Bank of Japan Rate Hike: The Crypto Market’s Next Big Shockwave

Tokyo tightens the screws. Global markets hold their breath. What happens to crypto when the last zero-interest-rate holdout finally blinks?

The End of an Era—And a Liquidity Faucet

For years, the Bank of Japan's ultra-loose policy acted as a hidden tailwind. Cheap yen sloshed into every risky asset class imaginable—including digital ones. A rate hike doesn't just raise borrowing costs; it signals a profound shift in the global liquidity landscape. That free-money pipeline? It just got a regulator.

Flight to Quality or Flight to Decentralization?

Traditional finance playbooks predict a rush into 'safe' assets like government bonds. But crypto has never read those playbooks. Watch for a potential short-term shock as leveraged positions unwind, followed by a fascinating divergence. Bitcoin, increasingly viewed as digital gold, could attract capital seeking a sovereign-free store of value. Speculative altcoins might feel the squeeze as the 'easy money' test gets harder to pass.

The Carry Trade Unwinds

This move threatens the classic yen carry trade, where investors borrowed cheap yen to fund investments elsewhere. As that trade reverses, it could trigger capital outflows from risk assets globally. Crypto, sitting at the intersection of high-risk and high-liquidity, often feels these tremors first. It's a brutal reminder that in a connected financial system, no market is an island—not even a decentralized one.

The Verdict: A Stress Test, Not a Death Knell

Don't mistake volatility for failure. This is the system working as designed. Central bank policy shifts act as a stress test, separating robust, utility-driven projects from those built on monetary fumes. The crypto that emerges will be leaner, meaner, and less dependent on the whims of men in suits making decisions in wood-paneled rooms—arguably the whole point of the experiment in the first place. After all, what's the use of building a new financial system if it crumbles under the same old pressures?

BOJ Rate Hike Decisions on Spark

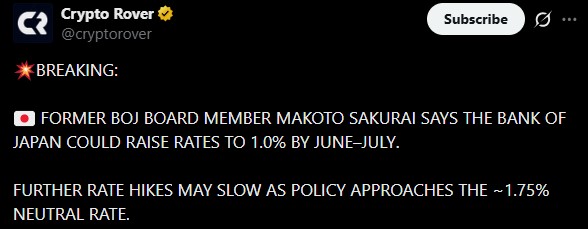

On December 18, the Bank of Japan raised its key interest level to 0.75%, marking the highest rate since 1995. Former BOJ board member Makoto Sakurai forecasted that rates could reach 1.0% by June-July 2026 and approach a neutral level of around 1.75%.

This price increase comes as Japan faces high inflation and mixed economic signals, with the central bank aiming to balance growth with price stability.

Reasons Driving Frequent Hikes

Japan ended negative interest rates in March 2024, targeting inflation above 2%. Current inflation stands at 2.9% year-on-year in November 2025, exceeding the BOJ’s target 2% for four consecutive years. Real wages have fallen for 10 straight months, while GDP contracted by 0.6% in Q3 2025 (-2.3% annualized).

In comparison, the U.S. inflation stands slightly lower at 2.7%, with higher interest rates at 3.75% and unemployment at 4.6%, highlighting Japan’s slower growth and weaker wage dynamics despite tighter labor conditions.

Current Market Effects

Japan’s 10-year government bond yield jumped to a record 2.10%, up 100 basis points (1%). This means investors now demand higher returns, reflecting rising inflation expectations, possible Bank of Japan interest rate hikes, and changing economic outlooks.

On the other hand, Japanese yen rebounded to around 157 per dollar after hitting an eleven-month low, with authorities signaling potential intervention to curb excessive exchange-rate movements. Finance Minister Satsuki Katayama and top currency diplomat Atsushi Mimura emphasized action against speculative moves in the yen.

The crypto market also responded in a fair way, rising 1.04% today, and 0.43% on the day of the 0.75% hike announcement, in the 24 hours space amid institutional accumulation and Fed liquidity optimism.

In general, rising rates usually put downward pressure on crypto prices because borrowing is costlier, investors seek safer returns, and liquidity tightens. However, looking at the current scenario, it could be a result of the strong bull run in the market.

What’s Next

Japan’s gradual rate hikes signal the BOJ’s cautious approach to normalizing policy, but inflation and weak GDP growth may require careful monitoring in 2026. Markets will watch whether rates reach the projected 1.0% by mid-2026 and how further tightening affects the yen, borrowing costs, and investor sentiment.

For crypto and risk assets, aside from this, the outlook depends on global liquidity and macro events, including U.S. CPI data (Jan 13, 2026), the MSCI DAT ruling (Jan 15, 2026), and the Fed meeting (Jan 28, 2026), which could shift risk appetite.