Federal Reserve Injects $31B Liquidity: Largest Move Since COVID Era Shakes Markets

The Fed just opened the spigot—and Wall Street's getting soaked.

The $31 Billion Question

Forget subtle adjustments. The central bank just deployed its biggest liquidity cannon since the pandemic panic, dumping thirty-one billion dollars into the system overnight. That number isn't a typo—it's a statement. Markets twitched, algorithms recalibrated, and traders scrambled to decode the message behind the money.

Liquidity, But Make It Fashionable

This isn't your grandfather's quantitative easing. The move bypasses traditional channels, targeting specific pressure points with surgical precision. They're not just adding fuel; they're redesigning the engine while it's running. Banks get breathing room, credit markets get a caffeine shot, and everyone pretends this level of intervention is totally normal for a 'stable' economy.

Post-Pandemic Playbook

Remember 2020's firehose approach? This feels different—more calculated, less desperate. The Fed's playing 4D chess while everyone else checks their balance sheets. They're signaling confidence while building a buffer, preparing for whatever economic ghost might appear next. It's monetary policy as performance art, and we're all unwilling critics.

Markets React (Because They Have To)

Initial shock gave way to speculative frenzy. Bonds yawned, equities blinked, and the dollar did its usual mysterious dance. The real action? In the derivatives pits and dark pools where billion-dollar bets adjust to the new liquidity landscape. Thirty-one billion might sound like monopoly money to a central bank, but it reshapes risk appetites from hedge funds to main street.

The Fed just reminded everyone who holds the purse strings—and the panic button. They'll call it 'proactive adjustment.' Traders will call it a lifeline. Economists will write papers about it. And the rest of us? We'll just watch the numbers dance, wondering when the music stops. After all, what's another thirty-one billion between friends when the national debt's already playing in the cosmic leagues?

What Happened?

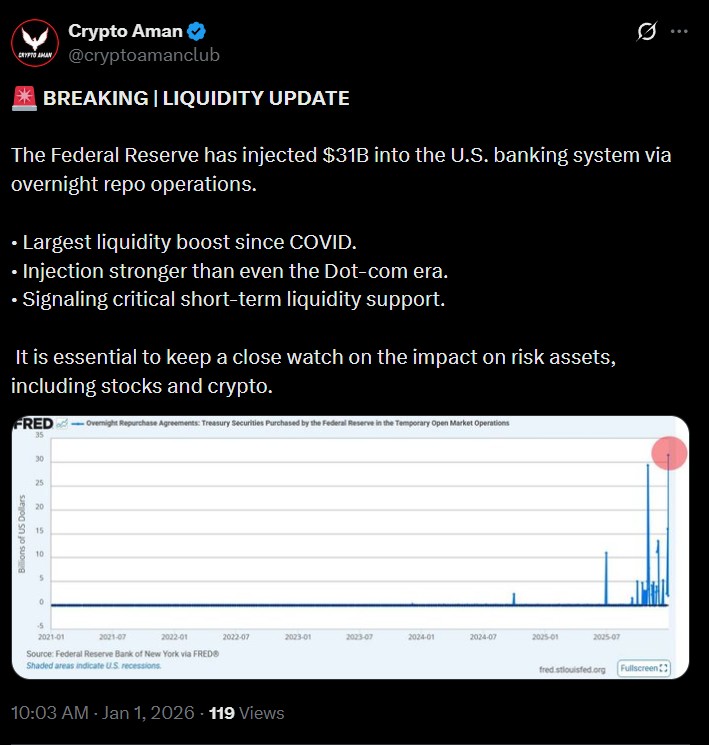

The U.S. Federal Reserve liquidity operation conducted at the beginning of 2026 added $31 billion to the banking system by the use of overnight repurchase agreements (repos).

