Fed’s Liquidity Tsunami: Gold Rockets to $4,533, Silver Soars to $79, While Bitcoin Plays Catch-Up

Central bank printers are running hot, and traditional safe havens are cashing in. The latest wave of Federal Reserve liquidity isn't just lifting all boats—it's launching gold and silver into a stratosphere Bitcoin has yet to reach.

The Metals Steal the Show

Forget subtle gains. This liquidity injection acts like rocket fuel for precious metals. Gold isn't just climbing; it's breaking records, punching through price ceilings that seemed theoretical just quarters ago. Silver follows suit with a parabolic move of its own, leaving analysts scrambling to update their decade-old charts. The message from the market is clear: when fiat gets diluted, the ancient stores of value get their moment.

Digital Gold's Surprising Lag

Here's the twist that has crypto circles buzzing: Bitcoin, the so-called 'digital gold,' isn't leading the charge. While it's far from stagnant, its trajectory appears more measured against the explosive rallies in its physical counterparts. It raises a provocative question for the bulls: is this a temporary divergence or a sign that, in a true liquidity crisis, investors still sprint to the tangible first? Some on Wall Street would call that a 'flight to familiarity'—or, as cynics might put it, the same old herd mentality dressed in a digital suit.

The real test isn't which asset spikes first, but which one holds its ground when the music eventually slows. For now, the Fed's punch bowl is full, and everyone's invited to the party—even if some guests are making a more dramatic entrance than others.

Source: X (formerly Twitter)

On its own, this may not look like a big move. But this Fed liquidity injection adds to more than $120 billion already injected this year, which raises an important question. If markets are stable, why does the system still need regular support?

These repo operations usually appear when banks face short-term cash pressure. It does not mean a crisis has started, but it does show that liquidity is not flowing freely.

