XRP’s 2026 Breakout Trade Ignites After 20% Weekly Surge in January

XRP just flashed its most significant breakout signal in years—and the timing couldn't be more critical.

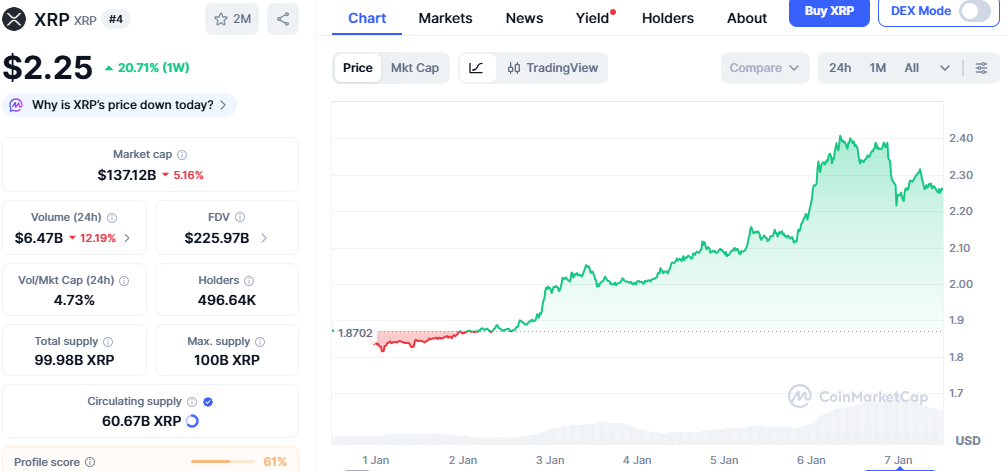

The Setup: A 20% Weekly Rocket

Forget gradual climbs. The asset ripped higher by a fifth in a single week, slicing through resistance levels that had held for months. That kind of move isn't just noise; it's a market-wide alert. Volume spiked, liquidity followed, and the charts now paint a picture of momentum we haven't seen since the last major cycle.

Why This Isn't a Fluke

Technical structures are aligning. Key moving averages have been reclaimed, and the price action suggests a fundamental shift in sentiment. It's the classic pattern: consolidation, then a violent expansion. This rally provided the fuel. The 2026 trade everyone's been whispering about? It's no longer theoretical.

The Road Ahead: Volatility & Validation

Expect chop. Breakouts get tested, and skeptics will call for a pullback—that's healthy. The real question is whether this weekly close holds as a new support floor. If it does, the path opens for the next major leg. If not, well, welcome to crypto, where even the best setups can get tangled in broader market nerves or, heaven forbid, another regulator's press conference.

One thing's clear: the dormant phase is over. XRP is back on the front page, and the market is voting with its capital. Whether this marks the start of a sustained 2026 trend or just another exhilarating pump before the usual finance-sector letdown remains to be seen. But for now, the breakout is live.

Source: CoinMarketCap

Why the XRP Breakout Trade Narrative Getting Attention?

The biggest push came after CNBC discussed XRP on its Power Lunch show, calling it one of the hottest crypto trades right now.

One interesting aspect was how the currency continued to increase even while Bitcoin and ethereum were calm.

Source: X (formerly Twitter)

This is important because it reveals the beginning of this cryptocurrency acting as if it is trading based on its own story. It is not based solely on overall market speculation but instead is finding success based on actual demand related to the payment system provided by Ripple.

Ripple's technology is utilized in fast cross-border payments, where the token has been integral to the finalization of these transactions. Another area that has been emphasized by RippleX involves the growing utility in stablecoin settlements.

What Pushed XRP Above $2.30?

Several factors came together at the same time.

First, the long legal battle with the SEC is now behind Ripple, removing a major cloud that had followed this coin for years. This alone improved confidence.

Second, it recently received approval from the CFTC to be used as collateral on certain U.S. platforms. That helped attract more institutional interest.

As per the Sosovalue, US spot XRP ETFs saw $19.12 million in net inflows in a single day, pushing total cumulative inflows to $1.25 billion, highlighting steady investor demand.

Together, these factors helped confirm the Breakout Trade when the price moved above $2.30.

Why it Pulled Back After the Rally?

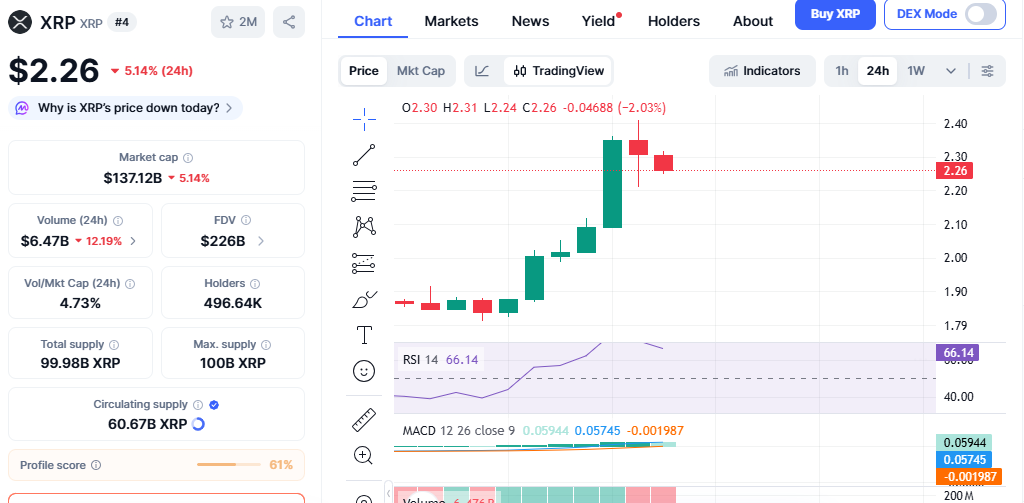

After such a fast rise, some cooling was expected. It dropped nearly 5% in the last 24 hours as traders locked in profits.

Technical indicators show it became overbought. The RSI crossed above 80, which often leads to short-term pullbacks. On-chain data also shows large holders selling around 65 million coins in a single day, adding pressure.

Source: CoinMarketCap

This doesn’t mean the trend is broken. It simply means the market needed to cool down after a strong move.

Short-Term Price Outlook

In the short term, orice depends on support levels.

Bullish Case: If it holds above $2.17, buyers may try again to push the price toward $2.31. A clean move above that level could bring back momentum toward $2.42.

Bearish Case: On the downside, if selling continues, it could slide toward $2.02. That level is important to watch for trend strength.

Long-Term Price Outlook

Looking into the future, it appears that the XRP Breakout Trade is a strong opportunity as long as Ripple continues to grow.

It processed a payment volume of $95 billion and also raised $500 million in the last part of 2025.

The firm also stated that they have no plans for an IPO, opting to instead work on developing products.

The XRP price prediction suggests, It may target the $3 range in the long run. Volatility is going nowhere, but the overall trend is optimistic.

Conclusion

The XRP Breakout Trade is more than a price hype. It's a result of positive regulation developments, operational applications of the currency, and institutional interest. The recent downturn is a pause rather than a reversal.

This article is for informational purposes only and not a financial advice. Kindly do your own research before investing in the crypto market.