Crypto Market 24-Hour Pulse: Where Bitcoin & Altcoins Stand Now

Bitcoin holds the line while altcoins scramble for position—here's the snapshot that matters.

The Bitcoin Benchmark

No dramatic plunge, no parabolic surge. The flagship cryptocurrency demonstrates resilience, trading within a defined corridor that has traders watching for the next decisive move. It's the calm that either builds confidence or precedes a storm.

Altcoin Arena: Selective Momentum

Beyond Bitcoin, the action fragments. A handful of major altcoins notch modest gains, suggesting capital isn't fleeing but is becoming increasingly selective. Others tread water, their narratives momentarily paused. This isn't a broad-based rally; it's a stock-picker's market where fundamentals and catalyst timing are separating winners from the stagnant.

The Dominance Dance

Bitcoin's share of the total market pie remains the critical metric. Its slight ebb or flow dictates the risk appetite for the broader ecosystem. A steady hold here keeps the altcoin game alive; a sharp reclaim by BTC could trigger a 'flight to quality'—or what passes for it in this volatile space.

Volume Tells the Tale

Scrutinize the trading volume behind the price moves. Are gains on thin air, or supported by real capital commitment? The difference often predicts staying power versus a fleeting pump. Right now, the data points to cautious engagement, not reckless speculation.

The market breathes, consolidates, and prepares for its next directional lurch. In the meantime, traders navigate a landscape of technical levels and sentiment shifts, all while traditional finance pundits—who still can't properly define a wallet—decide if this is a 'bubble' or 'the future.' The truth, as always, is being built block by block.

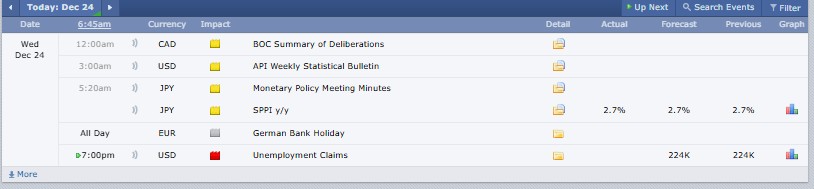

Major Crypto Events Today

Source: Forex Factory

24-Hour Crypto Market Update: Prices, Volume & Trends

The global cryptocurrency market today recorded a capitalization of $3.05 trillion, reflecting 1% change in the last 24 hours. Total trading volume noted $110 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 57.4%, while ethereum (ETH) carries 11.8%. As of now, 19090 cryptocurrencies are being tracked. The largest gainers of industry are Liquid Staked BTC and the XRP Ledger ecosystem in the last 24 hours.

(Note: BTC and ETH are often viewed as less volatile historically, but still risky.)

Bitcoin (BTC) price today reached $87689.63, down by 1.04% in the last 24 hours, with a trading volume of $43.6 billion and a market cap of $1.75 trillion.

Ethereum (ETH) price today is at $2970.64, slightly dipping 1.81% in 24 hours with a trading volume of $21 billion and a market cap of $358.5 billion.

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

RateX (RTX) is at $3.45, down 2.62% with a strong trading volume (TV) of $360.98 million.

Velo (VELO) at $0.006811, gaining 0.69%, while recording a TV of $256.77 million.

Bitcoin (BTC) is at $87,614.61, down 1.04%, with a massive TV of $43.62 billion.

Yooldo ESPORTS at $0.4342, falling 2.61%, and posting a trading activity of $1.04 billion

Pump 2 (PUMP) at $0.0003171, surging 55.44%, with a trading activity of $278.06K.

(Ranked by 24-hour percentage gain)

PIPPIN at $0.4608, up 32.22%, with a trading volume of around $73.4 million.

Canton (CC) at $0.09012, rising 3.49%, and has recorded a strong trading volume of nearly $322.6 million.

Immutable (IMX) at $0.2353, gaining 3.05%, with a trading volume of about $18.5 million.

(Ranked by 24-hour percentage loss)

BEAT (Audiera) at $2.46, down 34.63%, with a trading volume of about $121.78 million

NIGHT (Midnight) price today at $0.08002, falling 19.60% with a trading volume of around $1.67 billion.

PUMP (Pump.fun) at $0.001714, declining 10.24%, with a trading volume of $122.13 million.

Stablecoins noted no change over the past 24 hours, with a market capitalization of $313 billion and trading volume of $88.5 billion.

The Decentralized Finance (DeFi) market declined 1.4% over the last 24 hours, recording a market cap of $102.9 billion and total value locked (TVL) at $4.79 billion. Defi dominance globally marked 3.4%.

(TVL refers to the total crypto assets locked in DeFi protocols.)

Fear and Greed Index Today

Source: Alternative Me

The current Crypto Fear and Greed Index is 24 (Extreme Fear), the same as yesterday (24). Sentiment is somewhat better than it was last week (16) and last month (19), but there is still a certain amount of fear caused by price volatility, shy investors, and poor short-term confidence, even as the situation is gradually stabilizing.

Latest Crypto Market News Today, 24 December

(Note: All these updates affect traders, influencing liquidity, sentiment, and possible returns, which means that close attention should be paid to them.)

Circle announced its MiCA-compliant euro stablecoin, EURC, has reached 300 million euros in circulation, driven by growing demand for transparent, reliable stablecoins in real-time settlement and cross-border digital commerce globally.

Bitcoin miner Cipher Mining will acquire a 200MW Ohio site, entering the PJM market. The facility will support Bitcoin mining and data centers for cloud giants by 2027.

A Brazilian symphony will transform real-time Bitcoin price movements into live music, using algorithms, backed by cultural tax incentives, and perform in Brasília to let audiences hear crypto volatility fluctuations.

The U.S. SEC sued AI-themed crypto platforms and investment clubs, alleging fake trading apps, social media crypto scams, and WhatsApp schemes that defrauded retail investors of at least $14 million globally.

Bank of Canada retained the rates at 2.25% on the grounds of economic stability around the world, increasing risks of inflation, surplus supply in the domestic market, and doubts about the U.S. trade policies on future investment.

The US economy grew strongly in Q3 as GDP ROSE 4.3%, inflation edged up to 2.9%, and consumer spending jumped 3.5%, beating forecasts and signaling resilient economic momentum.

Comparative Insight

Market sentiment has slightly improved from last week’s index of 16 to 24 today, yet it remains in extreme fear. Compared to last month, stability is improving, but BTC and ETH prices dip 1.04% and 1.81% respectively. Also, regulatory pressure and macro uncertainty still limit strong bullish momentum.

What This Means for Crypto Users

This revocation is an indicator of a weak market where the volatility in the short-term is the order of the day. Volume, dominance, and sentiment indicators should be carefully followed by the traders, and long-term users should remain cautious, diversify their exposure, and avoid making emotional decisions based on fear or abrupt price changes.

This commentary is only informational and not for long-term conditions. It does not indicate the direction of the price or indicate an action to be taken on the investment.

CoinGabbar’s Opinion

Based on the 24-hour crypto market update, Given Extreme Fear (24), BTC and ETH decline by over 1%, and DeFi is down 1.4%. Short-term investment remains risky. Gradual accumulation can be an advantage to long-term investors, whereas daily traders should anticipate intense price movements and make a priority of hard-and-fast stop-loss plans.

Disclaimer: This is not financial advice. Do Your Own Research before investing. CoinGabbar is not liable for any financial loss. The crypto assets are risky, and you may lose all your investments. Not all regions can offer some of the services or assets discussed.