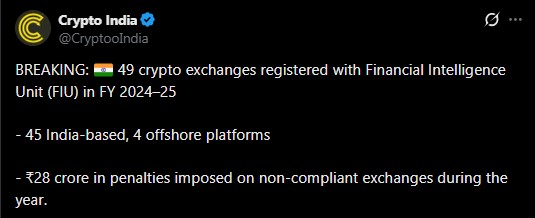

India’s Crypto Crackdown: FIU Tightens Compliance Noose on Digital Asset Exchanges

India's financial watchdog just turned up the heat. The Financial Intelligence Unit (FIU) is slamming the rulebook on crypto exchanges, demanding strict adherence to anti-money laundering protocols. It's a regulatory squeeze play that's sending shockwaves through the nation's digital asset corridors.

The Compliance Ultimatum

Forget the gray areas. The FIU's directive is crystal clear: register, report, and comply. Exchanges operating in Indian cyberspace must now fall in line with the Prevention of Money Laundering Act (PMLA). No more flying under the radar. The message is blunt—shape up or get shut out. It’s a move that separates the serious players from the fly-by-night operations overnight.

Playing in the Sandbox

This isn't a blanket ban; it's a forced maturation. The regulators are essentially building a walled garden. Exchanges that can navigate the KYC (Know Your Customer) and transaction reporting maze get to stay. Those that can't, well, they're finding the gates locked. It’s classic regulatory Darwinism—adapt to the new environment or face extinction. The goal? A sanitized ecosystem where every digital rupee can be traced.

The Ripple Effect

Expect consolidation. Smaller platforms without the legal firepower will likely fold or merge. Liquidity pools might shift toward the compliant giants. For users, it means more paperwork upfront but potentially safer harbors for their crypto holdings. It’s the inevitable trade-off when a Wild West market gets a sheriff—less freedom, more security. Some call it progress; others call it a straitjacket.

A Global Signal

India's move echoes a worldwide trend. From MiCA in Europe to evolving frameworks in Asia, nations are drawing regulatory perimeters around crypto. India's vast user base makes this a bellwether moment. How the market adapts here could provide a blueprint—or a cautionary tale—for other emerging economies. It’s a high-stakes experiment in balancing innovation with control.

So, while the compliance headache is real, the alternative—a regulatory free-for-all—was never sustainable. Just ask any traditional banker; they’ve been dealing with these rules for decades. Sometimes, the most bullish thing for an asset class isn't a price pump, but a clean set of books. Even in crypto, the taxman always gets his cut.

Some of the major native registered names include CoinDCX, WazirX, CoinSwitch, ZebPay, Mudrex, Unocoin, Giottus, Bitbns, BuyUcoin, Flitpay, etc

Four offshore networks – Binance and KuCoin are registered in 2024 after being fined, while Coinbase and Bybit in early 2025.

The data comes from FIU-IND’s annual report, and has also been reported by outlets such as The Economic Times.

India Crypto Adoption Approach: Strict Compliance, Not a Ban

Unlike some nations that have banned digital assets completely, India chooses a compliance-first framework:

Heavy taxation (30% tax + 1% TDS)

Strong AML (Anti Money Laundering) oversight via FIU-IND

Allowing operations only through registered entities

Since crypto exchanges were put under Prevention of Money Laundering Act (PMLA) in 2023, FIU registration for any platform running inside the country is compulsory. Registered platforms must:

Report suspicious transactions

Follow strict KYC and AML rules

Maintain transaction records

Cooperate with law-enforcement agencies

Non-compliance can now lead to fines, show-cause notices, website blocks, and service bans.

During the 2024–25 financial year, FIU-IND charged ₹28 crore ($3.37 million) in penalties on cryptocurrency exchanges that failed to meet rules under the PMLA, 2002. While some investigations also linked non-compliant platforms to hawala networks and terror-funding risks, underlining why enforcement has intensified.

Major Exchanges Fined Before Compliance, Still Choosing India: Why?

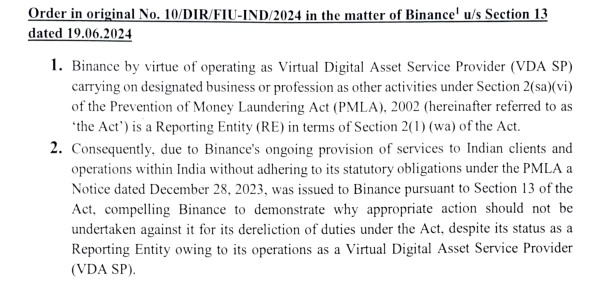

The well-known global platforms were the most significantly fined exchanges. Binance was fined ₹18.82 crore ($2.27 million) in June 2024 for operating in the nation without registration. The exchange later paid the fine, registered with FIU-IND, and resumed services.

Bybit Fintech Limited was fined ₹9.27 crore in January 2025 for similar violations. Smaller penalties on platforms like KuCoin and others contributed to the total ₹28 crore figure.

Even after facing the strict compliances, why platforms still want to work in the country is the question many traders search. While the platforms have to follow the rules, paying taxes and penalties, India is one of the largest digital trading marketplace for them.

The young and huge population, interested in cryptocurrencies, drives their profit portfolio up to ten times higher than what they are being charged. The country ranks in the crypto adoption list, and no one wants to miss this big opportunity.

On the other hand, the country is also working towards its digital asset infrastructure enhancement, even if it is gradual.

Global Race: Increasing Demand, Rising Rules

India’s digital asset market is maturing fast. With 49 registered exchanges and ₹28 crore in penalties, FIU-IND has made it clear that crypto can operate in the country, but only under strict rules.

This strictness can MOVE some traffic offshore, but it marks important safety measures:

Safer platforms with stronger compliance for users

Reduced risk of fraud and illicit activity

More transparency in exchange operations

Following the similar measures, the rules are developing on the global levels. The EU’s MiCA regulation already covers the region, while the US introduced a stablecoin law, GENIUS Act, in 2025. Singapore, UAE, and Hong Kong are licensing exchanges.

Over 100 jurisdictions now regulate crypto in some form, highlighting the importance of being regulated. FIU-led model fits into this global shift toward structured oversight instead of unchecked growth.

This article is based on publicly available regulatory disclosures and official reports.