XRP Price Plummets: Unpacking the Shocking Drop Despite ETF Launch in 2025

XRP's market performance defies logic—again. Just as Wall Street rolls out the red carpet with a shiny new ETF, the token nosedives. What gives?

Market Whiplash: ETF Hype Meets Cold Reality

Traders expected fireworks after the XRP ETF approval. Instead, they got a damp squib. The 'buy the rumor, sell the news' playbook struck with brutal efficiency—because nothing makes crypto traders happier than cutting their own profits.

Whales Playing Hungry Hippos

On-chain data shows mega-wallets dumping bags while retail FOMOed into the ETF. The oldest trick in the book: let the plebs fund your exit liquidity. Classic decentralized finance—where the little guy gets decentralized from his money.

Regulatory Sword Still Dangling

That lingering SEC lawsuit won't vanish just because BlackRock slapped XRP into an ETF wrapper. Institutional money wants clarity, not clever legal footwork.

Blood in the Water

Now the technicals look ugly. Key support levels shattered like a crypto influencer's credibility. Next stop? Probably lower—unless the 'greater fool' theory kicks in harder than a Reddit hype squad.

Silver Lining Playbook

Long-term holders shrug. Volatility? Expected. Manipulation? Inevitable. Just another Wednesday in crypto land—where fundamentals go to die and narratives get rich.

The launch of the first spot XRP ETF was expected to bring a strong boost to the market, but instead, XRP has slipped into another round of losses. The token fell more than 7% in a single day, dropping from the $2.50 zone and sliding toward $2.20 as broader market pressure continues to weigh down sentiment.

For many holders, the big question is simple, why is XRP falling even after such a historic launch?

Unexpected XRP ETF Debut

Crypto analyst Nick Crypto Crusader explained that the price drop has less to do with XRP and more to do with the overall market. Bitcoin is still selling off sharply, pulling down most altcoins with it. During such periods, even positive news struggles to lift prices.

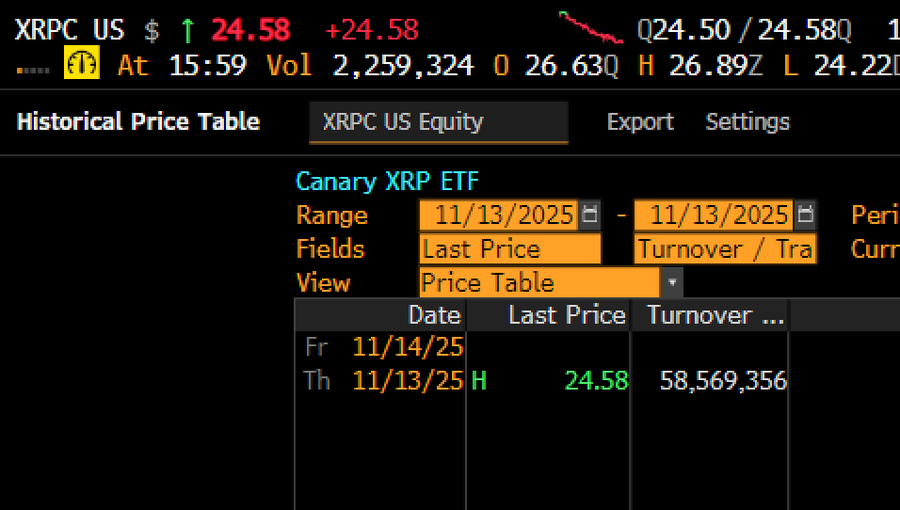

Still, the debut of Canary Capital’s spot XRP ETF (XRPC) shocked many analysts. The fund opened with over $58 million in first-day trading volume, the strongest ETF launch of the year.

Senior ETF analysts had expected around $17 million, yet that estimate was crushed within the first 30 minutes of trading.

Crusader noted that while the inflows were impressive, they remain small compared to XRP’s massive market cap. It will take far larger inflows to influence spot prices meaningfully.

Real ETF Buying Hasn’t Started Yet

Another key point he highlighted is that ETF launches rarely show instant price reactions. Even bitcoin dipped in January 2024 when its spot ETFs went live. The bigger moves came later, once institutional buying settled in.

Crusader also added that Canary Capital still needs a few days to purchase the XRP required to back the ETF.

This means the real buying pressure from the fund hasn’t even started yet, something that could reduce supply once inflows scale up.

XRP Faces Major Breakdown Warning

XRP tried to push higher above $2.50, but, much like Bitcoin and Ethereum, it couldn’t maintain the momentum. The price quickly reversed and fell below $2.30, dropping nearly 9% as the entire market turned red.

Meanwhile, trader ChartNerd noted that XRP recently broke down from a descending triangle, losing the $2.70 support in late October. This MOVE pushed the token into the $2.00–$2.20 support zone.

For XRP to recover, it must break above $2.40. If it fails, the price could slide again, with key support levels at $1.80 and $1.50.