Lummis Slams DOJ Bitcoin Sale—Directly Defying Trump’s Reserve Order

Federal authorities just liquidated a massive Bitcoin stash—right over a presidential mandate to hold it.

The Contradiction in Plain Sight

Senator Cynthia Lummis didn't mince words. The Department of Justice's move to sell seized Bitcoin, she argues, flies directly in the face of former President Trump's executive order to maintain a strategic crypto reserve. It's a policy whiplash playing out in real-time, with billions in digital assets caught in the crossfire.

Why This Sale Stings

This isn't just about balancing a ledger. Dumping such a large position onto the market can suppress prices—a classic move that treats Bitcoin like a confiscated yacht rather than a strategic national asset. It sidelines the very monetary innovation the reserve order was meant to embrace.

The Bigger Battle for Legitimacy

The clash exposes the raw, unresolved tension at the heart of U.S. crypto policy. One branch sees digital gold; another sees a commodity to be cashed. Every sale like this undermines efforts to formalize crypto's role in the treasury—making the whole reserve concept look like a political talking point, not a financial strategy. After all, what's a government directive worth if another agency can bypass it with a sell order? Just ask any trader watching the order book get slammed.

So the DOJ gets its liquidated gains—a tidy sum for the general fund, no doubt—while the long-term strategic play gets sold off cheap. A familiar short-term win for bureaucracy, a long-term loss for a coherent financial future. Typical.

This liquidation has set off a political firestorm because it seems to fly right in the face of Executive Order 14233. That mandate was supposed to lock down all "Government BTC" to build the nation’s Strategic bitcoin Reserve. For anyone following the market, this internal power struggle is a major headline, making people wonder if the long-standing "War on Crypto" is actually over or just shifting to a new front.

The Samourai Wallet Liquidation: A Breach of Mandate?

The heat of the argument centers on a November 3, 2025, transaction. Allegedly, the USMS used Coinbase Prime to liquidate assets that were supposed to be kept in a "digital Fort Knox." Under Trump’s new mandate, these coins are considered strategic national resources similar to how we treat Gold or the Strategic Petroleum Reserve. They aren't supposed to be sold on the open market

Senator Lummis took to social media to voice her alarm, stating, "We can’t afford to squander these strategic assets while other nations are accumulating Bitcoin." Critics argue that the Southern District of New York (SDNY) and the DOJ are operating as a "Sovereign District," ignoring the executive branch’s shift toward treating This digital asset as a long-term national asset rather than criminal loot to be discarded.

Market Watch: How Bitcoin is Handling the Drama

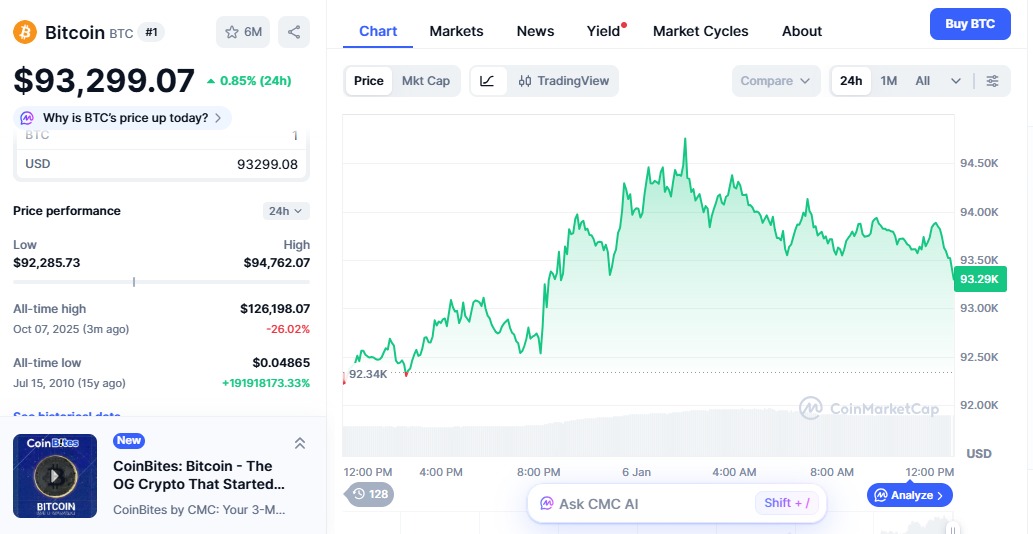

Despite the political noise, the market is showing a surprising amount of backbone. As of today, January 6, 2026, the total crypto market cap has hit $3.26 trillion, climbing 1.76% as big investors stay focused on the long term. Bitcoin itself is holding its ground, currently trading at $93,299 a rise of 0.85% over the last 24 hours. While the DOJ’s $6.3 million sale is a drop in the bucket for BTC’s total volume, the real risk is the mixed message it sends to the world about U.S. financial policy.

Despite the $6.3 million sell-off, the broader market remains bullish on the prospect of a formal federal reserve. However, as Senator Lummis criticizes DOJ Bitcoin sale activities, the fear remains that inconsistent enforcement of Executive Order 14233 could lead to more "surprise" liquidations that dampen price discovery.

The Legal Tug-of-War Over "Government BTC"

Legal experts point out that the Samourai developers forfeited their holdings under 18 U.S. Code § 982, which fits the Executive Order's definition of "Government BTC" to build the nation’s Strategic Bitcoin Reserve. There is no statutory requirement that mandates these funds be converted to fiat currency immediately. The decision to sell appears to be a discretionary MOVE by the DOJ, one that flies in the face of Deputy Attorney General Todd Blanche’s recent memo, "Ending Regulation By Prosecution."

Conclusion: Will the White House Intervene?

The defiance shown by the DOJ has led many to wonder if President Trump will issue a formal pardon for the Samourai developers or take disciplinary action against the agencies involved. As Senator Lummis criticizes DOJ Bitcoin sale tactics, the pressure is mounting on the administration to consolidate control over federal digital assets. As the total crypto market cap holds at $3.26 trillion, the industry is looking for a "unified front" from Washington. If the U.S. truly intends to build a "Digital Fort Knox," it must first stop the leaks within its own departments.