Bybit Japan Exit Plan Explained: The Real Reasons Behind the 2026 Withdrawal and What Comes Next

Bybit pulls the plug on Japan. The crypto exchange confirms a full exit from the market by 2026, leaving traders scrambling and regulators watching.

The Compliance Crunch

Japan's Financial Services Agency doesn't play games. Their rulebook is thick, expensive, and non-negotiable. For a global platform like Bybit, the cost of playing by Tokyo's rules—endless paperwork, capital requirements, operational overhead—simply outweighed the reward. It's a classic case of regulatory friction grinding expansion to a halt.

What's Next for Users?

Panic isn't a strategy. Bybit's 2026 deadline gives users a long runway. The plan? Wind down services orderly. Expect a phased closure: first, new registrations and deposits will halt, followed by trading, with final withdrawals completed before the curtain falls. Users must move assets to another licensed exchange or into private wallets. Missing the deadline means dealing with a bureaucratic asset recovery process—a headache best avoided.

The Bigger Picture: A Strategic Retreat

This isn't a failure; it's a recalculation. Exiting a hyper-regulated, competitive market like Japan frees up capital and engineering firepower. Bybit can double down on friendlier jurisdictions or emerging tech like DeFi integration. Sometimes, stepping back from one battle lets you win the war. After all, in global finance, capital flows to the path of least resistance—and lowest compliance cost.

So, Bybit cuts its losses. Japanese traders find new homes. And the market moves on, proving once again that in crypto, the only constant is change... and the relentless, profit-seeking flow of capital away from regulatory choke points.

Bybit Japan Exit Explained: Regulatory Pressure Takes Center Stage

The primary cause behind this is regulation compliance. The country has one of the toughest crypto regulation frameworks in the world today. There are rising enforcement risks for unapproved crypto exchanges.

As per the government’s update, users found to be residing will have their account access limited gradually after 2026. Users with incorrect residence classification have to undergo Identity Verification Level 2 (KYC2 with address proof) before 22nd January 2026; otherwise, they will be considered as users by default.

The warning issued illustrates the larger trend of global operators being forced to localize or exit highly regulated regions.

Bank of Japan Interest Rate Decision Adds Macro Pressure

Another critical element that is related to the exit is the change in monetary policies being adopted by the country. This is clearly demonstrated by the Bank of Japan rates decision, which recorded an increase to 0.75%, which is the highest since 1995.

Former BOJ board member Makoto Sakurai forecasts further rate hikes in the BoJ, perhaps reaching 1.0% by June-July 2026, targeting a long-run rate of around 1.75%. This policy reversal on keeping very low interest rates may boost the yen and will significantly affect digital asset transactions.

Such signals in the interest rates decision by the BOJ add complexity for exchanges that are already faced with the cost of strict compliance.

Bybit Exchange Strength Remains Solid Despite Exit

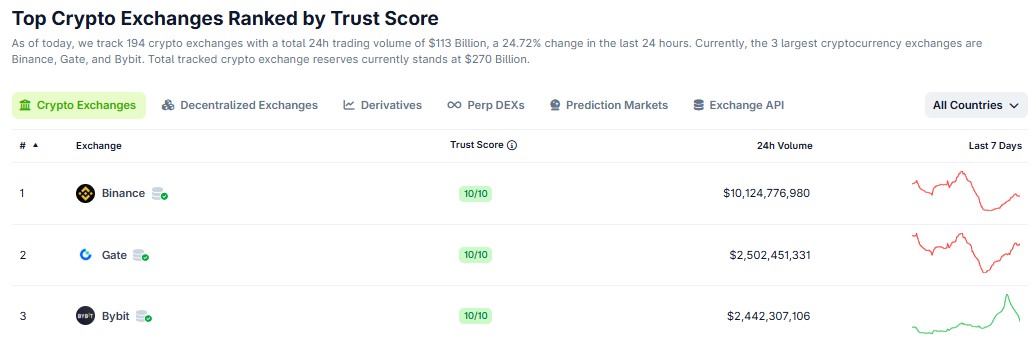

However, the exit of Bybit does not in any way affect the strong international positioning the exchange enjoys. Based on the information provided by CoinGecko, it has a score of 10 out of 10 in terms of trust, and its average trading volumes within the last 24 hours amount to $2.44 billion, ranking it in the third position in the world in terms of trading volumes.

Additionally, it has more than 70 million users and is one of the leading crypto exchanges in the world. This shows the trust towards the platform.

Conclusion

The Bybit Japan exit setup is an indication of compliance strategy. Even as the users face restrictions, the exchange is establishing itself in other parts of the world. The implications of regulation and central bank policy in crypto are redefining the future of cryptocurrency exchange platforms.

Note that the following page is only for informative purposes and not for financial/investment or legal advice. There is always risk in trades related to cryptocurrencies.