Spain Crypto Regulations: MiCA & DAC8 to Reshape Market in 2026

Spain's crypto landscape is bracing for a regulatory earthquake. The 2026 arrival of MiCA and DAC8 isn't just a policy update—it's a complete system reboot.

The New Rulebook

Forget the wild west. MiCA brings a unified EU license, forcing exchanges to prove reserves and play by strict transparency rules. DAC8? That's the taxman's digital eye, tracking every transaction to ensure the treasury gets its cut. Spain's market, from Barcelona's fintech hubs to Madrid's trading floors, must adapt or exit.

Survival of the Fittest

The shakeout starts now. Compliant giants may consolidate power, while smaller, agile players face a brutal compliance tax—a classic case of regulatory capture dressed as investor protection. The irony? The same rules designed to curb speculation might just cement the dominance of the largest, most institutionalized crypto assets.

By 2026, Spain's crypto scene won't just be regulated; it'll be reinvented. The question is, who gets a seat at the new table?

So, how will the new Spain crypto regulations really affect cryptocurrency users and providers in this country?

MiCA Authorization: As from July 2026, Compliance is Mandatory

MiCA defines rules for operations in the crypto market in terms of categorization such as utility tokens, security tokens, and stablecoins. The National Securities Market Commission (CNMV) is responsible for regulating MiCA, which has already registered more than 60 companies, including big banks and exchange operators such as BBVA, Cecabank, and Renta 4 Banco.

The MiCA is to be fully enforced as a part of Spain Crypto Regulations from July 1, 2026. Every provider of cryptocurrency services has to receive full authorization to continue operation. Any firm that does not meet European specifications can be forced to close down.

This action aims to protect investors, as well as ensure the regulation, transparency, and control of the digital asset market at an appropriate level within Europe.

DAC8 Reporting: Complete Transparency for Tax Administrations

To complement MiCA, the Administrative Cooperation Directive 8 (DAC8) enters into effect as of January 1, 2026. Under DAC8, exchanges and service providers must report user transactions, balances, and fund movements to EU tax authorities.

This law removes anonymity in regulated crypto operations. The Spanish Treasury can track, freeze, or seize digital products to collect taxes, giving the government more detailed information than before.

What This Means for Users and Providers – Self-Custody Rules

Experts have highlighted the significance of self-custody because DAC8 only concerns those assets which are held in custody by exchanges/service providers. Persons who hold a cryptocurrency in self-custody are beyond the DAC8 obligations.

José Antonio Bravo Mateu, a digital asset taxation expert, advises careful planning: “From January 1, 2026, any crypto held on exchanges can be seized directly for tax debts. P2P (peer-to-peer) transactions and privacy tools can legally protect user privacy if not conducted as regular economic activity.”

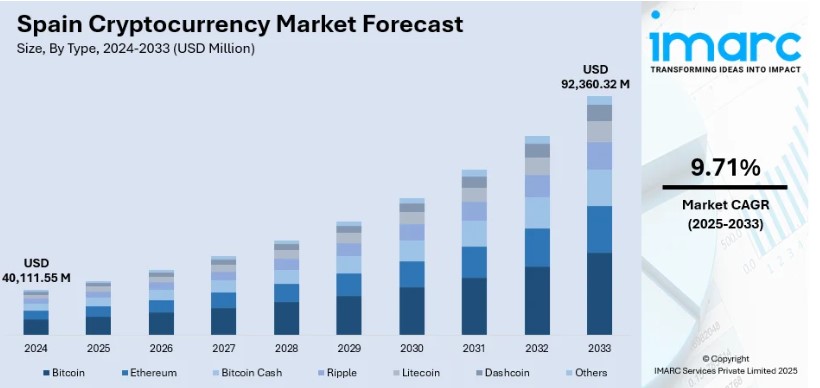

Current Market Condition of Spain

Spain’s cryptocurrency market remains strong and fast‑growing, despite the lack of regulatory frameworks. The sector reached an estimated USD 40,111.55 million in 2024 and is projected to climb to USD 92,360.32 million by 2033, according to imarc groups reporting.

Driven by increasing investor interest, wider adoption of bank‑backed digital asset services, and stronger financial education efforts, the nation lies in the top ten cryptocurrency adopting countries in Europe under Chainalysis list.

User adoption is also growing, with a forecast of over 25 million crypto-users in 2026 by Statista, supported by a 51.5% adoption rate in 2025. However, plans in Spain, like the Sumar party’s proposal to raise crypto tax rates to 47%, could create tension in the market.

Conclusion: Future Outlook Towards an Organized Marketplace

The 2026 regulations make it clear that Spain is gearing up towards a more organized, transparent, and structured world of cryptocurrencies, striking a perfect balance between innovation and protection of investment as well as fiscal conservatism. As such, Spain aims towards developing a mature market.

As all these regulations come into effect, Spain's cryptocurrency space is facing an important question: WOULD strict regulation help the market to invest and adopt in a safer way, or would it in any way trigger people to adopt decentralized platforms instead? The year 2026 would be pivotal in determining Spain's cryptocurrency regulations.