Bank of America Shocks Traditional Finance: Now Recommends Up to 4% Bitcoin Allocation for Clients

Wall Street's old guard just blinked—and crypto bulls are taking notes.

The Institutional U-Turn

Bank of America, a titan of traditional finance, is quietly telling its wealthiest clients to consider something unthinkable a decade ago: a 4% portfolio slice in Bitcoin. Not gold. Not bonds. Digital gold. The recommendation marks a seismic shift in institutional thinking—from outright dismissal to calculated allocation.

Why 4% Matters

That number isn't random. In portfolio theory, even a single-digit percentage allocation to a volatile, non-correlated asset can dramatically reshape risk-adjusted returns. Bank of America's analysts appear to be betting that Bitcoin's scarcity and growing adoption narrative now outweigh its infamous volatility—at least for clients who can stomach the ride.

The Fine Print & The Friction

Don't expect your local branch manager to be pushing BTC over CDs. This guidance targets high-net-worth individuals and institutional portfolios, wrapped in layers of compliance and caveats. The bank still can't hold the asset directly—clients would use approved external custodians. It's a classic Wall Street maneuver: recommend the rocket fuel, but keep the liability at arm's length.

A Cynical Take

Let's be real—this is also a brilliant fee capture strategy. After years of watching client funds flee to crypto-native firms, traditional banks are building the bridge to bring those assets back under their umbrella. Manage the fiat on-ramp, collect the advisory fee, and maybe even custody the keys someday. The house always finds a way to take its cut.

The Bigger Picture

Bank of America isn't alone. A slow-motion stampede of institutional capital is testing the crypto waters—dipped a toe in ETFs, now wading toward direct allocations. When conservative portfolio managers start quoting Satoshi, you know the narrative has flipped.

The final take? Wall Street isn't embracing decentralization—it's professionalizing the speculation. But for Bitcoin, that institutional validation might be the ultimate bullish signal. Even if it comes with a 2% management fee attached.

This advancement marks a clear shift from a cautious approach to active participation in digital assets. For investors, this means cryptocurrencies exposure is now being framed as a controlled portfolio tool, not speculation.

What Changed at One of America’s Largest Banks?

Under the new policy, more than 15,000 advisors across Merrill Lynch, Bank of America Private Bank, and Merrill Edge can now proactively suggest cryptocurrencies exposure to their customers. Earlier, cryptocurrency advice was there, but advisors were only allowed to discuss it if the client asked first.

Currently, with new cryptocurrency policy reforms in the banking giant, users will be recommended a 1% to 4% allocation of their portfolio to crypto. The investment is going to be mainly through U.S. spot bitcoin ETFs, making access safer and simpler for investors.

Why Bank of America Supports BTC Now: ETFs Driving Confidence

The bank highlighted Bitcoin’s strong performance over the time. Although the digital asset faced major drops in 2025, it even reached around $76,500 in April, 2025. But the coin shows significant progress in the year-to-date performance, while also warning that cryptocurrencies remain volatile.

According to the bank’s investment team, small and controlled exposure can help balance risk, similar to other alternative assets like commodities or private equity.

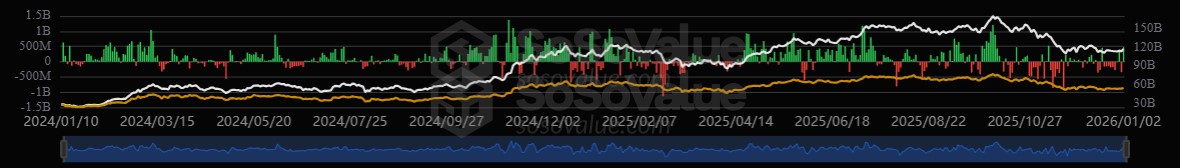

Additionally, the decision follows massive success in the U.S. Bitcoin ETF market. Since their approval in 2024, the ETFs have attracted over $57 billion in inflows, signaling strong demand.

Bank of America now covers major ETFs, including:

BlackRock’s IBIT

Fidelity’s FBTC

Bitwise’s BITB

Grayscale’s Bitcoin Mini Trust

These regulated products make it easier for traditional investors to gain BTC exposure without directly holding digital assets.

However, the U.S. banking giant sees BTC as a diversified portfolio, not a replacement for traditional assets.

Crypto Goes Mainstream in 2026: Wall Street Is Moving Together

Bank of America is not alone in this advancement. Other well known names in the financial sector have already issued similar guidance, understanding BTC’s increasing value:

Morgan Stanley: 2–4% cryptocurrency allocation

BlackRock: 1–2%

Fidelity: 2–5%, especially for younger investors

This broader trend shows how crypto is being treated as a legitimate investment class, not just speculation. However, at the same time, banks still stress caution. Digital asset exposure is meant to be limited and diversified, not an all-in bet.

For now, with supportive U.S. regulations, strong ETF inflows, and backing from major banks, 2026 is shaping up as a turning point for crypto adoption. Bitcoin is increasingly viewed as a strategic asset rather than a fringe investment.