ZenChain’s $ZTC Crashes: 3 Brutal Reasons & The Path Forward

ZenChain's native token, $ZTC, just took a nosedive off a cliff. The charts aren't pretty. Here's what ripped the floor out from under it.

1. The 'Smart Money' Exodus

Whale wallets didn't just sell—they dumped. Massive, coordinated outflows from early backers and venture funds triggered a classic liquidity crisis. The order book thinned, and retail got caught holding the bag. A timeless tale of 'your exit liquidity is my entry.'

2. Ecosystem Stagnation Hits Hard

Development momentum stalled. Promised protocol upgrades missed deadlines, and key partnerships fizzled. In crypto, standing still is moving backward. Competitors ate ZenChain's lunch while its roadmap gathered digital dust.

3. The Macro Chill Freezes All

Broader market sentiment turned icy. When Bitcoin sneezes, altcoins catch pneumonia. Risk assets got hammered, and speculative plays like $ZTC faced the full brunt of the sell-off. No project is an island in a regulatory hurricane.

So, What's Next for $ZTC?

The path forward is brutal but clear. Survival hinges on the core team delivering—under fire. Can they reignite developer activity, secure real-world utility, and rebuild burnt trust? Or is this another 'fundamentals' project that forgot price is the ultimate metric?

Prediction is a fool's game in this volatility, but one thing's certain: recovery requires more than hopium and Twitter threads. It needs shipped code and tangible adoption. The market's patience—and capital—has limits. Just ask your portfolio.

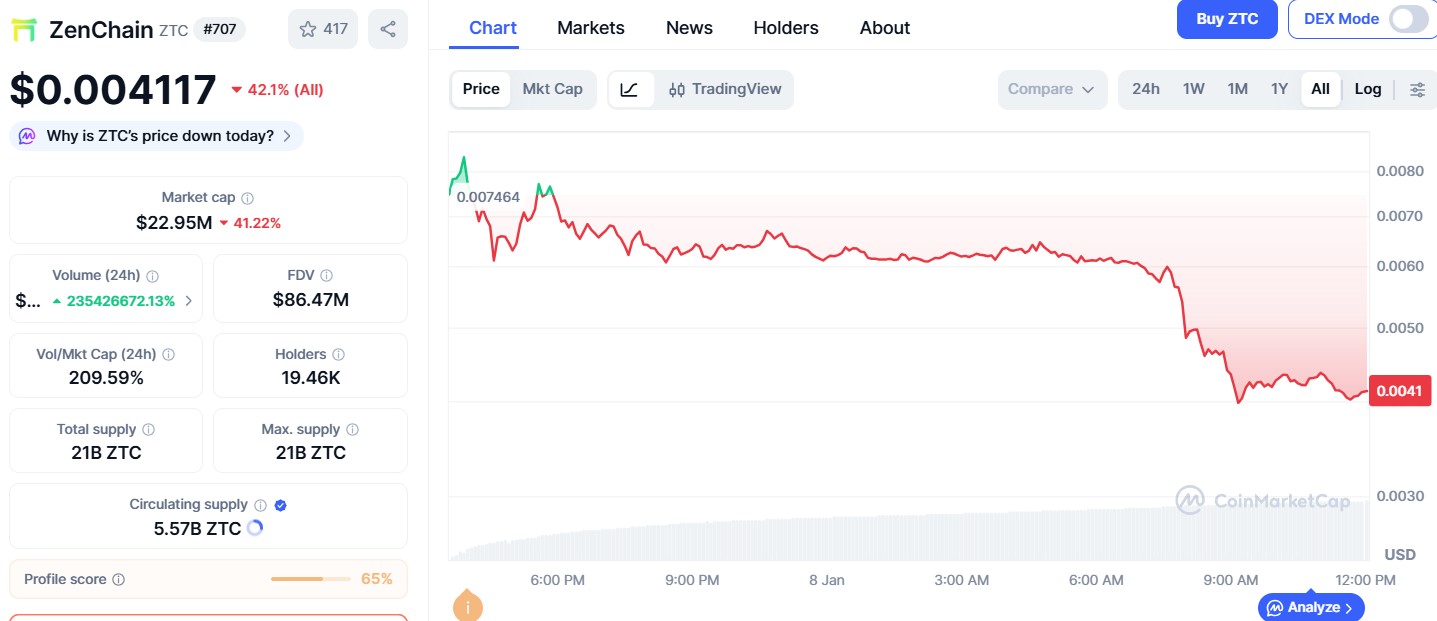

ZenChain Price Crash After Listing: What the ZTC Data Shows

The price numbers are quite intense right now. The token started trading at about $0.0074 but has already slid down to $0.0041, marking a 44-45% decline overnight.

