Gold & Silver Soar to ATH as Bitcoin Nears $90K: Is the Crypto Rally Finally Here?

Precious metals just smashed records—and Bitcoin's knocking on $90,000's door. The old guard and the new frontier are surging in unison. What's fueling this dual ascent?

The Traditional Safe Haven Run

Gold and silver aren't just glittering; they're screaming. Hitting all-time highs signals a classic flight to safety, but with a modern twist. Inflation jitters, geopolitical tremors—the usual suspects are back. Yet, this time, digital eyes are watching.

Bitcoin's $90K Threshold

While bullion basks, Bitcoin is doing what it does best: charging toward a psychological barrier. The $90,000 mark isn't just a number; it's a beacon for institutional portfolios still heavy on, well, paper. The proximity suggests a market priming for a potential breakout, one that could leave traditional asset managers scrambling for explanations—and allocations.

Convergence or Coincidence?

Is this a rare alignment of asset classes, or is capital simply hunting for any store of value outside of central bank influence? The synchronized rise hints at a broader narrative: diminishing faith in conventional financial levers. Gold's rally lends a veneer of legitimacy to the 'digital gold' thesis, whether old-money purists like it or not.

The Cynical Take

Let's be real: Wall Street will spin this as 'portfolio diversification' while quietly sweating over the fact that a decentralized protocol is keeping pace with a millennia-old asset. Nothing frightens a fund manager more than a ledger that doesn't require their permission.

What Comes Next?

Watch the flows. A decisive break above $90,000 for Bitcoin could ignite the next leg of the crypto rally, pulling attention—and capital—from the metal surge. Conversely, a rejection might see that money double down on physical assets. The tension between the vault and the blockchain has never been more profitable, or more telling. The race for the ultimate hedge is on, and for once, the starting pistol fired for both at the same time.

Source: X (formerly Twitter)

In answering this question, it WOULD be necessary to consider both the charts and the larger market cycle.

Silver’s Explosive Rally

Silver recently touched a historical high of around $83.75 per ounce, thanks to the shortages emerging along with the growing demands in the solar, ev, and AI industries. At silver all time high, the total market value of the metal exceeded $4.8 trillion, exceeding global companies.

But looking at the Tradingiew XAUGSD chart, the cooling trend is more apparent. Prices corrected close to 10% intraday before settling in the $77-$80 range. RSI readings came down from overbought to the mid-40s, indicating that the momentum is slowing down rather than failing.

Source: TradingView

The MACD is flattening, and the volume is normalized. This is indicative of a consolidation of the extreme levels, and it is not crashing.

Another experienced investor, Robert Kiyosaki, has also warned of a FOMO phase of this metal asset, urging investors to wait.

Gold Is Consolidating After Record Levels

Gold shows a similar pattern. After trading NEAR $4,550, gold has moved sideways with mild pullbacks. RSI remains near 50–56, a neutral zone that usually reflects balance between buyers and sellers.

There is no clear breakdown on the Gold chart. Instead, price action suggests consolidation after a strong rally. Historically, this behavior often appears near cycle pauses rather than trend reversals.

Bitcoin Chart Signals Fresh Momentum

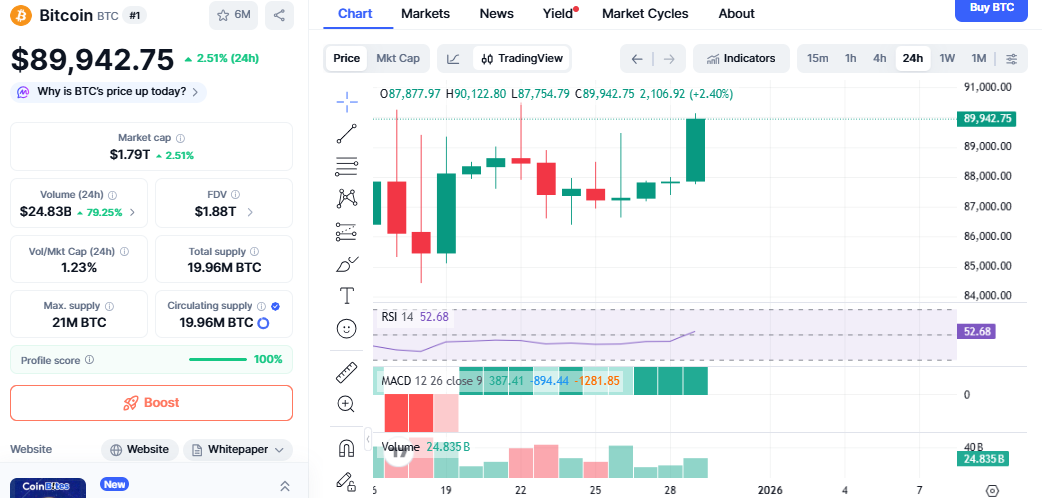

While metals cool, crypto is heating up. As per the Coinmarketcap, Bitcoin price today is near $89,000–$90,000, up around 2.5% in 24 hours. Market cap stands near $1.79 trillion, with 24-hour volume jumping over 79% to $24.8 billion.

Source: CoinMarketCap

RSI near 52–53, showing room for upside

MACD flipped positive for the first time in days

Price cleared key resistance at $88,000

A major driver was a short squeeze. Over $102 million in crypto shorts were liquidated in hours, including $23M+ in BTC shorts, forcing bearish traders to buy back BTC.

This price action strongly supports the Bitcoin Rally Next narrative.

Historical Pattern Points to Rotation, Not Weakness

Gold rose from $1,450 to $2,075

Silver jumped from $12 to $29

BTC stayed flat around $9,000–$12,000 for months

Only after gold and silver peaked did BTC explode, rising from $12,000 to $64,800, while total crypto market cap expanded nearly 8x.

Today, a similar structure is forming. Gold and silver moved first. The digital asset lagged. Now metals are pausing, and bitcoin is breaking out.

Liquidity, Structure, and the Bitcoin Setup

Unlike 2020, The crypto asset now has more catalysts:

Ongoing FED liquidity injections

Expected rate cuts

Improved crypto regulation clarity

Spot ETFs and institutional access

Reduced exchange inflows (down ~54% vs early December)

Whale data shows over 270,000 BTC withdrawn from exchanges in 30 days, tightening supply.

If it holds above $88,000 and closes strong into year-end, BTC Rally Next becomes more than speculation, it becomes a structural trend.

Conclusion

Gold and silver often MOVE before other markets, and this usually signals a shift, not danger. Their recent drop, along with BTC staying strong, suggests money may already be moving into crypto. Even though prices are still volatile, the data shows buying activity is building rather than investors selling off.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.