Crypto Phishing Plummets 83% in 2025, But Q3 Losses Hit Record High

Phishing attacks targeting crypto wallets and exchanges nose-dived last year—a headline that would make any compliance officer smile. Yet the devil, as always, is in the quarterly details.

The Contradiction in the Data

While annual figures show a dramatic decline in scam volume, the third quarter of 2025 tells a different story. That period alone accounted for the highest concentrated losses on record. It suggests attackers aren't giving up; they're just getting more efficient—and more patient.

Quality Over Quantity

The trend points to a brutal shift in strategy. Scammers are ditching the spray-and-pray approach. Instead, they're running fewer, more sophisticated operations aimed at bigger prizes. Think surgical strikes on high-net-worth wallets versus carpet-bombing Twitter with fake support accounts.

The Security Paradox

This creates a strange paradox for the industry. Broader security education and better wallet safeguards are clearly working to reduce overall incidents. But for those who do get caught, the financial hit is now catastrophically higher. One successful phish can fund a scammer's operations for a year.

It's the financial market's oldest lesson, repackaged for the digital age: risk never disappears; it just consolidates. And in crypto, consolidation has a nasty habit of turning into a single, life-changing mistake for someone—usually right after they think they've finally figured it all out.

Source: ScamSniffer X

Crypto Phishing Scam Report 2025

Scam Sniffer’s 2025 Annual Anti-Scam Report reveals a major decline in wallet drainer phishing attacks across EVM chains. Total monetary hit dropped to $83.85 million, down from $494 million in 2024, while the number of victims fell to 106,106.

This improvement reflects stronger wallet warnings, better detection tools, and rising user awareness. However, the report makes it clear that phishing is far from over. Scams are not fading away but evolving, shifting their time, methods, and victims.

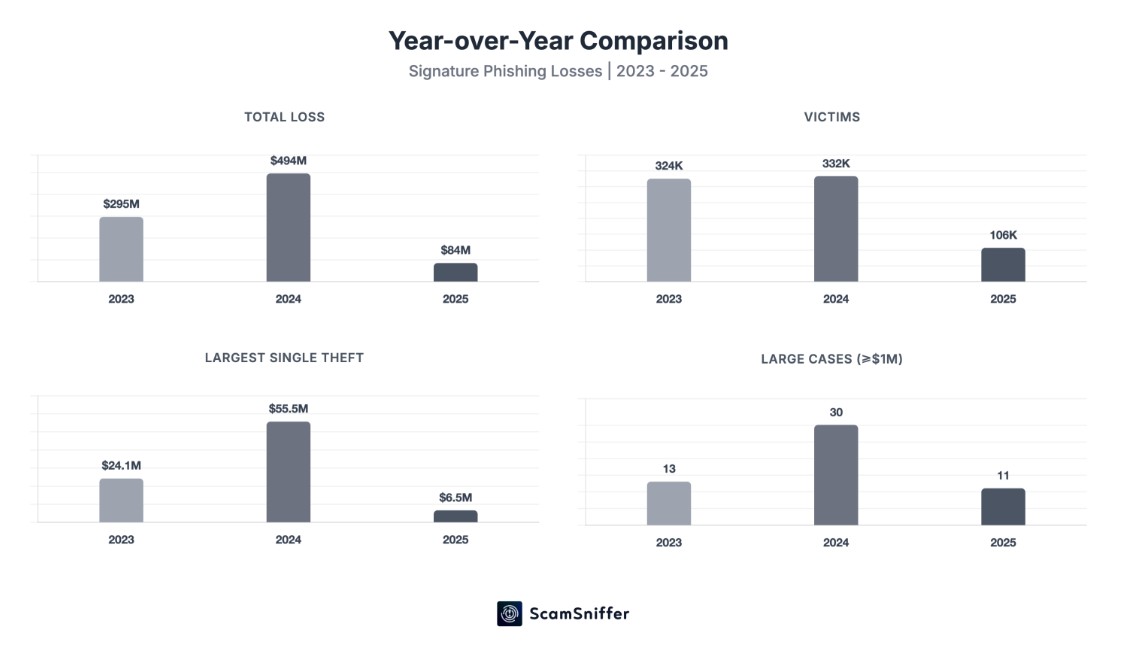

Yearly-Wise Comparison

Compared to previous years, 2025 marks a strong turnaround. The damage fell 83% year-over-year, and victims declined 68%.

The loss increased in 2024 in tandem with the rise of crypto prices, and 2025 demonstrated that better defenses can reduce harm.

The highest single theft also decreased massively to $6.5M, compared to more than $55 million in 2024.

Average loss per victim decreased to $790, showing reduced impact per incident.

