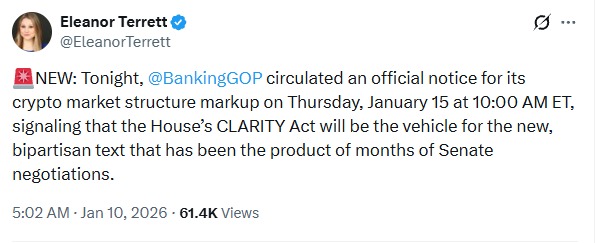

CLARITY Act Crypto Bill: Senate Schedules High-Stakes Vote for Jan 15 - The Crypto Industry’s Moment of Truth

The U.S. Senate just dropped a date that could reshape digital finance: January 15. That's when lawmakers will vote on the CLARITY Act—a bill that could finally draw regulatory lines in the crypto sand.

What's Actually in the Bill?

Forget vague promises. The CLARITY Act aims to cut through the regulatory fog by defining which digital assets are securities and which are commodities. It's a direct challenge to the current enforcement-by-lawsuit approach, proposing a framework instead of fines.

Why January 15 Matters

This isn't just another committee hearing. A Senate floor vote signals serious momentum. Passage could unlock institutional capital that's been waiting on the sidelines, fearful of regulatory whiplash. Failure would send the opposite signal—more uncertainty, more hesitation.

The Stakes for Builders & Traders

For developers, clarity means knowing the rules before you build. For exchanges, it defines compliance pathways. And for everyday holders? It potentially legitimizes holdings that regulators have treated like contraband. The bill bypasses years of bureaucratic drift, forcing a legislative answer to a defining question: Is crypto here to stay in the U.S.?

The Cynical Take

Of course, Wall Street veterans will note the timing—just enough runway for politicians to take credit before the next election cycle, and for banks to position their own crypto custody plays. Regulatory clarity often arrives just in time for the big players to consolidate their advantage.

The countdown to January 15 is on. The Senate isn't just voting on a bill; it's voting on whether America leads or follows in the next financial system.

The timing couldn’t be more critical. The industry is still haunted by the "October 10 Massacre" of late last year, where over $100B in market value evaporated in a single day of liquidations. To this day, we don’t have a full report on what or who triggered that crash. The CLARITY Act crypto bill is designed to ensure that those kinds of "black box" implosions never happen again by forcing exchanges out of the shadows and into a strictly monitored regulatory light.

How the CLARITY Act Crypto Bill Could End Market Manipulation

If you have long advocated for a market free from artificial distortion, these provisions represent a major victory. Analysts and traders, including well-known figures like Crypto Rover, estimate that this legislation could slash market manipulation by a staggering 70% to 80%. It doesn't just suggest better behavior; it makes common predatory tactics like wash trading (faking volume) and spoofing (placing fake orders to MOVE the price) federal crimes.

The bill also levels the playing field for the average investor by demanding:

Live Monitoring: Regulators WOULD finally have the "eyes" to spot foul play as it happens, rather than months later.

Proof of Reserves: No more guessing if an exchange actually has your money; routine, mandatory audits would be the new law of the land.

Institutional Clarity: By defining what is a commodity versus a security, the bill clears the path for massive Wall Street firms to invest in altcoins beyond just Bitcoin.

The 60-Vote Hurdle: Will it Pass?

Despite the excitement, the path to President Trump’s desk isn’t a guaranteed sprint. The Senate is currently split 53–47, and since any major market structure bill needs 60 votes to pass the floor, Republicans must win over at least 7 Democrats. Alex Thorn, head of research at Galaxy, suggests that the "canary in the coal mine" will be the committee vote next Thursday. If 2 to 4 Democrats join the Republican majority, it signals a strong bipartisan surge that could see the bill signed into law by March 2026.

Conclusion

As we edge closer to the January 15 deadline, the tension in the crypto space is palpable. The CLARITY Act crypto framework represents more than just new rules; it’s an attempt to turn digital assets into a "grown-up" asset class that can sit alongside gold and stocks without the constant fear of a covert explosion. While a failed vote might cause a short-term dip in sentiment, the momentum behind this framework suggests that Washington is finally ready to stop arguing and start legislating.

Mark your calendars next Thursday could be the day the crypto market finally gets the clarity it has been begging for.

YMYL Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Readers should consult qualified professionals before making financial decisions related to cryptocurrency or securities.