Crypto Markets Roar: Bitcoin Eyes $88K as Ethereum Jumps 5.5% in 24-Hour Surge

Digital assets charge forward as major tokens post significant gains.

The Big Movers

Bitcoin continues its relentless march, trading within striking distance of a key psychological threshold. The flagship cryptocurrency's strength is fueling a broader market rally.

Ethereum Leads the Charge

Ethereum isn't just following—it's leading. The network's native token posted a standout performance, significantly outpacing the market's average gains. That kind of move gets traders' attention and suggests renewed confidence in the smart contract platform's fundamentals, not just speculative froth.

What's Driving the Rally?

While the raw numbers tell one story, the underlying currents matter more. Is this institutional money finally making its move, or just retail FOMO catching up? The market's shrugging off traditional finance's usual doom-and-gloom—turns out, decentralized networks don't wait for a central bank's permission to appreciate. A welcome change from watching legacy finance play with monopoly money while pretending it's a real economy.

The momentum is undeniable. When both market leaders advance in tandem, it signals more than a fleeting pump—it hints at a deepening conviction that digital assets are here to stay, and their best days aren't behind them, but ahead.

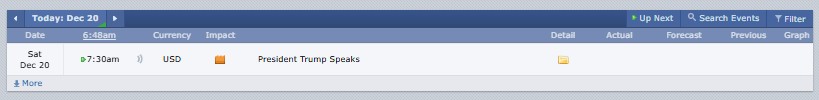

Major Crypto Events Today

Source: Forex Factory

24-Hour Crypto Market Update: Prices, Volume & Trends

The global cryptocurrency market today reached a capitalization of $3.07 trillion, reflecting a 3.7% rise over the last 24 hours. Total trading volume hits $136.11 billion, showing steady market activity.

Bitcoin (BTC) remains the largest crypto, commanding 57.3% market dominance, while ethereum (ETH) holds 11.7%. Currently, 19120 cryptocurrencies are being tracked, with Polkadot and XRP Ledger ecosystem showing the strongest gains in the past day.

Note: BTC and ETH are often viewed as less volatile historically, but still risky.

Bitcoin (BTC) priced at $88,070.14, up 3.2% in the last 24 hours, with a trading volume of $45.64 billion and a market cap of $1.75 trillion.

Ethereum (ETH) price today at $2978.31, rising 5.41% in 24 hours, with a trading volume of $27.08 billion and a market cap of $359.65 billion.

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Japanese Akita Inu (JAI) is priced at $0.00005102, up 602.01%, with a trading volume (TV) of $62.38K.

Zcash (ZEC) is at $449.02, gaining 15.28%, with $758.14M in TV.

GaiAI (GAIX) is at $0.1414, down 0.16%, recording $373.71M in TV.

Yooldo (ESPORTS) is at $0.4624, rising 13.88%, with TV of $1.31B.

Sophon (SOPH) is at $0.01641, jumping 41.25%, supported by TV $131.72M.

(Ranked by 24-hour percentage gain)

UNUS SED LEO (LEO) is trading at $7.98, up 19.11%, with a trading volume of $4.45 million.

Zcash (ZEC) is priced at $448.83, gaining 15.14%, supported by a strong $758 million trading volume.

Aptos (APT) stands at $1.63, rising 13.74%, with a trading volume of $144.9 million.

(Ranked by 24-hour percentage loss)

Jelly-My-Jelly (JELLYJELLY) is priced at $0.07626, falling 39.48%, and has recorded around $100.2 million in trading volume.

Audiera (BEAT) is trading at $2.00, declining 21.08%, with a trading volume of nearly $116.4 million.

MemeCore (M) is trading at $1.40, down 10.55%, with a trading volume of about $19.8 million.

Stablecoins experienced a 0.1% decline over the past 24 hours, with a market capitalization of $313 billion and a trading volume of $107 billion.

The Decentralized Finance (DeFi) market has dipped 5.2% in the last 24 hours, reaching a market cap of $103.9 billion, while the total value locked (TVL) stands at $5.3 billion.

(TVL refers to the total crypto assets locked in DeFi protocols.)

Fear and Greed Index Today

Source: Alternative Me

Today’s Fear and Greed Index is 20 (Extreme Fear), up from 16 yesterday, but down from 23 last week. Compared to 11 last month, sentiment has improved slightly. Fear of extreme volatility indicates the instability of the prices and the regulatory concerns and lack of confidence among the investors, leading to cautious trading and low risk-taking.

Latest Crypto Market News Today, 20 December

Coinbase Institutional argues that the 2026 crypto industry is 1996, not 1999, as institutions MOVE to higher levels of trading, privacy tech, AI agents, interoperable blockchains, and Coinbase tokenized assets.

Crypto hedge funds had their worst year since 2022, with altcoin strategies crashing, arbitrage dwindling because of ETF inflows, and managers moving to DeFi to find new opportunities in 2025.

The US SEC filed proposed final judgments against ex-Alameda CEO Caroline Ellison and former FTX executives Gary Wang and Nishad Singh, seeking permanent antifraud bans and multi-year management prohibitions.

U.S. Michigan consumer sentiment ROSE slightly to 52.9 in December, but stayed weak year-on-year, as cost pressures persist, while falling inflation expectations signaled easing price concerns for households nationwide overall.

New York Fed President John Williams said November CPI was likely understated by 0.1% due to data issues, adding December figures should better reflect true inflation trends.

Bomb threat emails were sent to Hyundai Group offices in Seoul with 13 BTC. The buildings were searched by the police, who did not find any explosives or threats and did not see any imminent threat.

(Note: All these updates will affect traders in terms of liquidity, sentiment, and possible returns, which is why it is necessary to monitor them closely.)

Comparative Insight

Although prices and capitalization have improved significantly compared to yesterday and last month, the sentiment is still poorer than that of last week. Such a divergence implies short-term Optimism as a result of momentum, which is not yet substantiated by substantial long-term confidence.

What This Means for Crypto Users

The volatility and swift price fluctuations are to be anticipated by crypto users. Increasing amounts and profits are short-term prospects, and excessive fear is a warning. Both trading and investment decisions should be carefully observed with regard to regulatory changes, macro information, and trends in the ecosystem.

This market commentary is only informational and not for long-term conditions. It does not indicate the direction of the price or indicate an action to be taken on the investment.

CoinGabbar’s Opinion

According to the 24-hour update, crypto investment is risky but selective. Trending assets can be a good trade for short-term traders, whereas long-term investors ought to be cautious, diversify their portfolios, and not make emotional decisions during fear-based sentiment.

Disclaimer: This is not financial advice. Do Your Own Research before investing. CoinGabbar is not liable for any financial loss. The crypto assets are risky and you may lose all your investments. Not all regions can offer some of the services or assets discussed.