Gold and Silver React First

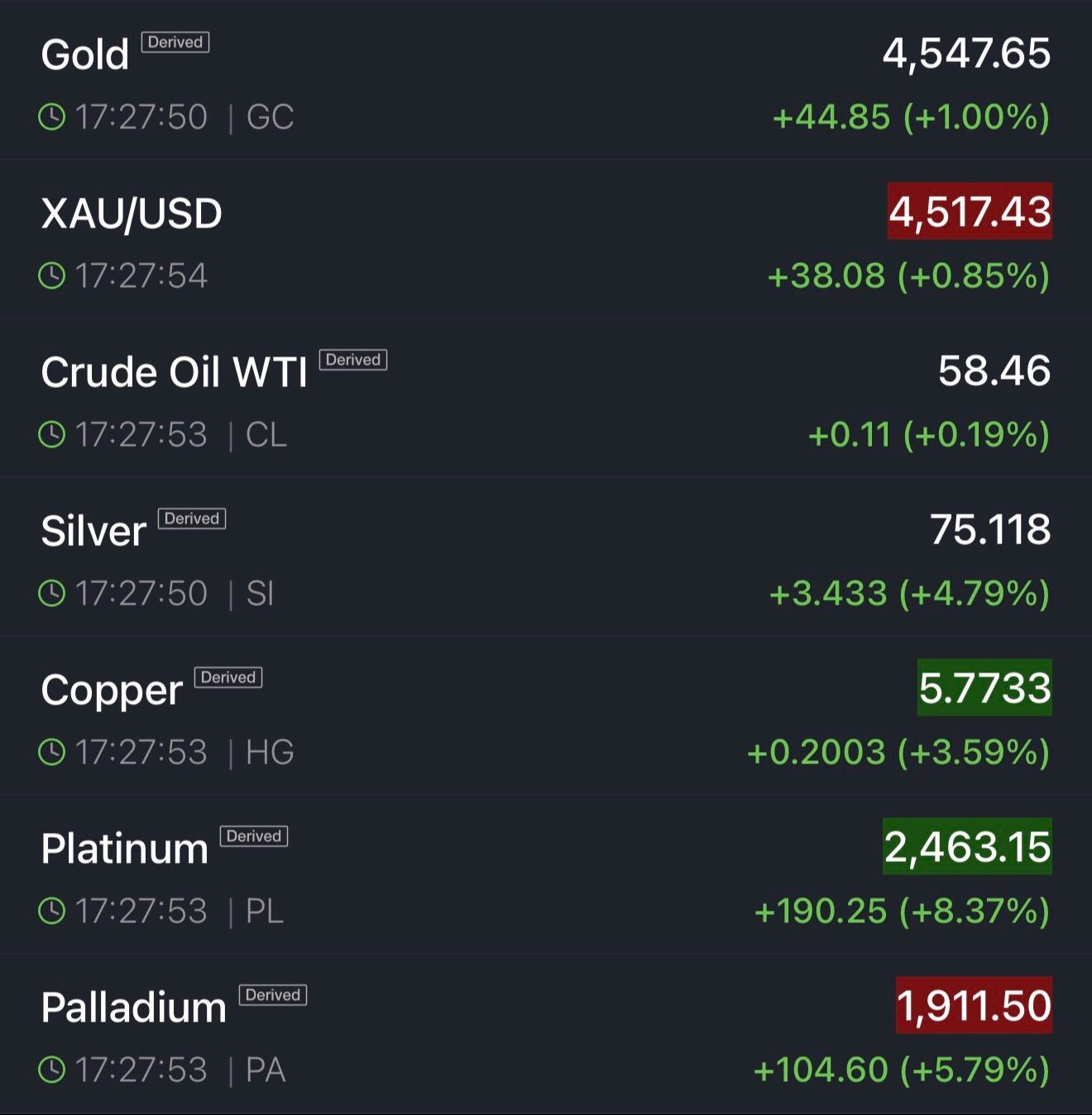

Right after the Fed liquidity injection, gold and silver moved sharply higher. Gold touched a new all-time high NEAR $4,533 per ounce, while silver climbed to around $79, marking one of its strongest rallies in years.

Source: X (formerly Twitter)

What makes this MOVE important is that it is not just gold and silver rising. Copper, platinum, palladium, and even oil are also moving up together. This kind of broad commodity rally does not usually happen in a healthy economy.

In normal growth periods, commodities behave differently. Industrial metals increase with demand, energy commodities increase with consumption, and precious metals remain unchanged.

However, when everything else goes up simultaneously, it indicates that investors are losing confidence in financial commodities and are thereby transferring their funds to physical commodities.

Such episodes have happened in the past. These incidents happened prior to the dotcom bust, the 2008 financial crisis, and in 2019 during the repo market episode. Every time, the commodity markets anticipated the economic data change.

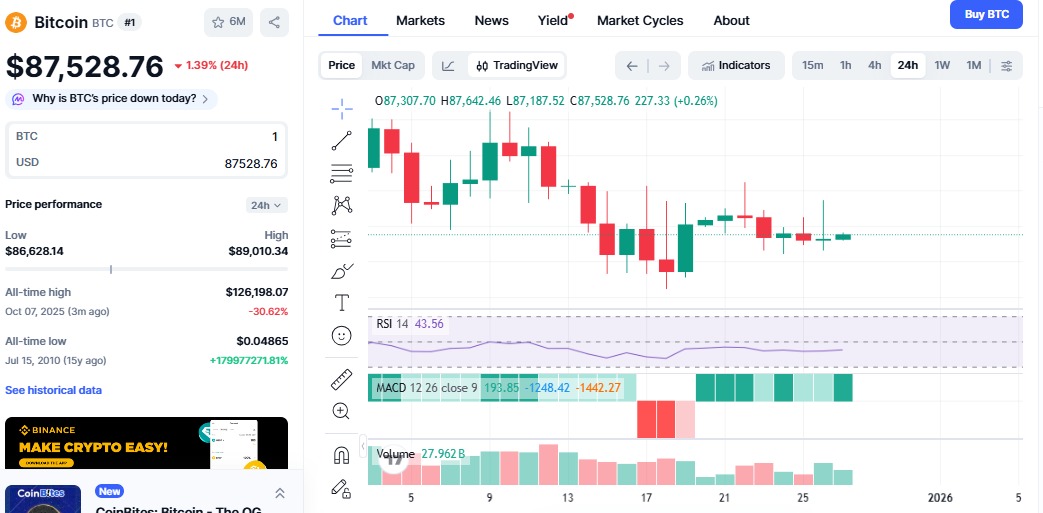

Bitcoin Lags amid Fed injections

When gold and silver record highs, Bitcoin is finding it difficult. Although the Fed has infused liquidity in the markets, it is seen trading below $90,000, currently near $87,500. This is also down by nearly 30% from its recent high of $126,198, reached merely three months ago.

BTC is considered to be "digital gold" but is not correlating with Gold at this current moment.

The answer may lie in timing. XAUUSD leads in reaction to fear. bitcoin tends to follow after the conditions in the market, in terms of liquidity, become more favorable.

Volatility Indicates Pressure is Building

Although price seems to be quite stable, interesting information can be observed in Bitcoin's data. The realized volatility is about 37.8%, indicating that Bitcoin is actually moving more than seems to be the case. However, the implied volatility is approximately 15.1%, indicating that traders are not yet expecting a large movement.

This difference between realized volatility and implied volatility will frequently happen prior to a large breakout. This indicates a buildup beneath the surface.

The injection of liquidity by the Fed may not be sufficient to ignite a rally on its own, but it represents a litany of indicators that signify that change is underway.

Short-term Bitcoin Price Outlook

From a Bitcoin price point of view, the cryptocurrency is holding support near $86,600. If buyers manage to push the price above $90,000, the next targets could be $98,000 to $102,000. If support breaks, Bitcoin may revisit the $82,000 to $84,000 range before finding stability.

Source: BTC CoinMarketCap Chart

For now, the market is waiting.

The Bigger Picture

The Fed liquidity injection is not about stimulus. It is about keeping the system working. Gold and silver are responding by protecting value. Bitcoin is still deciding its direction.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.