Coinbase Insider Breach Exposes $400M Vulnerability

An internal security failure at a major exchange triggers a nine-figure financial hemorrhage.

The Inside Job

Forget sophisticated external hackers—this time, the threat came from within. A trusted employee with privileged access allegedly bypassed multiple security protocols, turning insider knowledge into a direct pipeline for draining funds. The breach exposes a critical, often-overlooked weakness in digital asset security: the human element.

The $400 Million Reality Check

The staggering figure isn't just a theoretical loss; it represents a direct hit to the exchange's balance sheet and user confidence. In an industry built on cryptographic trust, a single point of internal failure can unravel years of security theater. It’s a costly reminder that while blockchain is immutable, the companies built around it are decidedly not.

Security Theater vs. Systemic Risk

The incident forces a brutal audit of internal controls. How many layers of defense actually stop someone with the keys? The breach suggests that for all the talk of decentralization, centralized points of failure—and human error—remain the sector's Achilles' heel. It’s the kind of event that makes traditional finance veterans smirk into their lattes, muttering about 'due diligence.'

The fallout is a masterclass in risk management failure. It cuts through the hype, proving that no amount of tech can fully inoculate against greed or negligence. The market will absorb the shock, but the dent in institutional credibility? That'll take a lot more than a press release to fix.

Brief History of Coinbase Hack May 2025

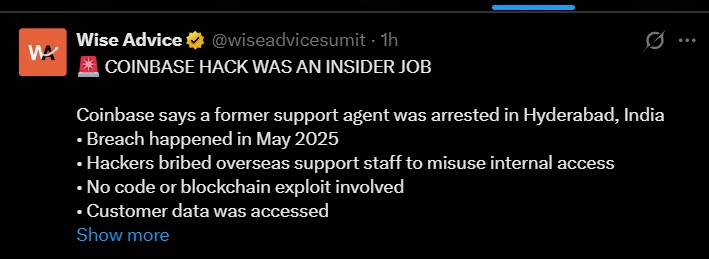

In May 2025, Coinbase data breach that was caused by bribed foreign customer support workers. Attackers did not hack systems, but they attacked humans who had internal access.

The hack was disclosed when an extortion email came on May 11, purporting to have sensitive user information.

It was later found that suspicious activity had been detected as early as January 2025.

The event happened soon after the exchange became a member of the S&P 500 Index and attracted a lot of attention.

Notably, the intrusion was not accompanied by stolen private keys or customer money, but it revealed severe vulnerabilities in insider access controls.

Source: Wise Advices X

Coinbase Hack Exposed Scammers in December 2025

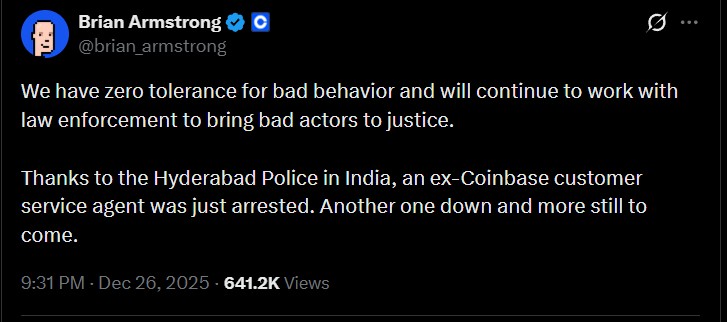

In December 2025, Hyderabad Police apprehended a former Coinbase customer service agent who was involved in the insider hacking scheme.

The arrest affirmed that hackers paid offshore support personnel in India and elsewhere to abuse internal access.

Coinbase CEO Brian Armstrong publicly thanked Indian authorities and assured more arrests.

The probe also linked the breach to a Brooklyn-based suspect who was also involved in impersonation fraud.

This was a breakthrough in the case since it changed the emphasis of the digital threats to insider malice and supported the importance of international law enforcement collaboration.

What Hackers Wanted?

Hackers gained access to the personal information of customers, such as their names, email addresses, physical addresses, dates of birth, nationality information, government-issued IDs, and partial banking information.

Most importantly, passwords, private keys, and login credentials were not lost. Attackers then ransomed the data and demanded a ransom of $20 million, threatening to publish the data. Coinbase declined to make the payments, opting to take legal action.

What Coinbase Lost Due to This Hack?

Despite the fact that customer funds were not lost, the breach hurt the reputation and trust. The company was under intense regulatory examination, customer grievances, and legal liability.

The reaction to the incident involved a lot of investigations, security enhancements, customer protection, and collaboration with law enforcement.

The estimated total response costs are between $180 million and $400 million, which is one of the most expensive insider-related events in the history of crypto.

Influence on Coinbase and Its Response

Coinbase Company responded promptly once the insider misconduct was detected. The company fired the support agents involved, discontinued compromised access, and reinforced internal monitoring systems. It also fully cooperated with the international law enforcement officers and publicly released the incident in order to be transparent.

The exchange also assured users that no private keys and funds were compromised. The case compelled the company to review its outsourcing procedures and insider risk management. The incident led to the reemergence of the debate concerning more rigid vetting, employee surveillance, and sensitive access restriction within the crypto support processes industry-wide.

Source: Official X

Why is this case important?

CEO Brian Armstrong reiterated that Coinbase has a zero-tolerance policy toward bad behaviour and praised Hyderabad Police for making the arrest, and warned of further arrests.

The significance of this case is that it demonstrates that human insiders can be the least secure point. It brings the dangers of outsourced customer support to the fore and demonstrates that even the most secure platforms may be compromised by bribery, rather than hacking abilities.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.