Michael Saylor’s Next Bitcoin Move: Will His Purchase Spark a Rally or Precede Another Dip?

All eyes are back on the Bitcoin oracle. Michael Saylor, the corporate world's most vocal Bitcoin evangelist, is reportedly gearing up for another major purchase. The market holds its breath—will his signature buy trigger the next leg up, or has his timing finally met its match against a looming correction?

The Saylor Signal

For years, Saylor's public acquisitions have acted as a bullish flare for the crypto community. His strategy is no secret: accumulate and hold, treating Bitcoin as the ultimate corporate treasury asset. Each announcement historically sent ripples—sometimes waves—through the market, reinforcing his thesis that fiat is melting and digital gold is the exit.

Rally or Retrace?

This time, the calculus feels different. Macro headwinds whisper of tightening, and Bitcoin's recent price action has traders nervously eyeing support levels. Does Saylor see a dip he's eager to buy, or is he charging ahead regardless, betting the long game dwarfs short-term volatility? The move puts institutional credibility on the line—again.

Timing the Untimeable

Attempting to trade alongside a billionaire's treasury strategy is a retail investor's favorite pastime and most reliable path to frustration. Saylor plays a decade-long game; the market often reacts in ten-minute intervals. That disconnect alone could fuel both the initial hype and the subsequent sell-off if patience wears thin.

The real question isn't about the next candle on the chart. It's whether the market still believes in the narrative Saylor sells—or if it's starting to treat his buys like a quarterly earnings report from a legacy bank: something to be scrutinized, then immediately forgotten.

Source: X (formerly Twitter)

Historically, the coin WOULD plunge following his purchase announcements. However, the prevailing market conditions at the moment seem to have changed with rising institutional and whale buying.

Saylor Next Bitcoin Purchase Puts MicroStrategy in the Limelight Again

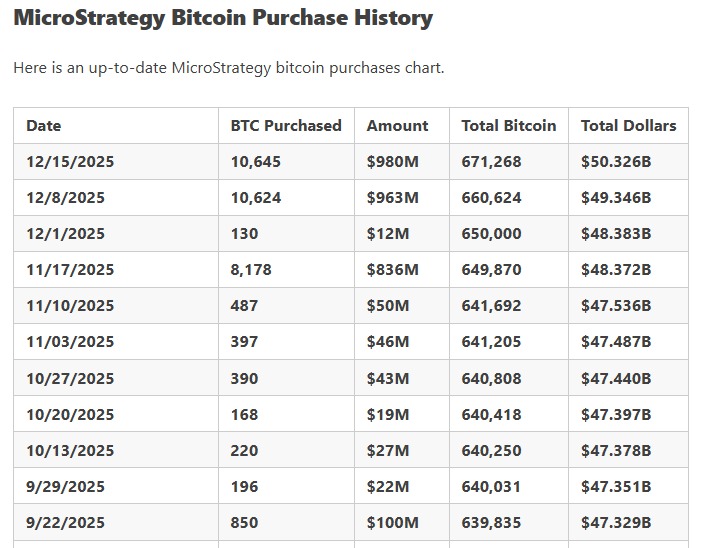

MicroStrategy, with a total holding of 671,268 BTC, is the largest institutional investor in BTC. MicroStrategy’s bitcoin holdings are placed at around $59.3 billion. The firm acquires its average holdings through diversification efforts spread over several years.

Source: Bitbo Treasuries

Recently, MicroStrategy has acquired over 10,600 coins in mid-December itself, investing nearly $980 million. As a result of this investment, the company has seen new peaks in its total BTC exposures despite the fluctuations in the stock.

The price for MSTR stock is hovering around 158, but the return over 3 months and 1 year is still negative. The long-term return, however, is indicative of extreme growth since the start of the Bitcoin strategy.

This means that Saylor's next Bitcoin purchase is a significant occurrence not only in regard to the digital asset, but it is of great interest to MicroStrategy stockholders as well.

Market Reaction History Raises Cautious

BTC has regularly fallen after previous purchase announcements. This is known as “sell the news.” Critics like Peter Schiff have questioned how MicroStrategy is funding its future purchases based on sales of shares and leverage.

It has regularly fallen after previous purchase announcements. Although he faced backlash, Michael didn’t budge in his decision. Michael's latest tweet, "back to oranges," suggested that he could buy again, keeping the rumors active about the next buy.

However, what’s important this time around is market structure.

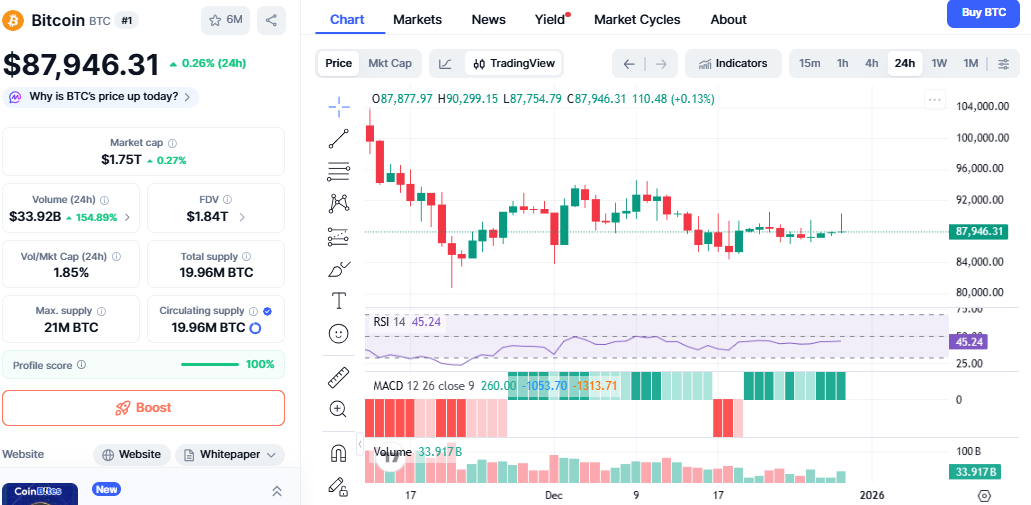

The current market price of BTC is trading around $88,000 to $89,000, with the total increase of 1.59% in the past 24 hours. Though the short-term trend is positive, the coin is, in fact, down by more than 1.5% in the last 30 days.

Source: CoinMarketCap Bitcoin Chart

RSI close to 45, the neutral region

Turning MACD line positive, implying momentum build-up

Strong support around the 30-day SMA at $89,163

This kind of setup appears to depict the crypto as being stable and not overheated at

On-chain data further supports this analysis. A total of 1,600 BTC, approximately $143 million, has left the Binance exchange in the last few hours, indicating less selling pressure.

BlackRock’s IBIT is the key initiator for the flows, with large institutional clients seeing corrections as opportunities for buying.

Conclusion

BTC's reaction to the next Microstrategy buy would be based on market follow-through, not the headlines. Whale accumulation, ETF flows, and the technicals indicate limited risk on the downside. If the cryptocurrency manages to maintain itself above $89,000 after the announcement, a slow march towards $92,000-$95,000 is definitely on the cards. Otherwise, another short-term correction towards $85,000 is also expected. This time, however, the market seems better prepared than in the past.

This article is for informational purposes only, kindly do your own research before investing in crypto.