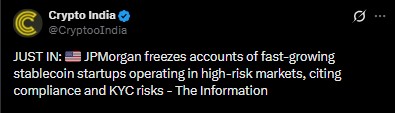

JPMorgan Chase Freezes Stablecoin Startups: Is Politics Pulling the Strings?

JPMorgan Chase slams the brakes on stablecoin startups. The question on everyone's mind: is this a cold business calculation, or a political power play?

The Regulatory Chessboard

Banking giants don't make moves without reason. The decision to freeze accounts and halt services for fledgling stablecoin firms sends a chill through the crypto corridor. It's a stark reminder of the gatekeeping power held by traditional finance—power that can be switched off with a single memo.

Follow the Money, or the Influence?

Industry whispers point to more than just risk aversion. The timing raises eyebrows. Is JPMorgan acting on its own volition, or responding to pressure from corridors of power wary of decentralized finance? The line between prudent compliance and political maneuvering is notoriously thin—and often just as profitable.

A Chilling Effect on Innovation

This freeze isn't just about balance sheets; it's about momentum. Startups relying on major banking partners face an existential threat when access is revoked overnight. It creates a paradox: innovate within a system that can cut your lifeline on a whim. Talk about building on shaky ground.

The Future of Finance—On Whose Terms?

The standoff highlights the core tension. Will the future of digital assets be built by nimble startups, or will it be curated—and controlled—by the old guard? JPMorgan's move suggests some banks would rather be the gatekeepers than watch the walls come down. After all, why disrupt a profitable monopoly when you can just regulate the disruptors out of existence?

Both of the startups involved reportedly used JPMorgan Chase via Checkbook, which happens to be a U.S.-based payments firm. However, the involvement in Venezuela, which happens to be under U.S. sanctions, raised concerns among JPMorgan Chase’s compliance team. The platform claims that this was not meant to be an attack on stablecoins, the timing here carries more than just one meaning.

Reasons Why JPMorgan Chase Acted against Blindpay & Kontigo

Both Blindpay and Kontigo target Latin American markets, where dollar-pegged stablecoins are prevalent for cross-border transactions. Blindpay, in particular, operates a U.S. dollar stablecoin used in Venezuela, a nation sanctioned by the U.S. under Executive Orders 13850 and 13884.

Inside JPMorgan Chase, compliance teams reportedly flagged disputed transactions and potential exposure to sanctioned entities. Under U.S. law, banks must strictly follow KYC, AML, and OFAC rules. Any failure can lead to heavy penalties from regulators like the SEC and the U.S. Treasury.

The spokesperson stated that the MOVE “has nothing to do with these companies,” adding that the bank actively works with stablecoin issuers and recently helped take one public. Still, involvement with high-risk jurisdictions left the bank little room to maneuver.

Venezuela Sanctions Add Pressure on Crypto Banking

The account freezes came as President Donald TRUMP escalated actions against Venezuela. In recent weeks, U.S. authorities intercepted two oil tankers carrying Venezuelan oil, with a third currently under surveillance. Trump openly stated the seized oil could be sold, stored, or added to U.S. strategic reserves.

The main focus is Venezuela’s state oil company PDVSA, which is already blacklisted. The U.S. Treasury also sanctioned six shipping companies accused of moving Venezuelan oil using fake location data and deceptive tracking practices. Officials claim these oil sales help keep Nicolás Maduro’s regime in power.

For JPMorgan Chase, any transaction linked to Venezuela carries major legal risk, making strict enforcement unavoidable.

Crypto Strategy Demonstrates Obvious Limits

But all these moves notwithstanding, it is not anti-crypto. It has indeed introduced the JPM Coin in 2019. Even at that, they are working on further enhancing their blockchain-based payment platforms for their institutional clients. Additionally, they have also explored regulated trading platforms.

Nonetheless, the bank is quite wary about general stablecoin market development. According to analysts, the overall development of stablecoin is still largely dependent on crypto market transactions rather than regular payments. This is why the bank is interested in institutional digital assets that are carefully controlled, rather than in startups in high risk areas.

Blindpay and Kontigo WOULD both have significant problems to overcome as a result of their inability to work with a large bank, especially with fiat-to-crypto transactions.

Conclusion

The JPMorgan Chase freeze of accounts is illustrative of the effects of sanctions and compliance on crypto banking. Though stablecoins provide access to finance, banks must shield themselves against the risks of sanctions on crypto. This is an indication of a world in which success in crypto will come through both regulation and technological advancement.

This post is purely for informative purposes only and not intended as an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.