BitMine Ethereum Staking Just Locked In 154,000 ETH — Here’s What It Means for the Network

BitMine's latest move isn't just a deposit—it's a statement.

Staking Surge: A Network Vote of Confidence

The addition of 154,000 ETH to the staking pool represents more than raw capital. It's a massive bet on Ethereum's long-term security and utility. This kind of institutional-scale commitment directly reduces the liquid supply, a fundamental bullish signal that traditional finance often struggles to quantify—they're too busy calculating their own management fees.

Liquidity Locked, Security Fortified

Every staked ETH strengthens the network's defenses. It's a two-for-one: validators earn rewards while the protocol's backbone gets harder to attack. This isn't passive holding; it's active participation that cuts out middlemen and bypasses the old gatekeepers of yield.

The Bigger Picture: Ethereum's Earning Potential

Staking transforms ETH from a speculative asset into a productive one. With major players like BitMine diving in, the narrative shifts from price swings to network throughput and sustainable yield generation. It turns crypto's wild west into a settled, income-producing frontier.

Forget trading desks—the real action is in the protocol's core mechanics. While Wall Street debates rate cuts, Ethereum is building its own economy, one staked validator at a time.

BitMine Ethereum Staking Expands with 154,000 ETH Added to Network

The firm transferred 154,000 ETH, worth roughly $451 million, into the Ethereum network's staking contract early Friday.

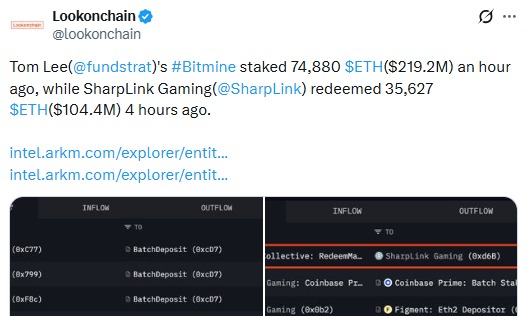

The MOVE came in two batches, with this being the first large-scale staking move by the company. According to on-chain data shared by Lookonchain, a single transaction staked 74,880 tokens worth $219.2 million.

Source: X (formerly Twitter)

This decision comes shortly after the firm completed its shift from Bitcoin mining to Ethereum-focused treasury management, with the company chaired by noted ETH proponent and Fundstrat co-founder Tom Lee.

World's Largest Corporate Ethereum Treasury Backs Staking Strategy

Before this transfer, the organisation had already built the world’s largest corporate Ethereum treasury. The firm currently has in its possession approximately 4.066 million ETH, valued at over $11.9 billion. This represents over 3% of the digital asset total supply-a very rare position for a single organization.

This strategy is expected to create a stream of consistent income. Assuming an annualized yield of 3%, the staked ETH could bring approximately $126 million every year in reward. This adds another revenue stream while keeping the firm deeply involved in blockchain's security and operations.

Tom Lee Signals Long-Term Conviction in the Digital Asset

Tom Lee has long reported that this cryptocurrency is very important to the future of finance. He believes a combination of staking, tokenization, and institutional use will help the token see long-term growth. This move by Bitmine Immersions supports that view with the upcoming Ethereum Glamsterdem Upgrade in the pipeline for 2026 .

Interestingly, while BitMine staked ETH, another firm, SharpLink Gaming, unstaked more than 35,000 tokens to free up some liquidity. The contrast makes BitMine’s long-term approach in clear juxtaposition to others managing short-term needs.

BMNR Stock Still Sees Mixed Response Throughout Markets

BMNR stock traded slightly lower, showing cautious investor sentiment. Shares still trade at a small premium compared to the company's value.

Shares of BMNR closed at $28.31, down 3.54% on the day. In post-market trading, the stock dropped to $28.10. During the session shares changed hands as high as $29.50 to as low as $27.90.

BitMine Immersion Technologies has a market capitalization of approximately US$1.21 billion.

Ethereum Price Outlook

The currency dropped by 1.6% over 24 hours, currently settling around $2,926, as the crypto market became cautious. The price dropped below the $3,000 mark and currently holds below its 200-day average, indicating weakness in the short term.

Source: CoinMarketCap Chart

There was a 24% decline in NFT sales on the network, impacting the number of activities, while recent derivative liquidations led to selling. The support level to watch next is $2,875, with further levels at $2,720.

Conclusion

Rather than being simply a tech relocation, this move by Tom Lee’s Bitmine Immersion, illustrates the vast institutional confidence in the future of this cryptocurrency. With a lockup of 154,000 ETH, BitMine effectively places its bets on future rewards and visions of becoming a bridge between Wall Street and blockchain technology.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.