Spur Protocol Listing & Presale Extension: What’s the Team Not Telling Investors?

Another day, another protocol racing to market before the music stops. Spur Protocol's listing timeline and presale extension raise immediate questions—standard operational pivot or a sign of deeper turbulence?

The Clock is Ticking

Extensions rarely signal overwhelming demand. They whisper about soft caps, shifting roadmaps, or last-minute technical gremlins. Teams preach patience while the market's attention span shrinks by the minute.

Behind the Curtain

What gets hidden? Sometimes it's benign: exchange negotiations dragging, KYC bottlenecks, or a smart contract audit requiring one more pass. Other times, it's vaporware fundamentals or team dynamics cracking under pressure. Transparency becomes the first casualty.

The Finance Sector's Cynical Take

Here's the free alpha: in traditional finance, this would trigger a regulatory filing and a shareholder lawsuit. In crypto, it's just another Tuesday. A presale extension often functions as a canary in the coal mine—or a clever tool to manufacture artificial scarcity when real demand falters.

Verifiable data stays king. Track the wallet activity, scrutinize the extended timeline against the original roadmap, and watch for team communication that says everything by saying nothing. The market punishes hesitation more brutally than failure.

Bullish on digital assets? Absolutely. Bullish on opacity? Never. The next generation of finance gets built by protocols that operate in the light, not those that master the art of the delayed reveal.

Spur Protocol Presale End Date Passes, But Official Signals Missing

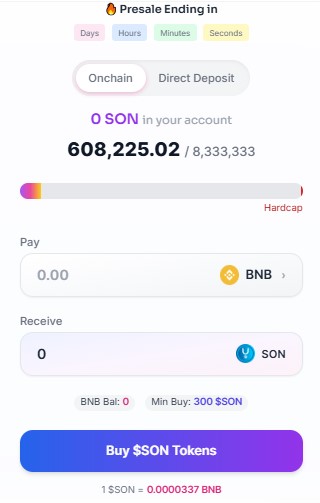

The deadline for the Spur Protocol presale was fixed for January 5, 2026. Though the countdown on the official website has hit '0,' there has been no announcement on social media. Another critical aspect is the sales figures. Out of 8,333,333 SON token allotted to early buyers, only 608,225.02 were sold. This is just 7.30%, leaving more than 7.7 million units unsold. In the past, this type of margin usually results in changing schedules or financial approaches.

Such uncertainties directly relate to the confidence in the Spur Protocol listing date and its immediate execution.

Funding Transparency and Popularity Trends Raise Concerns

As per data available on RootData, there is no information available for the project on the amount of funding and strategic investors yet. Such an aspect is usually indicative of an initial project where market hesitation is promoted rather than enthusiasm.

The popularity metrics for RootData also reflect a trend. The index reached almost 80 in early November, then went into a steady decline. Since December, it has maintained a level between 32 and 40, indicating almost a 50% decline from its peak.

Such circumstances are normally tied to market sentiment surrounding the listing date and presale in doubt.

When to Expect Spur Protocol Listing Date?

As per the website, the listing is still set for January 8. The exchanges are as follows: CoinStore, MEXC, BingX, SpurSwap, and PancakeSwap. However, there was a team update regarding possible postponements, so both the presale and launch are in question.

However, in the event of changes in the timeline, market analysts forecast a new window for Q1 2026, presumably within the months of February and March.

Conclusion

The Spur Protocol listing is no longer date-driven and is now communication-driven. When it comes to updates on funding, timing, and execution, clarity on these areas will determine whether confidence is regained or if uncertainties continue to abound. Stay updated with the official website or with CoinGabbar to get the fastest news on this.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.