India’s Crypto Regulation Clash Escalates as FIU and CBDT Enter the Fray

Crypto's regulatory showdown in India just got hotter. The Financial Intelligence Unit (FIU) and Central Board of Direct Taxes (CBDT) are diving into the debate—sparking fresh chaos in the world's most controversial digital asset market.

Who’s winning? Nobody yet. But the bureaucrats are certainly having a field day.

Taxmen vs. tech. Tradition vs. disruption. And as usual, investors are stuck in the middle—watching their portfolios swing like a Bollywood drama.

Bonus jab: At least someone’s making money—compliance lawyers.

India Crypto Regulation Reviewed by Parliamentary Panel

The Parliamentary Standing Committee on Finance, chaired by Bhartruhari Mahtab (BJD MP), held a nearly three-hour meeting on January 7, 2026, to review the country’s position on VIRTUAL Digital Assets (VDAs).

Officials from the Financial Intelligence Unit–India (FIU-IND) and the Central Board of Direct Taxes (CBDT) presented their views under the agenda “Study on Virtual Digital Assets (VDAs) and Way Forward.” This was the committee’s third meeting on cryptocurrency, with more discussions planned.

Chairperson Mahtab said the committee examined the current situation of cryptocurrency in the country and possible systems of regulation, noting that discussions are still at a formative stage.

Key Highlights of the Parliamentary Meeting

During the meeting, several important points were discussed regarding India crypto regulation, enforcement, and global practices:

Tracking crypto-linked fraud: CBDT informed the panel that money transferred through VDAs using fraudulent methods is being actively tracked.

Overseas asset parking: Authorities have detected cases where income and assets were converted into cryptocurrencies and parked in foreign countries.

Undisclosed digital asset income: CBDT has identified around ₹888.82 crore ($108 million USD) of undisclosed income from VDA transactions.

Tax enforcement: Notices and communications have been sent to more than 44,000 taxpayers involved in such crypto-related cases.

Global approaches: Mahtab said, countries worldwide are handling digital assets differently, ranging from bans to strict regulation. In his view, regulation would be a better option for the nation than an outright ban.

CBDT told the committee that cryptocurrency is firmly within India’s tax radar, with authorities now tracking suspicious transactions both domestically and offshore.

FIU-IND also plays a central role in India crypto regulation under anti-money laundering laws. As of January 2026, 49 crypto exchanges are registered with FIU-IND under the Prevention of Money Laundering Act (PMLA).

India Cryptocurrency Condition: Confusion in Policy, Adoption on Top

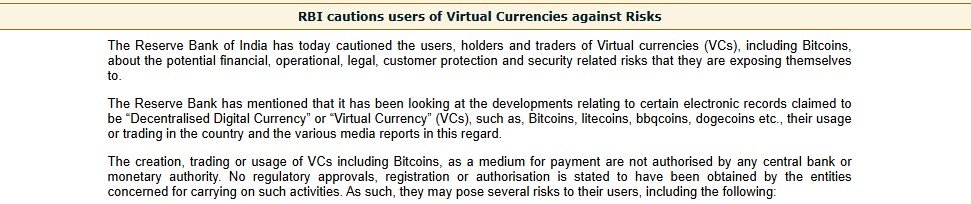

During the meeting, Mahtab acknowledged the policy contradiction that continues to surround India crypto regulation.

While the Reserve Bank of India (RBI) does not recognise cryptocurrency as legal tender, crypto-trading is still allowed and taxed. Currently, it imposes a 30% flat tax on virtual currency gains along with 1% TDS on every transaction.

An opposition member of the committee later pointed out that this mixed approach has created confusion among investors and businesses, as cryptocurrency is neither banned nor clearly regulated under a single law.

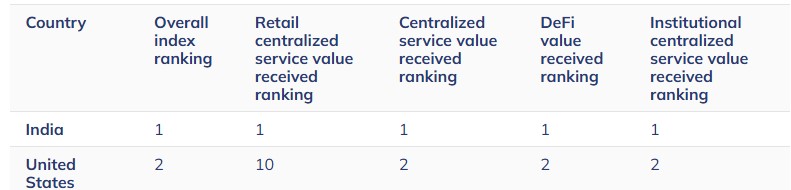

The nation had around 119 million crypto-users in 2025, and adoption is projected to cross 123 million by end-2026. Usage remains strong among young investors, small-city users, and for remittances.

However, experts believe clearer crypto regulation could encourage large participation.

SB Seker, head of APAC at Binance, highlighted the clear rules needed in the country in one of his interviews. He stated it will bring more institutional adoption, and could boost domestic exchanges by reducing reliance on offshore platforms.

Global Regulation: How Other Countries Are Moving

Globally, the cryptocurrency regulatory landscape has matured significantly, with most major economies choosing regulations over bans:

European Union: Established the MiCA framework and made it applicable to all exchanges and stablecoins.

United States of America: Stablecoin-specific legislation, GENIUS Act, move towards innovation-friendly regulations.

Singapore & Hong Kong: Functioning as regulated cryptocurrency hubs.

United Arab Emirates: Harmonized regulatory framework to encourage innovation.

Brazil: New VASP authorization regime starting February 2026.

China: Maintains a strict cryptocurrency ban, promoting its digital yuan instead.

These global trends are influencing India’s ongoing discussions on crypto policy.

Conclusion on What’s Next?

The January 7 meeting shows that India crypto regulation is evolving, but cautiously. Lawmakers appear inclined toward regulation rather than a ban, while enforcement against fraud and tax evasion continues aggressively.

Alongside parliamentary discussions, Indian industries have also stepped up direct engagement with the crypto industry. This week, the Bharat Web3 Association met the Finance Ministry to present its pre-Budget 2026 roadmap.

The proposal focuses on current TDS relief, loss set-offs, and banking access. The MOVE signals faster consultations as the nation works toward clearer digital asset rules.

For now, crypto in Indian territory remains legal, taxed, and heavily monitored, but without a dedicated regulatory law. As adoption grows and worldwide rules mature, major reform is likely to be announced soon to align with global standards.