Metaplanet’s Bitcoin Buying Spree Hits 35,102 BTC: Why This Move Changes Everything

Another corporate whale just doubled down on digital gold—and Wall Street's traditional playbook is looking rusty.

The New Corporate Treasury Standard

Forget bonds and cash reserves. Forward-thinking firms are now parking balance sheet value in the most resilient asset of the digital age. This isn't speculative trading; it's a strategic hedge against currency devaluation and systemic risk. When a single entity accumulates over 35,000 BTC, they're not just investing—they're building a fortress.

What the Number Really Means

That 35,102 figure represents more than a portfolio. It's a voting stake in the future of finance, a public bet against inflationary monetary policy. Each Bitcoin added shifts the scarcity dynamic, pulling more value from traditional markets into a transparent, programmable system. The message to shareholders? We trust code more than central bank promises.

The Ripple Effect Across Markets

Every major corporate purchase creates a supply shock—pulling coins off exchanges, tightening available liquidity, and forcing institutional competitors to play catch-up. It validates Bitcoin's role as a corporate asset class, pushing legacy funds toward allocation models they've spent years dismissing. Suddenly, not holding Bitcoin looks like the risky position.

A Quiet Revolution in Plain Sight

While traditional finance debates interest rates, the smart money is quietly opting out of the system entirely. This accumulation isn't just about profits—it's about sovereignty. No permission needed, no counterparty risk, just mathematical certainty where trust used to be the expensive variable.

One firm's balance sheet strategy just became every CFO's homework assignment—and the old guard is scrambling to explain why their 'prudent' cash reserves are melting against real assets. The future of corporate treasury management isn't being written in boardrooms; it's being mined in blocks.

Metaplanet Bitcoin Buy Pushes Holdings to 35,102 BTC

During the fourth quarter of 2025, the firm acquired 4,279 BTC for about $451 million, paying an average price of $105,412 per coin. As of December 30, 2025, the company now holds 35,102 BTC, bought for a total cost of nearly $3.78 billion.

At current market prices, those holdings are valued lower due to coin’s recent dip. Even so, the organisation reported a strong BTC Yield of 568.2% in 2025, showing how aggressively it expanded its position this year.

Source: Simon Gerovich X (formerly Twitter)

They began buying in April 2024 as a way to protect itself from a weakening Japanese yen. Since then, it has used a mix of debt, equity, and income from derivatives to fund its Bitcoin strategy.

Why Metaplanet Is Called “Asia’s MicroStrategy”

Because of its bold digital asset strategy, Metaplanet is often called “Asia’s MicroStrategy.” The company’s CEO, Simon Gerovich, has openly stated the goal of reaching 100,000 of this digital coins by 2026.

However, the aggressive buying plan has not come without concerns. After the latest Metaplanet bitcoin Buy announcement, the company’s stock fell around 8%, as investors worried about dilution and rising debt. Still, the accumulation itself shows strong long-term confidence.

MicroStrategy Bitcoin Purchase Confirms the Trend

Metaplanet is not acting alone. MicroStrategy, led by Michael Saylor recently added 1,229 BTC for about $108.8 million, at an average price of $88,568 per coin.

MicroStrategy's holding 672,497 BTC as of December 28, 2025, which cost over $50.44 billion at the average price of $74,997 per BTC is really impressive and gives a strong line to the company's long-term crypto investment policy. The company reported 23.2% BTC Yield in 2025.

These large purchases combined indicate one thing: right now, large institutions are buying the digital asset once more after recent price recovery.

What this means Ahead?

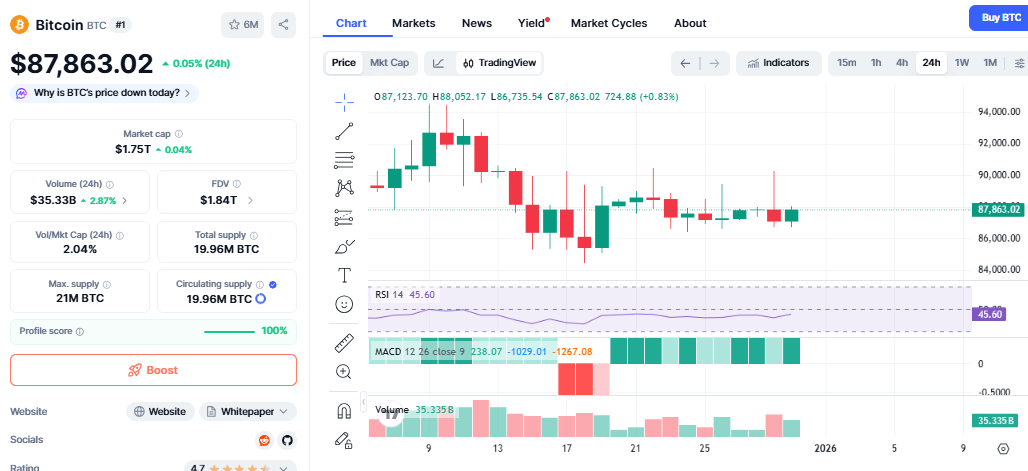

As per the Coinmarketcap, It is currently around $87,800 and is in a sideways trend following the recent pullback. The RSI in the area of 45 indicates a neutral momentum, which is neither overbought nor oversold. The MACD is still positive, which is a sign that the overall trend is still good.

Source: CoinMarketCap

If the price holds above $86,000–$87,000 and then retakes the $90,000 mark, the following targets might be $95,000 and perhaps even $100,000.

In case it drops below $85,000, it may fall to $82,000–$80,000.

Conclusion

The recent Metaplanet Bitcoin Buy along with the MicroStrategy acquisition, sends a clear message. After the $90,000 mark, the institutions are not exiting the market. Rather, they are stacking up quietly. The price volatility in the short term will still be there, but these moves are signs of increasing long-term confidence in crypto's future.

Disclaimer: This article is for informational purposes and not a financial advice, kindly do your own research before investing in crypto.