Polygon Price Surge Gains Momentum as Network Activity Shatters Records

Network usage isn't just climbing—it's exploding. And the price is following suit.

The On-Chain Reality Check

Forget the hype cycles and influencer chatter. The real story unfolds on-chain, where transaction volumes and active addresses are painting a picture of organic, utility-driven growth. This isn't speculative froth; it's genuine adoption.

Scaling Solutions in High Demand

As Ethereum's layer-2 battleground heats up, Polygon's infrastructure is being stress-tested by real-world applications. DeFi protocols, NFT marketplaces, and enterprise dApps are all piling on, drawn by the promise of lower fees and faster finality. The network is proving it can handle the load—and then some.

The Price-Network Effect

Here's the simple, often overlooked equation in crypto: sustained usage creates sustained value. When developers build and users transact, they're not just consuming blockspace—they're validating the entire economic model. Each new high in network activity reinforces the platform's fundamental proposition.

Of course, Wall Street analysts will still try to explain it with their traditional models—as if a P/E ratio could capture the velocity of a decentralized network. The surge continues, built not on promises, but on proven, relentless usage.

Source: X (Formerly Twitter)

At the same time, Project’s official account said,These messages show growing confidence inside the ecosystem.

Polygon Network Usage Is Hitting Record Levels

The main driver behind the price surge is network usage. The blockchain recently saw all-time-high activity. During this phase:

Over 13.6 million POL were generated in fees

More than 12.5 million tokens were burned

Daily burns crossed around 1 million tokens

A single day saw nearly 3 million token burned

This means supply is shrinking fast. When supply falls and demand remains strong, prices usually rise. The platform also ranked number one in network revenue among blockchains over the last week, proving people are truly using the chain.

Polygon Open Money Stack Changes the Game

Another major reason for the price surge is the Polygon Open Money Stack. This is a full financial framework that covers:

Payments

Wallets

Stablecoins

Compliance

Financial services

Blockchain infrastructure

The idea is simple: money should MOVE like information on the internet. Users should not need to understand blockchains, and businesses should not depend on slow banks. This turns it into serious financial infrastructure.

How POL Gains Value?

They made it clear that holders benefit when the network grows. POL earns value from:

Transaction fees

Token burns that reduce supply

Staking rewards

Future interoperability fees through Agglayer

When Polygon Chain and Agglayer succeed, holders benefit. That is why the $POL price rally feels more fundamental than speculative.

Why Is POL Outperforming?

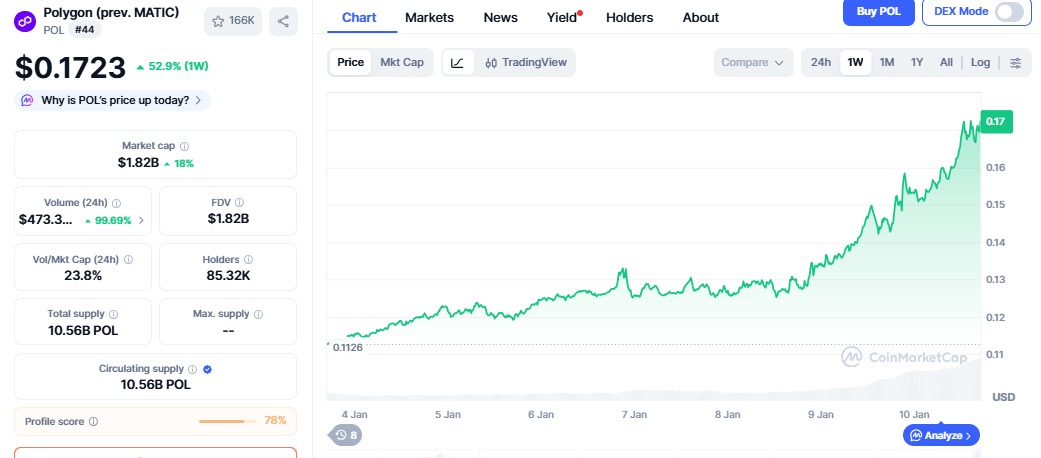

According to CoinMarketCap, It has gained more than 50% in one week.

Source: CoinMarketCap

This is not just market excitement. It is driven by:

Record network activity

Rapid token burns

Strong technical upgrades

Clear financial roadmap

What’s Next for the Price?

Polygon Price Prediction

It has broken resistance between $0.15 and $0.16. RSI is above 80, meaning it is slightly overbought. A small pullback is possible. If it holds above $0.16, the next targets are $0.18 and $0.20.

If the Open Money Stack gains adoption and burn rates stay strong, it could move toward $0.30 to $0.50 in 2026. Strong real-world payment usage could push it higher.

Final Thoughts

The polygon price surge shows that the it is growing through real demand, not marketing hype. Heavy token burns, strong network usage, and a bold financial vision are changing how investors see this digital currency. It is quietly building the rails for the future of digital money.

This article is for informational purposes only and not a financial advice, kindly conduct your own research before investing in the crypto markets.