Arbitrum Price Prediction 2025: Can On-Chain Strength Fuel a 10X Rally?

Layer 2 scaling solution Arbitrum is flashing bullish signals—but can its tech stack and adoption metrics translate into a market-crushing rally?

On-chain data shows surging TVL and transaction volume, while developers flock to its EVM-compatible environment. The protocol now processes more transactions than Ethereum mainnet during peak congestion.

Yet price action remains 68% below its 2024 ATH. Market makers cite overhang from early investor unlocks, while DeFi degens whisper about an imminent ecosystem fund injection.

Technical analysis paints a clearer picture: A weekly close above $2.40 could confirm a macro trend reversal. That would put the $10-12 range in play—a 5-6X move from current levels.

Of course, this assumes crypto's casino economics hold. When the Fed flips the liquidity spigot back on, even the most 'fundamentally strong' projects tend to moon for all the wrong reasons.

Arbitrum’s strong fundamentals continue to stand out across the industry, forming an important base for the broader discussion around arbitrum price prediction 2025. Despite price uncertainty, the chain’s sustained growth in contracts deployed, trading activity, stablecoin demand, and user engagement signals healthy ecosystem expansion that may influence future trends.

On-Chain Fundamentals Supporting the Arbitrum Price Prediction 2025 Outlook

Arbitrum consistently ranks among the most active blockchain ecosystems throughout the year, maintaining high developer and user activity across multiple categories.

According to Token Terminal data, nearly 3.9 million smart contracts were deployed on Arbitrum One over the past 365 days, placing it in the top tier of chains with long-term, sustained development. This metric highlights real infrastructure and application growth, which is an important foundation for evaluating any Arbitrum price forecast.

Moreover, the chain recorded an impressive $240.8 billion in ecosystem DEX trading volume over the same period. This figure reflects a strong presence of liquidity and continuous interaction across decentralized applications. Such consistent trading activity indicates the chain’s relevance within the broader DeFi landscape and supports the structural strength behind Arbitrum crypto.

Ecosystem Revenue and User Activity Strengthening the Arbitrum Price Chart Outlook

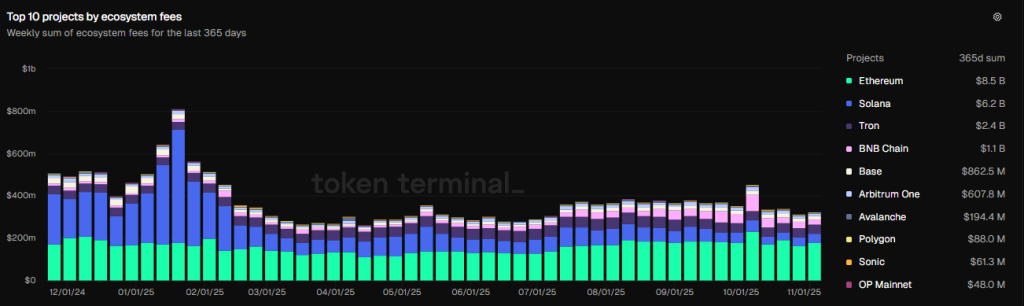

In addition to trading volume, the weekly ecosystem fees over the last 365 days reached $607.8 million, demonstrating high economic value generated by applications running on the network. This level of fee production reinforces Arbitrum’s position as one of the most active and economically relevant chains.

User participation further supports this trend. Arbitrum has averaged 2.4 million monthly active addresses across the past 365 days, which is one of the strongest user activity figures among L2 networks.

Additionally, the chain maintained 867,000 monthly monetized users, showing that a large portion of the community is engaging in revenue-generating transactions rather than passive interactions. Together, these metrics indicate robust long-term demand that may contribute to future Arbitrum Price USD stability and growth.

Stablecoin Demand and TVL Trends Supporting Arbitrum Price Prediction 2025

Beyond user activity, stablecoin demand is another important strength. Arbitrum holds $6.6 billion in stablecoin supply, ranking fourth globally behind Ethereum, Tron, and Solana.

This level of on-chain liquidity underscores strong demand from retail and institutional users, which often contributes positively to market structure and future valuation scenarios.

Further supporting interest, Arbitrum’s TVL stands at $2.88 billion, according to DefiLlama. While below the October peak of $4.108 billion, the decline appears healthy rather than alarming, especially considering the contrast with the current Arbitrum price chart consolidation.

Technical Structure Aligning With Arbitrum Price Prediction 2025 Scenarios

Technically, the Arbitrum price shows signs of stabilization after liquidity was grabbed on October 10. Current price action sits near a key horizontal support zone connected to the April and June swing lows. If a reversal forms at this level, it WOULD mark a classic third reaction point which would be potentially aligning with a reclaim structure.

If such a move occurs, analysts expect a potential recovery toward $0.62, the August swing high, by year end. This technical setup, combined with Arbitrum’s strong on-chain base, helps frame reasonable expectations for any mid-term Arbitrum price forecast. These elements collectively shape the broader narrative surrounding Arbitrum price prediction 2025 as the project continues to expand.