XRP Price Forecast: October 25-31 Showdown – Bulls or Bears in Control?

XRP traders brace for a volatile finale to October as key technical levels come into play.

Will the SEC saga finally loosen its grip on price action—or just another week of sideways purgatory?

Breaking Down the Battle Lines:

- Resistance at $0.55 remains the bull's Everest

- Daily RSI flirting with overbought territory

- Exchange reserves hint at accumulation phase

Meanwhile, Bitcoin's dominance wobbles—altcoins smell blood in the water. (Cue the usual 'this time it's different' chorus from bagholders.)

Prediction? Pain. Or profits. Probably both.

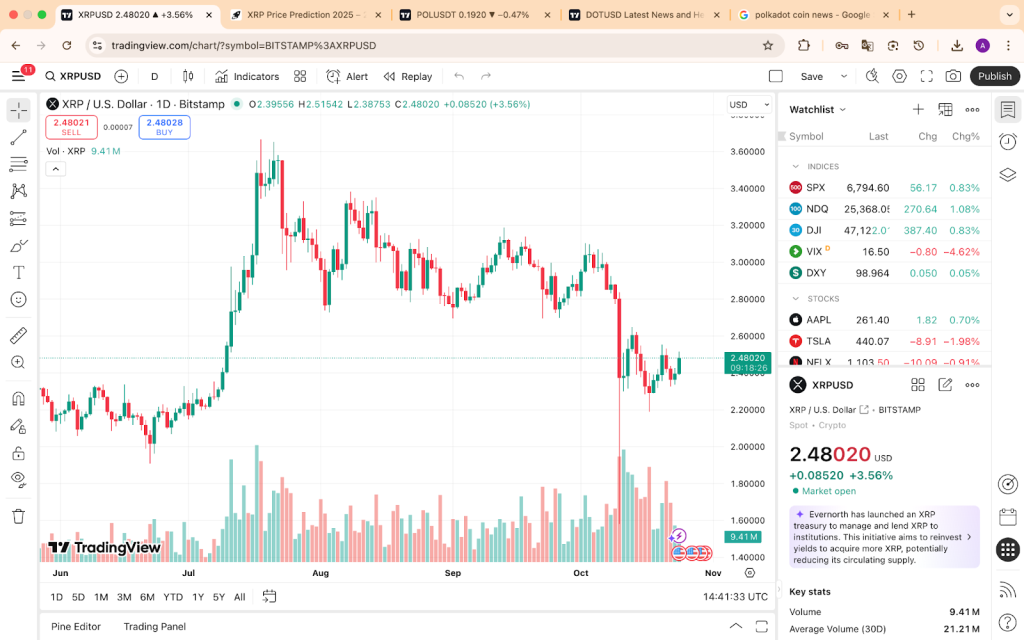

XRP is trading around $2.48 and is being watched closely by investors as the new week begins. The market remains jumpy after a series of bumpy sessions, but bear sentiment has yet to materialize. Analysts say in the short term, some weakness may be seen before the turnaround.

XRP Short-Term Outlook

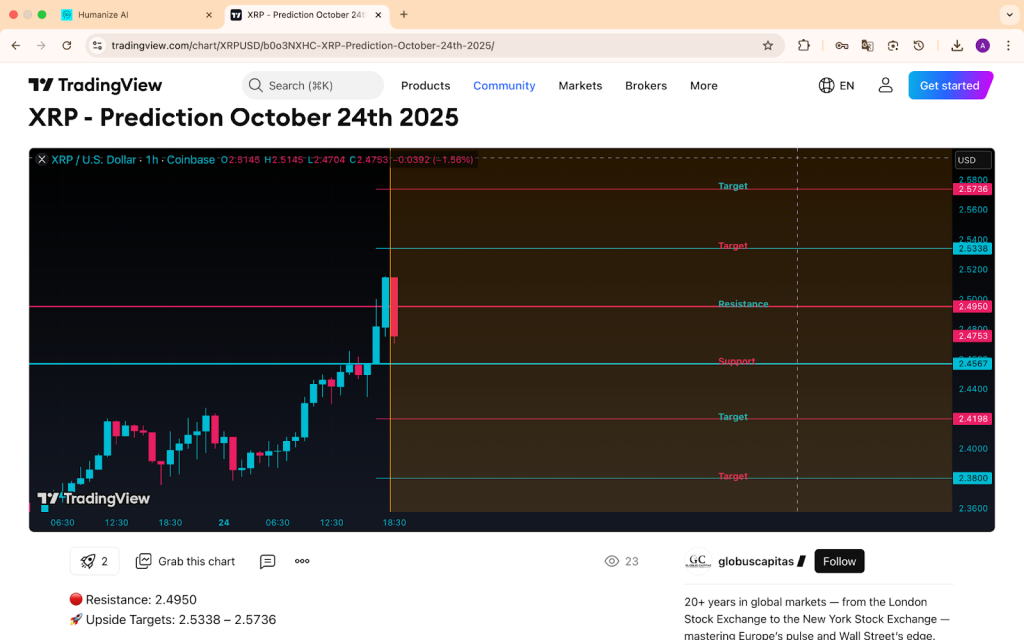

Source: Globuscapitas

According to Changelly’s latest data, the XRP price prediction for October 25–31 expects a slight dip early in the week. XRP is likely to be near $2.45 on October 25, going down about 1.32%. By October 26, the forecast indicates a dip toward $2.42. This aligns with the -2.53% move. On October 27 and 28, XRP may remain around $2.41, which aligns with the -2.93% analyst call. That level is basically the worst case in the near-term base scenario.

After that, the model expects a slight recovery. By October 29, XRP could bounce to $2.44. On October 30, a move toward $2.47 is in view. By October 31, XRP is projected to be NEAR $2.48, almost back where it started the week, with only a tiny -0.11% change.

Technical and Market Analysis

XRP’s four-hour chart shows a mixed but positive pattern. Its 50-day moving average continues to rise. This indicates short-term buying power. However, its 200-day moving average has been falling since October 20. When these two indicators disagree, it tends to lead to range-bound activity. In XRP’s instance, that range remains narrow between $2.40 and $2.55.

Source: Tradingview

The token’s circulating supply stands near 59.97 billion XRP, giving it a market capitalization of $144.8 billion and securing its position as a top-five cryptocurrency. While XRP is down 15.7% over the past month, the consistent defense of key supports suggests quiet accumulation. Traders view this as a dip zone for potential re-entry if broader sentiment improves.

Remittix: Building Real Utility In The PayFi Era

While XRP battles short-term pressure, Remittix (RTX) is winning attention for real-world blockchain adoption. The project lets users send crypto directly to bank accounts in over 30 countries, offering real-time foreign exchange conversion that turns digital payments into usable fiat. Its PayFi wallet beta is now live, giving users a working product that bridges crypto and everyday finance.

Remittix has raised over $27.7 million, sold 681 million tokens, and secured listings on BitMart and LBank after hitting key funding milestones. The project is CertiK-verified and currently ranked #1 among pre-launch tokens, backed by a 15% USDT referral program that pays users daily via the RTX dashboard.

XRP Outlook And Final Thoughts

The xrp price prediction for October 25–31 remains optimistic. If XRP defends at $2.40, it could climb back toward $2.48–$2.50 by the end of the month. However, a clean break below that zone may trigger fresh selling. Overall, traders see this as a waiting game — a period of consolidation before the next significant move.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway