How U.S. Political Turmoil and Dollar Decline Are Reshaping Crypto Markets

Political chaos meets currency weakness—and crypto's catching the updraft.

Dollar's Diminishing Dominance

When the greenback stumbles, digital assets sprint. A softening dollar makes dollar-denominated cryptocurrencies cheaper for international buyers, fueling demand. It's a classic currency trade, just with a blockchain twist. Traders aren't just betting on tech; they're hedging against traditional monetary policy failure.

Policy Uncertainty as Rocket Fuel

Washington's gridlock and regulatory whiplash aren't killing crypto—they're accidentally promoting it. Each political stalemate highlights the fragility of centralized systems, driving capital toward decentralized alternatives. The narrative shifts from 'crypto as speculation' to 'crypto as sanctuary'—a digital safe haven when trust in institutions erodes.

The Institutional Pivot

Big money isn't just watching anymore. Asset managers and corporate treasuries are quietly building positions, using political and currency volatility as cover for strategic entry. They're not adopting crypto philosophy; they're executing cold, calculated portfolio diversification. The ultimate Wall Street move: profiting from the system's decay while still collecting management fees on the old one.

Beyond the Short-Term Spike

This isn't merely a reactionary rally. The convergence of political risk and dollar weakness is accelerating crypto's maturation from fringe asset to mainstream financial instrument. Infrastructure develops, derivatives markets deepen, and the correlation with traditional markets—while still present—begins to fracture.

The trend reveals an uncomfortable truth: digital assets thrive on traditional finance's distress. As one veteran trader quipped, 'Crypto's best marketing team sits in the Federal Reserve and the U.S. Capitol.' The system's failures are becoming blockchain's foundational case study.

In his 2025 year-end review released in early 2026, Dalio said the U.S. may face major policy reversals if Republicans lose control of Congress. He compared today’s debt-heavy environment to past empires like the Dutch and British, where rising debt eventually led to currency devaluation. At present the U.S. Dollar Index fell nearly 9%, one of its worst annual performances in decades.

On the other hand, a loss of Senate and House power for Republicans means a reversal of existing economic policies. Can this administrative event trigger a transformation of the markets, the currency, and the crypto world in the year 2026?

Bitcoin as Dollar Hedge Gains Attention After the Warning

Bridgewater Associates founder Dalio emphasized that the decline of the dollar is not a cyclical phenomenon, but that it results from too much debt, deficits, and a shift in global funds from US assets.

Dalio has repeatedly argued that scarce assets perform better when governments rely heavily on debt and money creation. Bitcoin’s fixed supply of 21 million coins positions it alongside Gold as a potential store of value during periods of U.S. Political Risk and currency uncertainty.

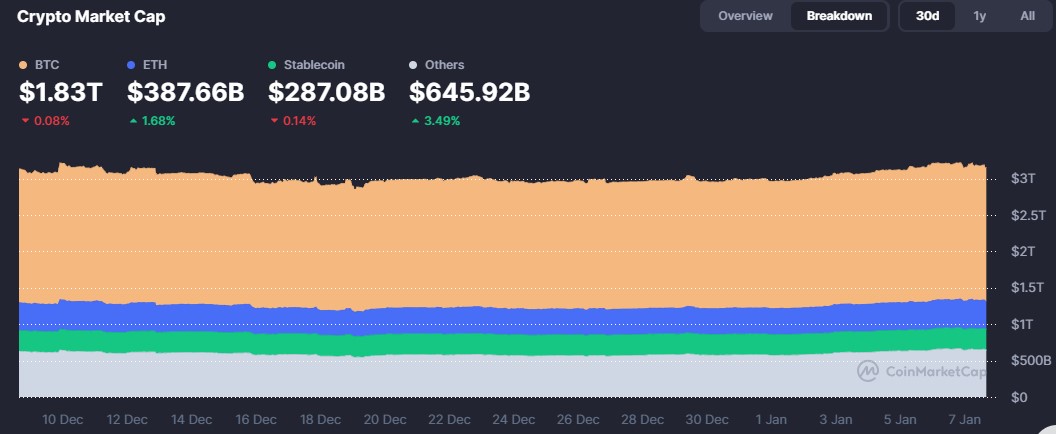

The data from 2025 supports Ray’s view. Gold surged nearly 67.77% during the year, while real US equity returns lagged. The broader crypto market also gained and now accounts around $3.16 trillion, where Bitcoin dominates with a $1.83 trillion market cap.

Crypto analysts say this trend reflects growing interest in scarce assets during periods of fiat erosion. Dalio has previously supported this view, recommending that investors allocate up to 15% of their portfolio to Bitcoin or gold as protection against dollar debasement.

From here, this scenario looks to favour digital assets, which is somehow true. But taking it as completely on the positive side is wrong as it risks cryptos on the other side.

How U.S. Political Risk Could Drag Crypto Along?

Beyond currency concerns, government-related risk may directly affect crypto regulation. The ruling party under President Trump, showing a great acceleration towards crypto infrastructure.

A change in government after the 2026 midterms could slow or reverse recent progress on bitcoin ETFs, stablecoin frameworks, and broader regulatory clarity. If political priorities shift, crypto reforms could face delays or cancellations, creating uncertainty for investors and companies operating in the U.S. market.

This policy risk adds another LAYER of volatility, as crypto adoption often depends on regulatory support and institutional confidence.

What This All Means in 2026

Dalio’s warning highlights a key theme for 2026: political shifts, debt pressures, and dollar weakness could push investors toward non-dollar assets.

Though gold is the best hedge, Bitcoin has been attracting growing interest as a long-term alternative in the wake of increasing U.S. Political Risk. But it also needs some regulatory clarity.

This analysis reflects market trends, not investment advice.