Michael Saylor’s $1B Bitcoin Move: Fact-Checking the Viral Strategy Claims

Did MicroStrategy just dump $1 billion in BTC—or is this another case of crypto Twitter spinning rumors into 'facts'?

Let’s dissect the hype.

The Setup: Saylor’s signature HODL rhetoric clashes with whispers of a nine-figure exit. No surprise—Bitcoin maximalists are screaming betrayal, while skeptics roll their eyes at yet another 'trust us, it’s strategic' corporate maneuver.

The Reality Check: Public filings show no mass sell-off. But with MicroStrategy’s debt-fueled Bitcoin buys, even a modest rebalance could spark panic. Remember when 'long-term hold' meant more than one earnings cycle?

The Punchline: In crypto, optics trump fundamentals. Whether Saylor sold or not, the market reacts first, asks questions never. Classic Wall Street playbook—just with laser eyes and memes.

Following the recent crypto market sell-off, Bitcoin slipped below $95K, its lowest in a month, sparking a wave of online rumors that Michael Saylor’s MicroStrategy sold over $1 billion in BTC to cut losses. But how accurate are those claims?

Here is an in-depth fact-check to clarify the situation.

Where Did This Claim Come From?

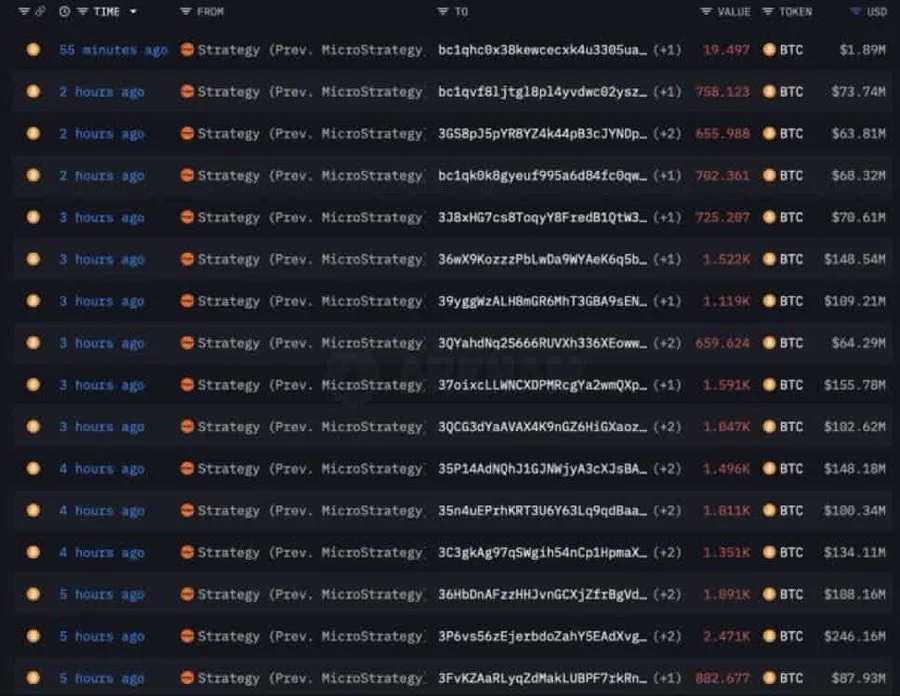

The claim was first magnified by crypto influencers and on-chain trackers highlighting wallet activity attributed to “Strategy (Prev. MicroStrategy).” The attached chart shows over a dozen large Bitcoin transactions in recent hours, some worth tens or hundreds of millions of dollars.

This data led to speculation that Strategy and Michael Saylor himself were selling off their bitcoin position. But are these claims supported by facts?

So what’s really happening?

Coinpedia Review: What’s Actually True?

According to verified financial media and Strategy’s own disclosures, there have been no reports, SEC filings, or company statements confirming any BTC sale in 2025. On the contrary, Strategy has recently continued buying Bitcoin, adding 487 BTC on November 10, and 397 BTC the week before.

Their total holdings now approach 641,692 BTC worth over $65 billion as of mid-November 2025.

Bitcoin’s on-chain data shows wallet activity linked to Strategy, but these movements don’t confirm any selling. Arkham Intelligence platform noted that Strategy has been moving billions of dollars of BTC as part of what appears to be a change in custodians for some of their Bitcoin.

So far, no on-chain or exchange evidence shows that these transfers resulted in actual Bitcoin sales.

No public filings, press releases, or major financial media outlets have reported a sale of Bitcoin by Strategy in 2025. On the contrary, filings show a pattern of consistent accumulation.

Michael Saylor continues to champion Bitcoin publicly, predicting dramatic long-term price increases and reiterating a “never sell” approach.

Summary Table: Coinpedia’s Evidence Against the Theory

| Claim Made by Theory | Coinpedia’s Counter-Evidence |

| Strategy has sold over $4B of its Bitcoin holdings | |

| Michael Saylor is selling Bitcoin | |

| On-chain large BTC transfers are confirmed sales |

Conclusion

| Claim | Michael Saylor’s Strategy Sold Over $1B of Bitcoin |

| Verdict | |

| Fact-Check by Coinpedia | As per Coinpedia research and a review of official sources, there is no credible or verifiable evidence linking the Strategy to having sold any significant amount of Bitcoin in 2025. The rumors are based mainly on misinterpretation of on-chain movements that lack confirmation of actual sales. |

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.