Rails Airdrop Phase 2 and Official Listing Date Announced: Why February is the Month to Watch

The calendar just got a major crypto marker. Rails drops the roadmap for its second airdrop phase and pins down the long-awaited exchange listing. It all converges in February.

The Countdown Begins

Phase two distribution mechanics are locked in. The protocol is shifting from eligibility checks to active reward claims. This isn't another vague promise—it's a scheduled deployment on the mainnet.

From Airdrop to Active Trading

The listing date announcement turns speculative hype into a tangible liquidity event. It provides the exit ramp from airdrop receipt to portfolio placement. Markets now have a fixed point to price in the circulating supply shock.

Why February Matters

This creates a perfect storm of tokenomics events. Claiming windows open just as exchange order books go live. It forces a rapid transition from community ownership to price discovery—bypassing the usual stagnant post-airdrop period.

The cynic's view? Another perfectly timed liquidity injection before the quarter-end reporting cycle, giving traditional finance metrics a temporary, crypto-flavored sugar rush. But for the rest of us, it's a masterclass in momentum engineering.

Rails Airdrop Phase II Countdown Begins

This deadline is not symbolic. It marks the end of Season II and the final opportunity to qualify. Daily check-ins, quests, and evaluation tasks stop on this date. At least one Evaluation Quest is required for conversion, while KYC is only necessary for play evaluations. A $20 purchase remains optional, not mandatory.

New users are still able to join, mint card, connect a wallet, and earn points through previous trading history and quests. This design shows that the system values participation over early access. The Rails Airdrop is therefore still open but for only a limited time, so these days FORM the last opportunity for engagement.

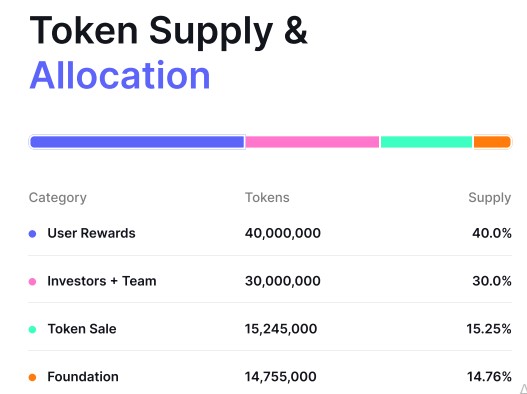

Rails Tokenomics Breakdown: Emphasis on Rewarding Users

A total supply of 100 million tokens has been defined in this project. The distribution pattern is community-centric.

User Rewards: 40,000,000 (40.0%)

Investors + Team: 30,000,000 (30.0%)

Token Sale: 15,245,000 (15.25%)

Foundation: 14,755,000 (14.76%)

From this balance, it is clear that almost half of the supply is allocated to users. That allocation directly supports the idea behind the Rails Airdrop, where active users receive the largest share of value creation. It also creates clarity for long-term supply distribution and market stability.

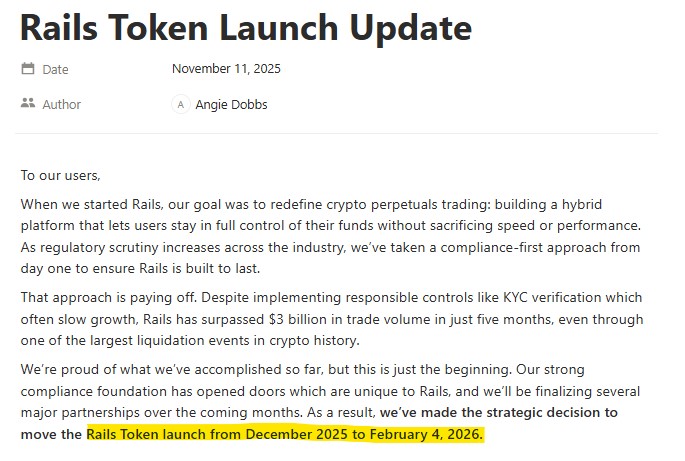

Rails Listing Date and TGE: February 4 the Day?

The official team has not yet confirmed a public TGE announcement. However, a blog published in November 2025 stated that February 4, 2026, was the final and fixed token listing date. No delays were expected according to that update.

With Phase II ending on February 1, a February 4 conversion event fits naturally into the timeline. If this date holds, exchange names and launch timings are expected to be shared very soon. This makes Q1 2026 the most likely window for the token’s first market appearance. The token Airdrop therefore transitions from participation phase into valuation phase within days.

Conclusion

The Rails Airdrop stands at a turning point. The closing of Phase II occurs on February 1, and with TGE on February 4, there’s a clear transition from points to tokens. The powerful tokenomics establishes whether user engagement leads to a sustainable ecosystem worth through this stage.

Note that this article is for information purposes only, not for investment purposes. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.