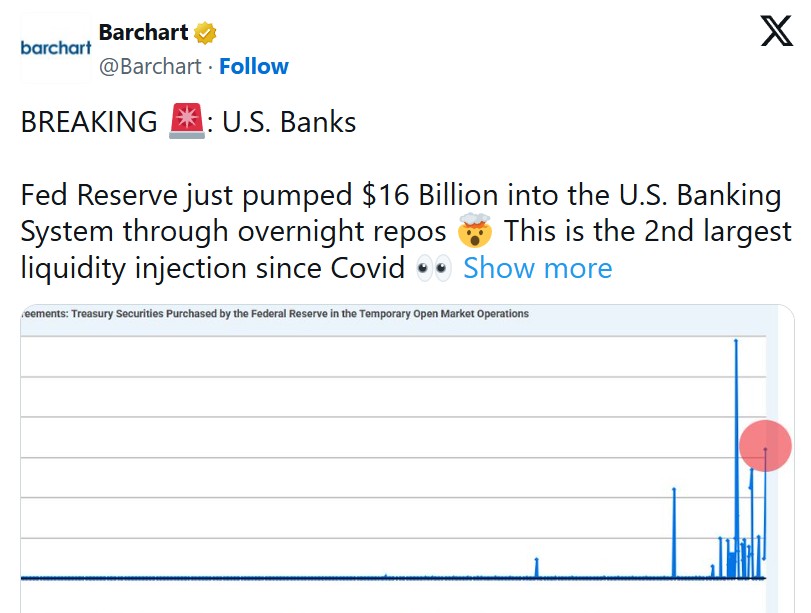

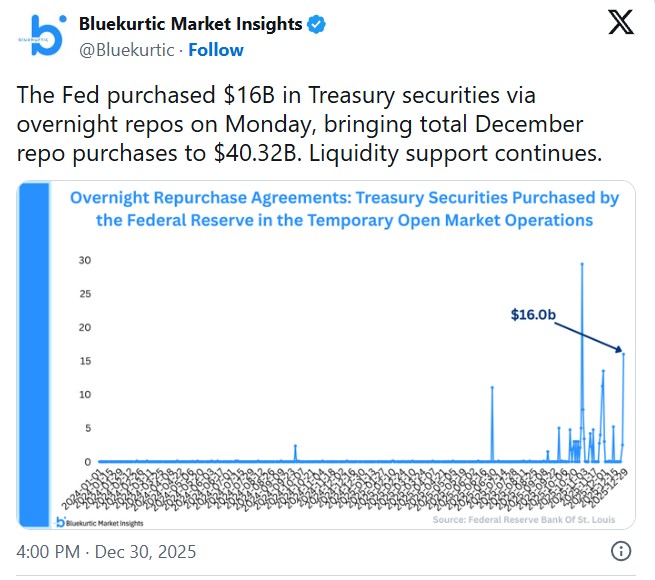

This was after another significant operation was made on December 30 with an addition of $16 billion, which brought the total December repo injections to $40.32 billion.

This is the highest amount of overnight liquidity increase since March 2020, according to the Federal Reserve Economic Data (FRED), and it exceeds the level during the Dot-com bubble era.

Source: CryptoAman X

Why is this important?

The large repo operations are not common outside the times of financial stress. Although the Fed typically performs repos at the end of the quarter and year, the volume of this intervention is noticeable, and the market participants are trying to understand whether there is an underlying pressure in the short-term funding markets.

What Does the Data Show?

Graphs of the temporary open market operations indicate a sharp spike in the activity of repo. In the past, such spikes have been associated with economic uncertainty or stress in the market. Shaded recession zones on the charts further highlight how unusual the current MOVE is.

Source: Official X

Is This a Crisis?

Most analysts do not view this as an outright crisis. The dominant reason has been cited as the restrictions of the end balance sheet and the regulatory reporting requirements that tend to make banks hesitant to lend to each other. The institutions resort to the Fed as a backstop when the private lending becomes tight.

Other commentators feel that there is more stress under the surface due to the size of the injections. Financial analyst Andrew Lokenauth opined that banks might require additional funds to meet the commitments related to collateral mismatches and commodity-related exposures. Persistent reliance on Fed facilities can signal rising risk aversion.

What did the Federal Reserve Say?

The Fed maintains that these operations are not quantitative easing (QE). Officials describe them as routine liquidity management aimed at keeping short-term interest rates under control. Nonetheless, the latest FOMC meeting minutes might show a possible not QE reserve program, with a maximum of $220 billion of Treasury purchases during the coming year to have sufficient reserves.

Source: X

What of Fed Interest Rates?

The Fed is also wary of reducing rates even though liquidity is increasing. Policymakers pointed out that the rates will remain high longer unless inflation declines with persuasion. The next rate cut is not anticipated until March 2026 in the markets.

Source: X

What Is Going on with Global Liquidity, Bitcoin, and Stocks?

The world is now enjoying the highest liquidity ever, up about $490 billion, due to the better collateral situation, to fiscal flows that look like stealth QE, and more lenient policies in the major economies, including the seasonal liquid assistance of China.

In the past, risk assets like equities and cryptocurrencies have been supported by expanding liquidity. Most crypto-oriented analysts are optimistic that Bitcoin will finally react positively if the capital momentum persists.

Bitcoin is in a range of between $85000 and $90000, probably because of the high Fed interest rates regulatory unpredictability, low trading volumes, and investor paranoia.

Conclusion

The Federal Reserve is quietly reinforcing the financial system with substantial support while maintaining a restrictive rate stance. Although officials insist this is not easing, the direction of capital is clearly upward. Whether this marks a turning point for markets remains uncertain, but investors are watching closely as capital conditions continue to evolve.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. crypto assets are highly volatile, and you can lose your entire investment.