto adoption. Mobile penetration is near-universal, and digital payment infrastructure is world-class. This isn't just about retail speculation; it's about embedding blockchain solutions into the fabric of a digital-first economy. The latent demand is staggering, waiting for the right regulatory green light to unleash a flood of capital and innovation.

The APAC Power Play

So, can India clinch the top spot? It faces fierce competition. Established hubs like Singapore and Hong Kong offer regulatory clarity, while Japan's long-standing framework provides stability. But India's sheer scale is its ultimate trump card. Teng's backing signals that global players see the endgame: whoever wins India gains an unassailable position in the next decade of finance. The race isn't just about friendly regulations—it's about capturing a billion-person market.

The path forward is a tightrope walk. Excessive control stifles the very innovation that makes crypto valuable, while a laissez-faire approach spooks traditional institutions. India's success hinges on crafting rules that protect investors without protecting legacy banks from competition—a balancing act most governments fail, often opting to protect the old guard while talking a big game about the future. The coming months will reveal if India is building a launchpad or just another committee.

New research from Chainalysis reinforces this assertion, showing that APAC's monthly on-chain value tripled-from $81B in July 2022 to $244B in December 2024-with the country emerging as the region's strongest driver.

APAC Crypto Growth Surges with India Leading the Charge

Between 2022-2025, APAC demonstrated incredible growth. Monthly on-chain value first surpassed $100B at the end of 2023 and leapt to an all-time high of $244B in December 2024, fueled by global market Optimism following the US presidential election.

Even after the peak, APAC remained strong, with $185B+ monthly volumes attained through mid-2025. Inside this growth, it became APAC's largest market with $338B in on-chain activity, driven by:

Grassroots adoption

Strong remittance demand from a large diaspora

Young investors using assets as a secondary income

Fintech rails like UPI and eRupi making onboarding easier.

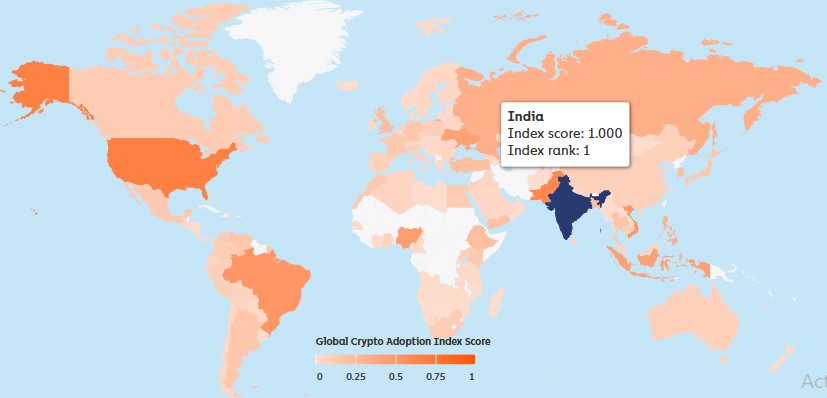

And by 2025, it topped the Global Crypto Adoption Index, beating every other APAC nation and mostly outperforming North America in user participation.

Crypto Shift: Real-World Blockchain Adoption Gains Steam. It is not just trading digital assets; it's now deploying blockchain at scale.

It became a pivotal moment when MJP Rohilkhand University uploaded more than 7 million education award records to the Polygon blockchain. Degrees, diplomas, and certifications stored on-chain now represent one of the largest real-world blockchain implementations in the country.

Emerging platforms like Polygon, CoinDCX, CoinSwitch, ZebPay, and Delta Exchange are continually strengthening the ecosystem, reinforcing trust and visibility in global terms.

Investor participation, too, has increased manifold. As explained by Kasif Raza:

5.72 lakh new SIP-style digital asset accounts opened in 2025

A 7× jump from 2024

Trading volume rose 37% to ₹51,333 crore ($6.15B)

2 crore+ active investors, of which 40% are users from Tier-2/3 cities

This indicates that adoption is no longer metro-centric in India; it's a movement.

The Hidden Challenge Slowing India Crypto Growth

Despite such high adoption, the country faces a deeper problem: a shortage of builders.

Influencer Zia ul Haque warns that domestic VC funding of Web3 has almost come to a standstill. The VCs need regulatory clarity, without which investment is frozen.

Major India crypto regulation concerns, according to Chainalysis, include:

30% tax on profits

1% TDS on every transaction

Uneven enforcement hurting Indian exchanges

Evolving rules delaying investor confidence

Today, most Web3 funding in the country comes from:

Global VCs, foreign angels, and Indian exchanges are dominated, indicating weak local support ecosystems. This creates a self-reinforcing cycle where no local pressure means slower regulations and less innovation.

What to Expect Next for India Crypto Market

At this very moment, the country finds itself at an inflection point. Never before has user adoption been stronger, on-chain activity more historic, or blockchain deployments more audacious. And yet, to lead globally, it needs support for its builders, stability in regulations, and investor-friendly tax reforms.

Conclusion

It is at the peak of a big global breakout. The strong grassroots adoption, massive APAC leadership, and real blockchain use cases indicate undeniable progress. However, regulatory clarity and builder support are going to shape the next chapter. If it solves these gaps, it could be the world's most influential hub.

This is for educational purposes only. Always do your own research before any investment.