Bitcoin Treasury Firms Under Siege: 40% Now Trading Below NAV in Market Shakeout

The discount bin is open for Bitcoin treasury firms. A staggering 40% of these publicly-traded Bitcoin holders are now trading for less than the value of the assets they custody—a clear signal that Wall Street's patience for the 'digital gold' narrative is wearing thin.

The NAV Gap: A Confidence Crisis

When a stock trades below its Net Asset Value (NAV), it screams one thing: the market has zero faith in management's ability to create value beyond simply sitting on a pile of coins. Investors aren't just pricing in Bitcoin's volatility; they're pricing in operational risk, regulatory overhang, and the gnawing question of why they shouldn't just buy the underlying asset and cut out the middleman—fees and all.

Pressure Cooker Environment

The discount acts like a financial pressure cooker. It invites activist investors, fuels merger speculation, and forces executives into a corner. Do they double down on communication? Slash costs? Or make a risky bet to pivot the business model? In traditional finance, this is where the sharks start to circle—and crypto markets are no gentler.

The Institutional Paradox

It's a brutal irony. These firms were built as a bridge for institutional capital seeking regulated, familiar exposure to Bitcoin. Yet, when the tide goes out, they're the first to be judged by those same old-school metrics. The market is delivering a cynical verdict: your fancy wrapper adds more complexity than value. Sometimes, the most efficient 'financial innovation' is just buying the damn thing yourself.

The coming months will separate the survivors from the fire sales. Firms trading at a steep discount have two choices: prove their premium or get acquired for parts. In the end, the market hates a discount, but it despises a stagnant story even more.

The premium phase ends as Treasury Stocks Fall Below NAV

For much of 2025, digital coin reserve companies thrived on market enthusiasm. Their shares traded well above the value of the digital asset they held, allowing them to raise fresh capital with ease. This premium expands reserves, buys additional digital asset, and issues new shares without diluting shareholder value.

However, this expansion plan has failed because many businesses are now selling at a discount.

Experts caution that issuing shares below NAV puts businesses in a defensive and uncertain position and destroys rather than increases shareholder value.

Analysts Compare the Trend to the Grayscale Discount Crisis.

Macro analyst Alex Kruger warned that the current framework cannot sustain itself, comparing it to the period when, Grayscale Bitcoin Trust premium collapsed and even labelling it a deeply flawed model.

This contrast draws attention to concerns that these discounts may deepen further if market confidence is not soon restored. Smaller businesses suffer even larger valuation gaps ranging from 30 to 60%, while major industry giants are now trading at a 17% discount.

Underperformance, Investor Confidence Challenges and M&A Concerns

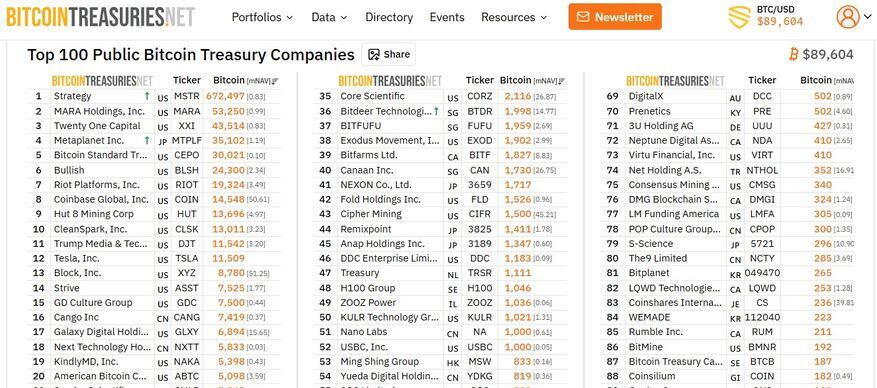

The Bitcoin Treasuries Net data shows that most of the top leading companies failed to keep up with the S&P 500’s performance over the past years; the decline of these firms started picking up towards the end of 2025.

According to the data, around 60% of companies have purchased this digital asset at higher prices than its market current values, which is putting extra pressure on their financial positions. What was once a fast-growing momentum has now slowed significantly, and this sudden shift has clearly shaken investor confidence.

Possible Consolidation and Restructuring Ahead

Consolidation may be the next significant step in the digital coin reserves industry, according to the market analysts. Now stronger companies may buy weaker ones trading at DEEP discounts, while others could become prime merger and acquisition targets.

Long-term planning, operational discipline and strategic restructuring are the options many companies will have to choose as capital-raising options are limited now.

A More Cautious Phase Ahead for Bitcoin reserves Firms

digital coin reserves firms may switch from aggressive accumulation tactics to sustainable financial management as the scenario develops. Survival of the firms depends upon rebuilding market trust, ensuring transparency and adopting sustainable treasury strategies in this competitive and changing market.