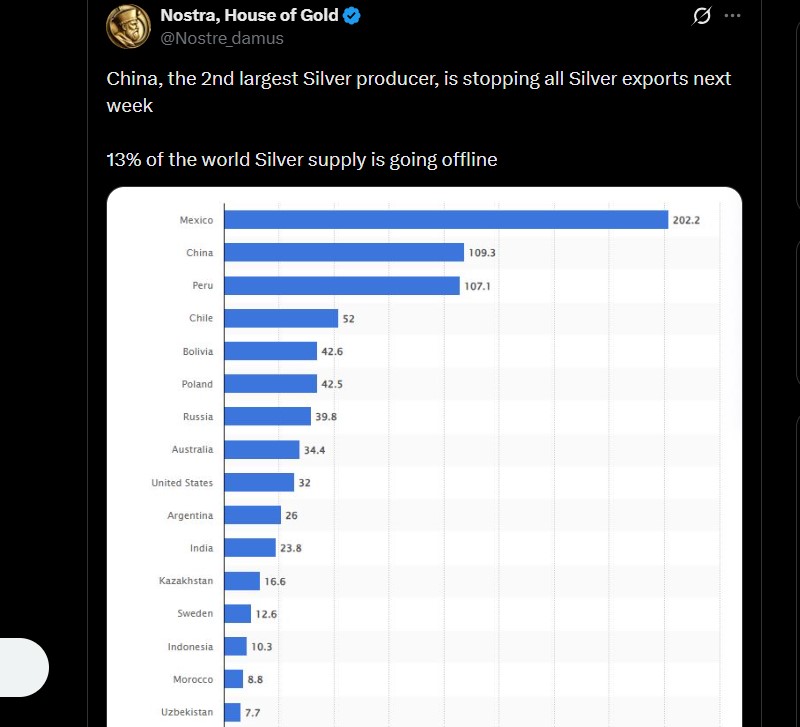

China’s Silver Export Ban in 3 Days: Will Prices Skyrocket or Crash?

China slams the door on silver exports. Markets hold their breath.

The countdown clock is ticking—72 hours until one of the world's largest economies shuts off a major valve in the global silver pipeline. This isn't a minor policy tweak; it's a hard stop. The immediate question isn't *if* the market will react, but *how violently*.

Supply Shock or Paper Tiger?

Traders are scrambling to model the fallout. On one side, you have the textbook supply shock scenario: remove a key supplier, and prices should, in theory, surge. Physical silver hoarders are already cheering, anticipating a scramble for remaining stockpiles outside China. The narrative writes itself—a perfect storm for a bullish breakout.

But the modern market rarely follows textbooks. The cynical view whispers that today's prices are less about physical bars in vaults and more about paper contracts and ETF flows. If the financialized market decides this ban is already 'priced in' or merely reshuffles global trade routes, the reaction could be a spectacular dud—a brief spike followed by a shrug. Nothing makes a trader look sillier than betting the farm on a story everyone else has already sold.

The Ripple No One's Talking About

Forget the silver charts for a second. The real signal here is strategic. China isn't just banning a commodity; it's locking down a critical industrial and, increasingly, technological metal. Silver is essential for solar panels, electronics, and the 5G rollout. This move screams industrial policy and long-term resource security over short-term export revenue. It's a playbook page torn right out of the rare earths handbook.

What's Your Move?

So, do you front-run the panic, or fade the hype? The volatility pump is almost guaranteed—algos will feast on the headlines. But sustained momentum? That requires a genuine physical squeeze the ETFs can't paper over. Watch the warehouse inventory data outside China like a hawk. In the meantime, grab some popcorn. The next three days will be a masterclass in how modern markets digest a geopolitical gut punch—or, as the finance bros will call it by week's end, 'just another Tuesday.'

Let’s understand why this is happening, what impact will it have of WHITE metal’s price.

“The China Silver Export Ban Factor”: What’s Behind This Massive Move?

According to posts from the Money APE X account, China Silver restrictions were not sudden. Under the Announcement No. 68, Beijing approved export limits back in October, shipments were allowed to surge temporarily, and now the gates are closing.

Starting this week, to get a license, a company must produce at least 80 tonnes of white metal a year and have millions of dollars in the bank. This blocks most small and medium-sized sellers.

Since the country controls about 60% to 70% of global white metal’s refining, this MOVE puts the government in total control of how much the rest of the world gets.

At the center of this shift is the China Silver Export Ban, which comes at a time when the asset’s market is already structurally broken.

Why China Banned It Now? The country is prioritizing its own “Green Transition.” The government wants to keep the precious asset for itself to stay ahead in:

-

Solar Power: Newer solar panels need 50% more of these safe asset than older ones.

-

Electric Cars (EVs): They have the world’s biggest EV market, and these cars need white metal for their electronics.

-

Big Machines: Keeping the asset at home ensures Chinese factories have what they need to build high-tech tools.

Why Samsung Silver Battery News Made the Situation Worse?

The supply shock meets a massive new demand narrative: Samsung’s solid-state battery. Industry reports from Wall Street Gold suggest these batteries let an EV drive 900 km and charge in just 9 minutes. To do this, they use a special LAYER made of this safe-asset and carbon.

While speculations say these batteries use 1 kg of this safe-asset each, this hasn't been officially confirmed for mass production yet. Even if only 20% of new cars use this tech, it WOULD eat up a huge amount of the world's precious metal.

This news came in exactly at the time China silver export ban and restrictions are surrounding the industry with fear, making the scenario even worse.

Will the Silver-Metal Price Surge Continue After China Cuts Supply?

Looking at the TradingView price charts, the asset is in a very "bullish" trend. The price is staying strong above the $76-$77 mark, which was a hard level to break before.

With the RSI (14) NEAR 70 and a positive MACD, momentum points toward a move to $82–$85.

Why is silver rising today ? It’s not just a guess, there is a real shortage. In cities like Shanghai, people are already paying over $80 for an ounce of precious metal because they want the real metal, not just a digital contract.

With the China silver export ban news today confirming the January 1st deadline, experts believe any small price drops are just "breaks" before the price jumps again toward $80 or even $100.

Do you know what is even more interesting to watch: This asset isn't the only thing getting scarce. The Bitcoin supply shock is also happening. Data shows that long-term investors have "locked away" 74% of all Bitcoin, meaning there isn't much left for others to buy.

Both the tokens are becoming "hard to get," which usually makes prices go up fast when demand increases.

Conclusion

The China Silver Export Ban is more than just a new rule; it’s the start of a global crisis. With vaults down 70% and the Samsung battery news showing that demand is only going up.

In the coming days, if it stays above $75.00, it is expected to keep climbing. If it breaks past $80.00, Coingabbar crypto experts believe Silver price prediction 2026 target could move quickly toward $85 or $100.

YMYL Disclaimer: Investing in hard assets can be risky sometimes because prices can change very fast. The information given above is only for educational purposes, and does not support any investment advice. Always "Do Your Own Research" before making any financial decision.