Lighter Airdrop Allocation Explained: How LIT Tokens Were Distributed?

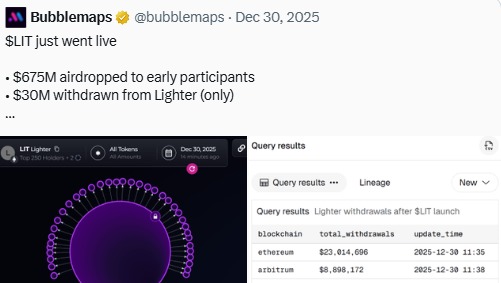

Lighter's LIT token airdrop just hit wallets—here's how the distribution actually works.

The Allocation Breakdown

Lighter's team sliced the airdrop pie into precise segments. Early testers and liquidity providers grabbed the largest shares, while community contributors and partner protocols took smaller, strategic cuts. The model prioritizes active network participants over passive holders.

Claim Mechanics & Vesting

Eligible users claim tokens directly through Lighter's interface. No complex KYC hurdles—just wallet verification. But here's the catch: portions unlock gradually. That vesting schedule? Designed to prevent immediate sell-offs and stabilize early trading. A classic move to manage tokenomics, though cynics might call it artificial price support.

Why This Distribution Matters

Lighter's approach bypasses traditional venture capital dumping. It places tokens directly in user hands, aligning incentives from day one. The allocation rewards past engagement while incentivizing future protocol use. It's a decentralized launch playbook, executed with surgical precision.

Will it work? The market decides now. Just remember—in crypto, 'fair distribution' often means someone still gets a bigger slice. The real test comes when vesting periods end and wallets unlock.

Source: Bubblemaps X

What Is the Lighter Airdrop Allocation?

The Lighter Airdrop Allocation was created to reward people who supported the platform early. Users earned points mainly by trading on Lighter. Later, these points were converted into LIT tokens.

50% of the total supply is reserved for the ecosystem, which includes users and future rewards.

The other half is locked for the team and investors, with a long vesting period.

From the ecosystem share, 25% was used only for the points-based rewards.

The remaining ecosystem tokens are planned for future reward seasons and partnerships. This shows the project is thinking beyond just one airdrop and wants to keep users active over time.

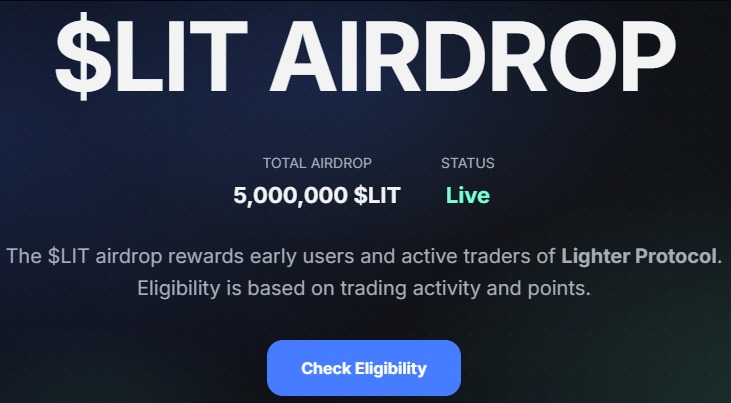

The official LIT airdrop page shows that, the project had accrued a total of 5 million tokens, and have been marked as live on the page. Users can check their allocation on the official site by connecting a wallet, and as such, it is clear that it follows a usage-based structure.

Source: Official Website

Founder Clears the Confusion

After the airdrop, some people raised questions about who received tokens and why. To clear things up, Lighter founder vladn.eth shared a message on Discord.

He explained that less than 10% of the allocation is linked to activities that are not related to trading.

One part involved a deal made before the private beta in late 2024.

A third-party liquidity provider agreed to supply up to $5 million to help early trading run smoothly.

The project confirmed there are no personal or financial connections with this provider. The goal was simply to reduce early risk and improve trading experience.

Jump Crypto’s Role Explained Simply

Earlier reports also showed that Jump Crypto helped with market-making on the project. For this support, Jump received 9.285 million LIT coins, which is about 0.93% of the total supply.

This was not part of user rewards. It was given to support trading activity and liquidity. Many exchanges and platforms follow similar arrangements during early stages.

Why LIT Price Is Going Up Again?

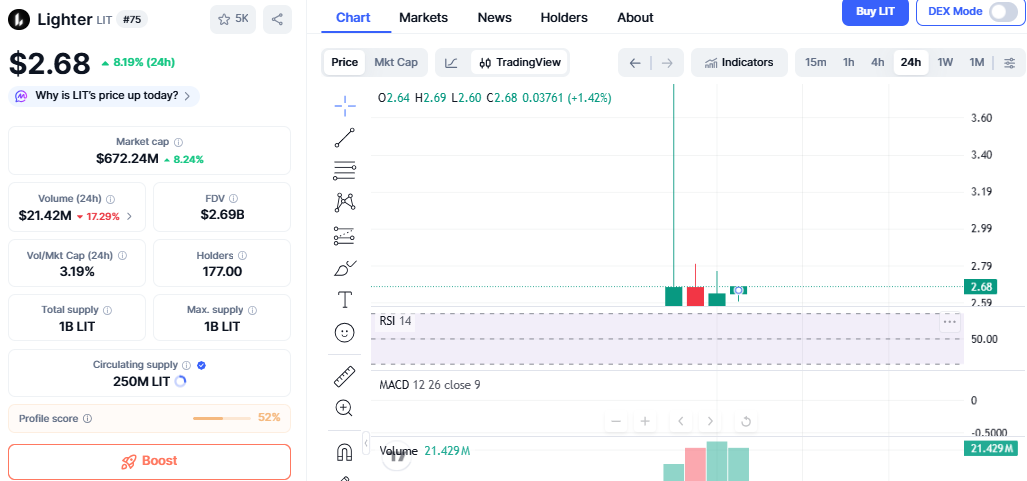

After listing NEAR $3.40, LIT dropped almost 30% as the early beneficiaries sold their tokens. Recently, the price recovered to around $2.68, showing that selling pressure has slowed down.

Source: CoinMarketCap

On-chain data shows wallets linked to him bought 13.25 million LIT, worth about $33 million. This alone now accounts for more than 5% of the circulating supply, which makes available supply tighter.

Things improve when large investors enter markets like this.

How Airdrop Could Affect LIT Moving Ahead

Looking at the Lighter price prediction,

Short-term, it is also likely to remain volatile because some people are selling. Although, heavy selling appears to be completed.

If the value of the token remains above the level of $2.60, it will probably approach the range of $2.80 to $3.00 once again. For the long-term growth of the company and the increase in value of the shares of Lighter's oil and gas services platform.

This article is for informational purposes only, kindly do your own research before investing in the crypto markets.