The 2025 Crypto VC Power Rankings: Which Firms Dominated Deals and Funding?

Forget the hype—follow the money. 2025's crypto venture capital landscape saw a seismic shift in power, with a handful of firms writing the biggest checks and locking down the most promising deals. The year wasn't about scattered bets; it was a strategic land grab by the industry's most connected players.

The Heavy Hitters Emerge

A clear tier of leaders pulled away from the pack. These weren't just funds with deep pockets—they were the gatekeepers to the next generation of protocols and infrastructure. Their playbooks focused on scalability solutions, institutional-grade DeFi, and the bleeding edge of AI-crypto convergence. If a project got their backing, it wasn't just a vote of confidence; it was a fast-track ticket.

Deal Flow Dictators

Leading the activity wasn't about quantity alone. The top firms mastered the art of the 'signaling round'—getting in early at valuations that would make traditional VCs blush (or finally take notice, depending on how cynical you are about their late arrival to the party). Their networks became the most valuable asset, creating a virtuous, or perhaps vicious, cycle of access and influence.

The New Guard vs. The Old Money

While crypto-native funds solidified their dominance, 2025 also marked the year traditional finance giants stopped dipping toes and started diving in headfirst. Their participation inflated round sizes and brought a new level of scrutiny—and spreadsheet modeling—to a sector that once prized anonymity over audited financials. A necessary evolution, or the end of an era? Depends who you ask.

The bottom line? Capital concentrated where conviction was highest. The firms that led didn't just fund companies; they funded entire narratives, betting that the real value in crypto isn't just in the code, but in the ecosystems they can build around it. Just remember, in venture capital, past performance is no guarantee of future results—unless you're the one collecting the management fees.

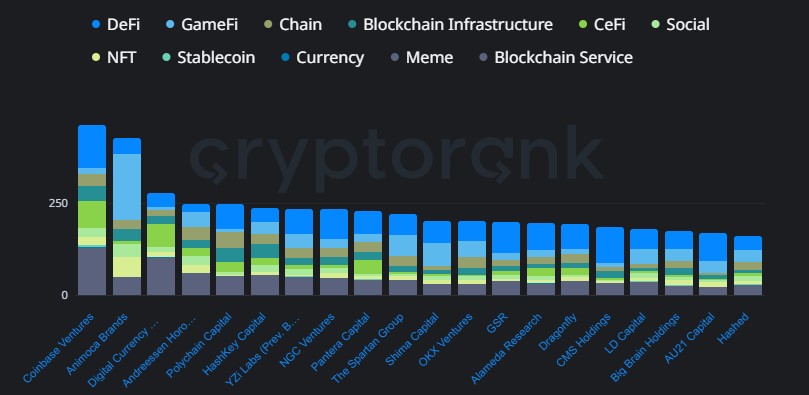

Talking about the leading performer of the year, according to the data, Coinbase Ventures topped the charts by participating in 87 deals, making it the most prolific funder in the sector.

Other active players include Animoca Brands with 52 deals, YZi Labs with 40 deals, and both GSR and Amber Group with 39 deals each. Panthera Capital closed 37 deals, while Selini Capital, Mirana Ventures, and Big Brain Holdings were also active with 33 deals each.

Understanding Crypto Venture Capital

Venture Capital or VCs refer to investment made in early-stage companies with high growth potential. In the crypto world, this usually means funding startups in sectors like DeFi (decentralized finance), GameFi, NFTs (non-fungible tokens), Centralized Finance, and blockchain infrastructure.

These investments help startups develop new products, expand operations, and attract talent, while giving VCs a chance to profit if the company succeeds. For example, a successful DeFi protocol could grow into a multi-billion-dollar project, giving early backers substantial returns.

2025 Funding Trends and Implications

According to the findings, crypto startups raised $171.37 billion across 10,582 funding rounds in 2025. Funding sizes varied widely:

Over 2,200 rounds raised $1–3 million, typical for early-stage startups.

Around 1,000 rounds raised $3–10 million, often for scaling operations.

More than 2,800 rounds raised $50 million or more, mainly for established projects or high-potential startups.

Here, funding rounds indicate the stage of the company's growth.

Earliest stages, where financial supporters help founders build their products and get the business off the ground.

Growth stage, providing funds to scale operations and reach more customers.

It often includes corporate investors or partners to strengthen their market presence.

The final one, where the company does not share the amount raised, usually for privacy or strategic reasons.

According to market analysts, In 2025, undisclosed stages are increasingly common as funds prioritize strategic positioning over publicity. Seed and strategic rounds follow next, suggesting that while institutional investors are cautious about public announcements, funding is flowing steadily across all stages.

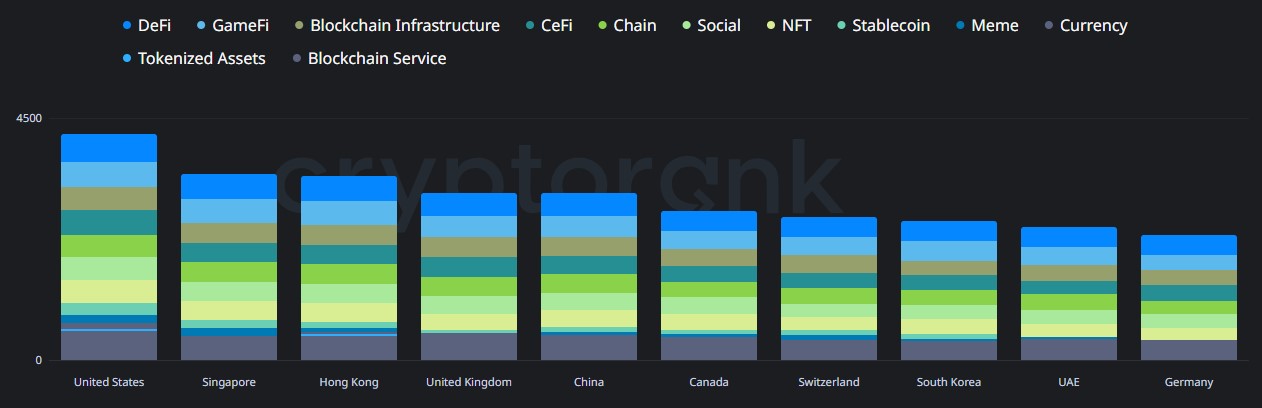

Countries Leading Crypto Innovations

In a general pattern or proving the historical trend, countries with potential technological ecosystems and regulatory clarity. As the hints are clear enough for the United States to be on top, it has 4,500+ projects gathering the funds from investors.

Other nations on the top list with their projects include:

Singapore: ~3,800 projects

Hong Kong: ~3,600 projects

United Kingdom: ~3,300 projects

China: ~3,200 projects

While funders are targeting regions that combine talent, regulation, and market opportunity, emerging nations are also seeing a growth trend in overall statistics.

What This Means for the Crypto Ecosystem

The high crypto VC activity indicates a healthy and growing digital assets ecosystem. Platforms like Coinbase and Animoca Brands are not just providing funds, they are influencing which early-stage blockchain startups succeed. Startups in DeFi, GameFi, NFTs, and blockchain infrastructure are likely to gain traction because of this support.

The monthly fundraising peaks in Q1 and Q4 2025 suggest strategic targeting of high-potential projects, which could accelerate innovation in the sector.

Looking forward, this strong VC activity could help blockchain startup develop more scalable products, attract global users, and compete with traditional tech industries.

This article is for informational purposes and not investment advice.