According to on-chain metrics, the asset’s market cap dropped to roughly $22.95 million. This sell-off occurred while the general crypto market was also down about 3%, which reduced risk appetite for new crypto listing tokens and led to the “Zenchain airdrop listing dump.”

The CoinMarketCap trading data shows why the price fell so fast. In just 24 hours, trading volume jumped very high, pushing the volume-to-market cap ratio above 200%, which caused the current Zenchain price crash.

ZTC Chart Confirms Distribution, Not Stability

From a technical perspective, being a crypto analyst, the $ZTC price failed to stay above $0.0055, which is also now the key resistance level. Right now, the price is hanging out NEAR a "floor" (support) at $0.0038-$0.0040.

This chart structure shows that investors were selling their coins to others rather than holding onto them for the long term, which is why the asse's price is down today.

In simple terms, the market is quickly reacting to risk instead of waiting for clear signals.

Why ZenChain Price Is Down Today: Crypto Market in Freefall

Market analysts say it wasn't just the technicals, but the whole crypto world was struggling yesterday and even now. Here are the three main $ZTC price drop reasons:

Bitcoin Liquidations: As per the Coinglass liquidation data, over the last 24 hours, more than 111,000 traders lost their bets as Bitcoin prices shook the market. When Bitcoin liquidations happen on this scale, new tokens like $ZTC usually get hit the hardest.

Bitcoin Weakness: $BTC has dropped about 3% and is struggling to stay above $90,000. When the "King of Cryptocurrency" is weak, people get nervous and sell their newer, riskier tokens first.

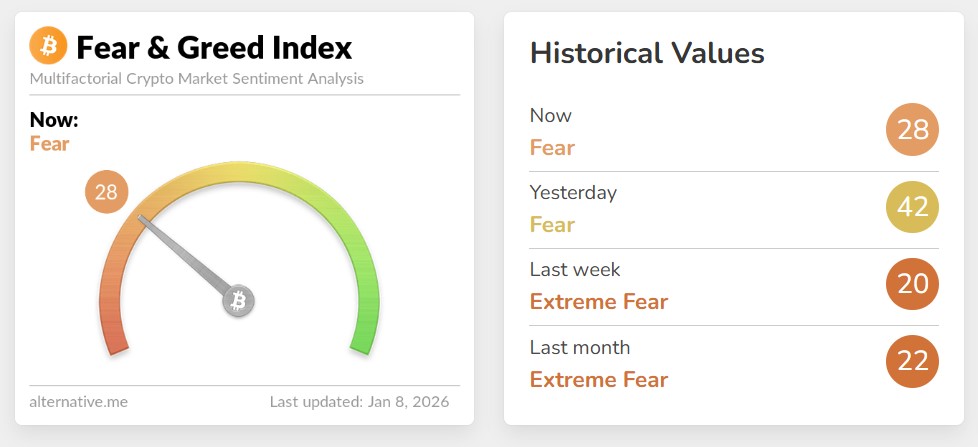

Extreme Fear: The "Crypto Fear and Greed Index" is currently at 28, which means people are feeling "Extreme Fear." In such conditions, recovery attempts in the new coin remain risky.

Will ZenChain Recover or Face More Risk? What Experts Say

In the short term, it's price recovery looks weak. However, if we look at the long-term ZenChain price prediction 2026, there is a chance for a comeback.

As highlighted by cryptocurrency expert Crypto GEMs, altcoins are sitting at an important support level, similar to what was seen before big altcoin rallies in 2018 and 2022.

A positive MACD signal is also starting to form, which means “Altseason 2026” is coming soon. If altcoin dominance starts, the coin could see a meaningful recovery. But for now, this is mostly a potential scenario until the shift starts.

ZTC Price Prediction 2026: What Could Happen Next?

-

The Bearish Path: If the price falls below $0.0040, it might keep going down toward $0.0033.

-

The Bullish Path: For things to get better, the asset needs to stay above $0.0040 and then climb back over $0.0050. The real test will be getting back above $0.0055. Only then will the recovery odds increase.

Conclusion

The current ZenChain price crash isn't just because of one thing. It's a mix of being a brand-new listing, cautious technicals, and a very weak crypto market.

What should investors do next? Traders should watch the $0.0040 key support level closely. A bounce from here will signal a bull run, while a fall from here will lead to bearish behavior.

YMYL Risk Disclaimer: The information provided in the above article is for educational purposes only and not financial advice. Investing in new cryptocurrencies like $ZTC is very risky. Always do your own research before investing.