Arthur Hayes Predicts Bitcoin’s Meteoric Rise: $100K First, Then $200K

Bitcoin's next price targets just got a major vote of confidence from a crypto heavyweight.

The Bull Case from a Founding Voice

Arthur Hayes, co-founder of BitMEX, isn't just betting on Bitcoin's success—he's mapping its ascent. His latest forecast sketches a two-stage rocket ride for the flagship cryptocurrency, with clear milestones that have the market buzzing.

From Six Figures to a New Paradigm

The path starts with a surge to $100,000, a figure that's transitioned from pure fantasy to a widely discussed benchmark. But Hayes doesn't see the journey ending there. The real story begins after that first peak, with a subsequent push toward $200,000 that would redefine digital asset valuation.

What's Fueling the Fire?

This isn't just hopeful thinking. The prediction leans into macroeconomic currents—think monetary policy shifts and institutional adoption—that could act as powerful accelerants. It's a scenario where traditional finance's usual playbook gets tossed out, and digital scarcity finally has its day.

A Reality Check for the Optimists

Of course, for every true believer, there's a skeptic waiting to point out that Wall Street has a long history of selling dreams before the alarm clock rings. The road to these numbers remains paved with volatility, regulatory hurdles, and the ever-present specter of a risk-off mood sweeping global markets.

Hayes's call cuts through the noise, offering a specific, aggressive timeline for Bitcoin's potential. Whether it plays out or becomes another footnote in crypto's volatile history depends on whether the world keeps buying what Bitcoin is selling.

Source: X (formerly Twitter)

Arthur Hayes' Bullish Bitcoin Price Prediction

He sees Bitcoin trading between $80,000 and $100,000 in the short term, possibly even reaching as high as $124,000 anytime soon. Eventually, Hayes added that it could surge as high as $200,000. He largely bases this potential increase on increased liquidity, particularly driven by the actions of the Federal Reserve.

“We are rotating out of $ETH and into high-quality DeFi names, which we believe can outperform as fiat liquidity improves,” Hayes tweeted.

According to Lookonchain data, he just transferred another 680 $ETH ($2.03M) to sell and rotate into high-quality DFi tokens.

Current Bitcoin Price Action

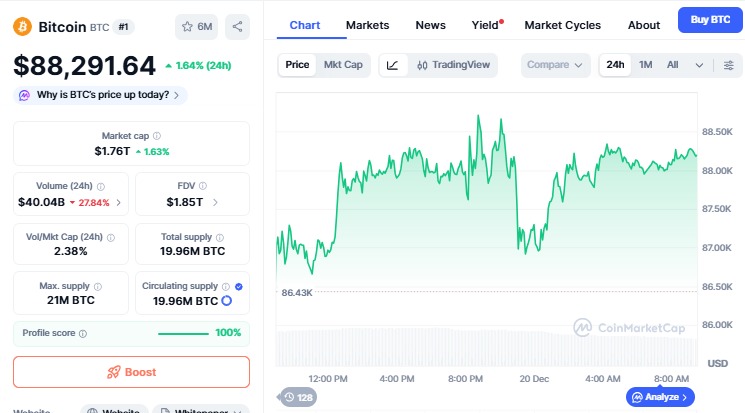

As per the Coinmarketcap, BTC is trading at $88,291, up 1.64% in the last 24 hours.

Source: CoinMarketCap Chart

After experiencing some losses recently, the cryptocurrency has managed to bounce back due to some vital drivers such as:

Whales have been the key players in BTC's recent breakout. Recently, a whale just transferred 2,509 BTC, worth about $221 million, out of exchange for a decrease in selling pressure.

Meanwhile, the coin has also been able to defend major technical support areas, like:

The 200-day moving average is currently situated around $85,000.

Even though bearish trends have been pointed out by the MACD and RSI.

The price remains in the so-called "value zone."

If BTC can stay above $91,311, then it might target further resistance points as high as $94,600.

Liquidity Outlook and Hayes' Predictions

Arthur Hayes Prediction is so optimistic about the future of Bitcoin; he projected that the cryptocurrency would hit $100,000 before making an eventual rise to $200,000. His Optimism is based on the fact that the increased liquidity from the Federal Reserve's Reverse Repo Program will ensure a surge in the price of the crypto.

Hayes forecasts that, in the near future, BTC would trade between $80,000 to $100,000, and could even climb higher beyond $124,000. This could see bitcoin finally break out into a strong rally, at least early in 2026, if financial inflows continues to improve. However, he said one should not forget that short-term price volatility may occur, for instance, because of decisions on interest rates by the Fed.

According to Hayes, with increasing liquidity, BTC will be a beneficiary of more institutional investments and better market sentiment. Everything depends on these liquidity-driven factors that push whether it can reach $200,000 or not, along with overall market trends.

Macro Conditions: Fed's Policies and Japan's Rate Hike

The broader market remains uncertain, with mixed signals coming from macroeconomic factors. Hayes's bullish outlook for BTC comes against the hawkish policies from the Federal Reserve, which also contributed to market volatility.

To add to that, the recent Bank of Japan rate hike further complicates things. The Japan rate hike put pressure on the yen carry trade, which could reduce the global liquidity and has a possible effect on Bitcoin's price.

This article is for informational purposes only, kindly do your own research before investing.