Crypto Market Reaction to Geopolitical Risk as US Venezuela Strikes: Digital Gold Shines Amid Global Tensions

When geopolitical shockwaves hit traditional markets, crypto traders don't flinch—they reload.

The Flight-to-Safety Playbook Gets a Digital Update

For decades, gold and the US dollar soaked up capital during international crises. Not anymore. The latest flare-up between Washington and Caracas saw a familiar pattern with a twist: Bitcoin's price action mirrored—and at times, outpaced—the old safe havens. It wasn't just a spike; it was a sustained recalibration of where smart money parks during a storm.

Decoupling from Wall Street's Fear Gauge

While the S&P 500 futures wobbled, major cryptocurrencies carved their own path. The correlation with traditional risk assets, once crypto's anchor, is fraying. This isn't mere speculation—it's a market voting with its wallet, treating digital assets as a distinct asset class with its own geopolitical hedge properties. The narrative that crypto only rises on pure risk-on sentiment is officially dead.

Stablecoins: The Unsung Sanctions-Busters

Look beyond the price charts. The real action was in the stablecoin corridors. Transaction volumes between sanctioned jurisdictions and the rest of the world surged, proving once again that code moves faster than diplomatic memos. It's the ultimate financial middle finger to legacy systems—a jab at the slow, costly machinery of traditional cross-border finance that still can't settle in under three days.

So, while pundits on financial networks debate the Fed's next move, the real monetary policy is being written on-chain. The market has spoken: in a fragmented world, a borderless, censorship-resistant ledger isn't just an investment—it's an insurance policy. And as any good trader knows, you don't wait for the fire to buy insurance. You buy it while the alarm bells are still ringing for everyone else.

What just happened?

Early this morning, January 3rd, the situation in Venezuela basically went from a simmer to a full-blown explosion. President TRUMP announced that a major U.S. operation successfully apprehended Maduro and his wife, Cilia Flores.

Source:X(formerly Twitter)

For the people in Caracas, it’s been a terrifying morning of explosions and low-flying jets. This didn’t come out of nowhere the U.S. has been squeezing the country since late 2025, but this MOVE is the most aggressive intervention we’ve seen in decades. It’s a total game-changer for regional stability.

The "Early Quiet" Crypto Market

You’d expect Bitcoin to be fluctuating all over the place with news like this, but interestingly, the markets are staying remarkably steady today. As of right now, the total crypto market cap is sitting at $3.06 trillion, which is actually up by about 0.95% over the last 24 hours.

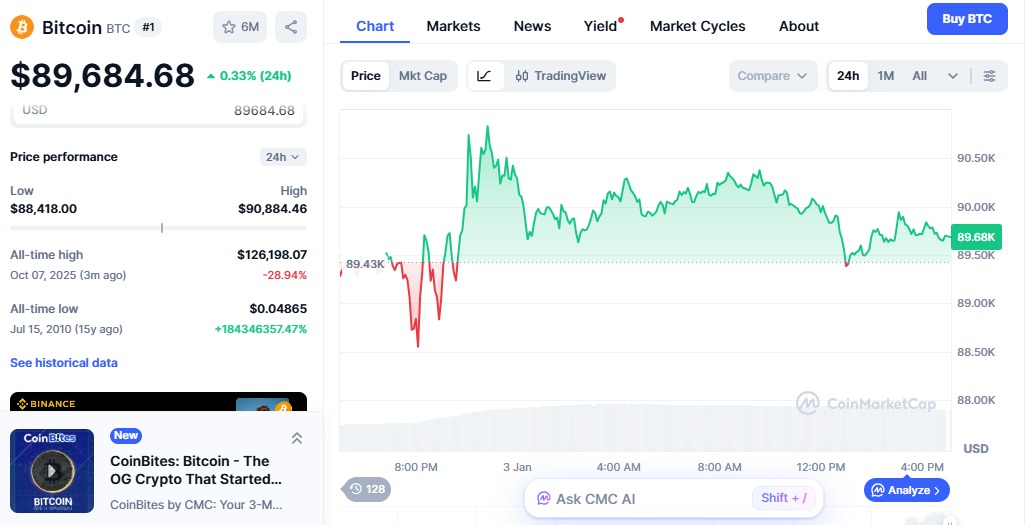

Bitcoin drops a little bit, currently trading at $89,690, showing a modest drop it was above $90,000 a few hours ago. Other major assets like Ether and XRP are also showing green on the charts for now.

Source: CoinMarketCap Bitcoin price Chart

Investors are staying quiet and waiting. They want to know if this is just a small, quick problem or if it’s the start of a huge disaster. Historically, crypto tends to shrug off these headlines at first, but once the reality of long-term instability sinks in, that’s when the "wait and see" approach usually turns into real volatility.

Keeping an Eye on the Bigger Picture

While the charts look calm now, the gears are turning behind the scenes.

Energy is already reacting: oil prices are ticking up because everyone is worried about supply chains being choked off.

Safety vs. Risk: In times of war or regime change, big money usually runs toward "safe havens" like gold. Whether Bitcoin will act like "Digital Gold" or get dumped as a "Risk Asset" is the big question for the next 48 hours.

The Bottom Line

Right now, the crypto market is in a "watchful pause". Everything feels quiet, but that silence is fragile. If the situation in Venezuela gets messier or if global powers start picking sides the calm we're seeing today could vanish pretty quickly.

If you're trading right now, keep the news alerts on. We’re in uncharted territory.