Source: Website of Scam Sniffer

Quarterly Comparison

Losses closely followed market momentum (Data given in terms of million)

Q1 ($21.94): A declining market kept activity moderate.

Q2 ($17.78): As confidence returned, scams picked up slowly.

Q3 ($31.04): The most profitable ETH surge resulted in the greatest losses, almost 37% of the annual mark.

Q4 ($13.09): The quietest quarter was caused by the cooling markets.

This confirms that cryptocurrency attacks grow when trading and user activity rise.

Source: Website

Monthly Comparison

Monthly losses ranged widely, from $2.04 million in December to $12.17 million in August. Almost 30% of annual losses are comprised of August and September.

The damage was lowest in December when the market participation declined. November stood out, with fewer victims but higher average losses, showing how targeted attacks can still cause serious harm.

Source: Website

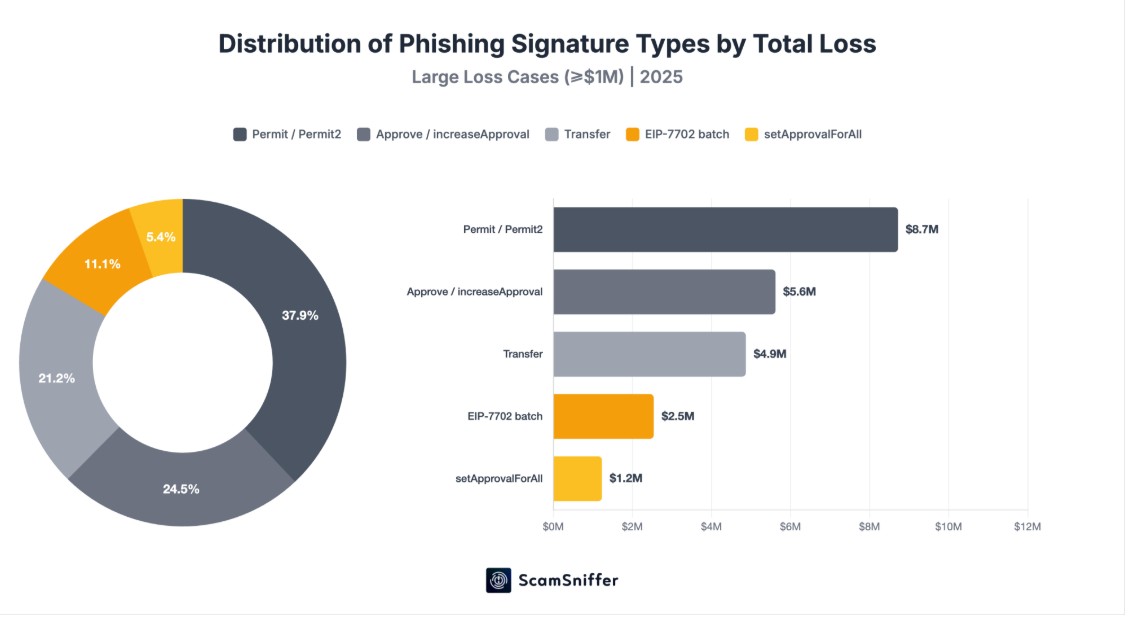

Popular Phishing Cases That Exceeded $1 Million

Only 11 cases crossed the $1 million mark in 2025, totaling $22.98 million.

The largest loss was $6.5M via a Permit signature in September.

Permit and Permit2 signatures accounted for 38% of major losses.

Two EIP-7702 batch signature attacks after the Pectra upgrade caused $2.54M in August.

These examples speak of the concentration of attackers on sophisticated signing techniques.

Source: Website

What Does All of This Data Say about Scams in 2025?

The statistics indicate that fraud is becoming less common but more intelligent. Mass attacks declined, yet attackers increasingly rely on technical loopholes and high-value targets. Loss depends heavily on market excitement rather than constant activity.

Is 2025 Preventing Losses or Moving Toward More Disasters?

2025 demonstrates that prevention tools are effective, but attackers evolve fast. The absence of constant updates, education, and protection at the wallet level may once again contribute to massive losses in the future market rallies.

Fewer downturn do not imply fewer risks. Other types of attacks, such as theft of private keys, malware, and supply chain compromises, are more difficult to trace and are not reflected in these figures. Security can no longer afford to be concerned with mere links.

Conclusion

Cryptocurrency Scams decreased drastically in 2025; however, the development of new attack techniques and market-driven booms demonstrates that scams are a severe issue that requires careful attention and enhanced security measures.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Readers should conduct independent research and exercise caution when dealing with cryptocurrencies and online platforms.