XRP Whales Gobble Up Tokens at 7-Year High While Retail Panics - What Do They Know?

Fear's gripping the market, but the biggest players aren't running—they're loading up. XRP whale accumulation just hit a level not seen in seven years, creating a stark divergence between retail sentiment and institutional action.

The Contrarian Bet

While headlines scream volatility and social media feeds flood with doom-scrolling, on-chain data tells a different story. Massive wallets are executing a quiet, sustained accumulation strategy. This isn't a one-day spike; it's a calculated position build-up that suggests a core belief in a fundamental disconnect between current price and long-term value.

Decoding the Signal

Whale movements often serve as a leading indicator, flashing before major trend reversals. Their ability to absorb sell-side pressure provides critical support, while their buying can exhaust available supply on exchanges. This creates a coiled-spring scenario—when general sentiment finally flips, the path of least resistance could be sharply upward due to a lack of immediate sellers.

The Cynical Take

Of course, in crypto, every 'smart money' signal comes with a caveat. Sometimes, a whale is just a fund rebalancing its portfolio, or—in the grand tradition of finance—one large entity making a very expensive mistake that the rest of us get to watch in real-time.

The bottom line? The market's fear gauge is red, but the smart money's ledger is telling a story of green conviction. Whether this is prescient accumulation or just another high-stakes gamble remains the trillion-dollar question.

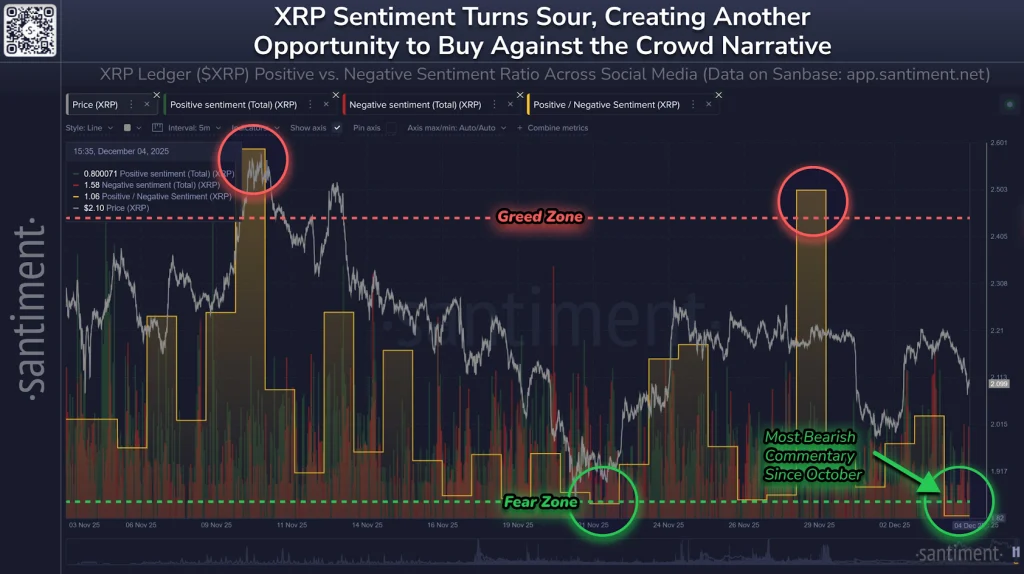

XRP Price has seen a tough couple of months, falling 31%, but new data suggests that a potential reversal could be on the horizon. Social sentiment around XRP shows the highest level of fear, uncertainty, and doubt (FUD) since October.

According to social metrics, days marked with green circles indicate abnormally high bearish comments about XRP (Fear Zone), while red circles show bullish days (Greed Zone). Interestingly, the last time sentiment reached this level of fear on November 21, XRP surged 22% in just three days before profit-taking slowed the rally.

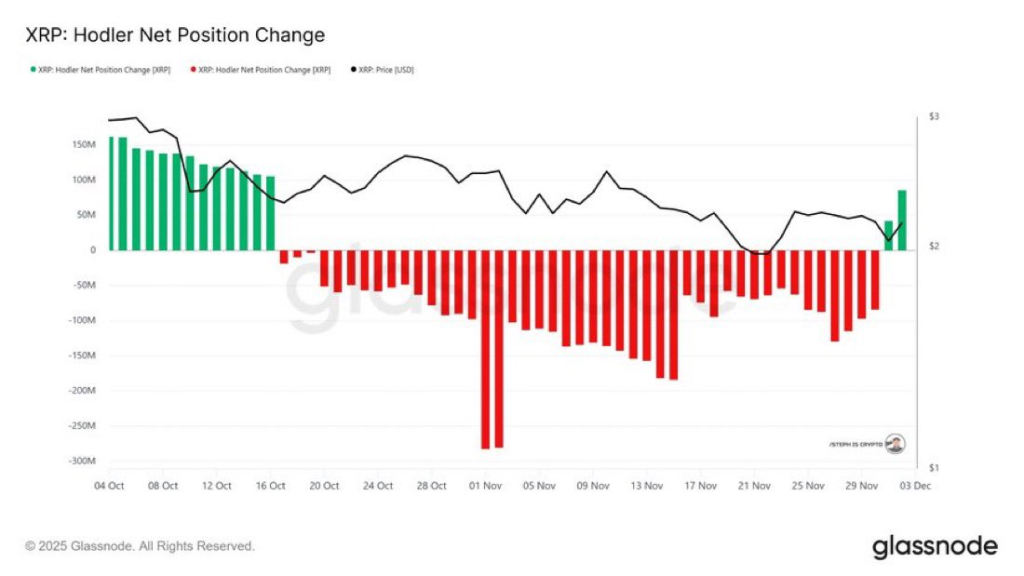

XRP Whale Accumulation Hits 7-Year High

After nearly a month of heavy outflows, XRP holders have flipped positive. Recent data shows the strongest net position increase since early October. When holders shift from selling to accumulation, it’s often an early sign that a price reversal may be coming.

XRP whale activity is showing a rare trend. While the number of mega whale wallets has dropped by 20% over the past two months, the remaining whales are holding more XRP than in the past seven years—about 48 billion XRP.

- Whale Wallet Count Drops: 569 fewer wallets in eight weeks

- Total Holdings Surge: 48 billion XRP

This unusual pattern, with fewer wallets but larger holdings, indicates that major investors are quietly accumulating XRP, suggesting strong long-term confidence.

XRP Price Analysis

According to Ali Charts, xrp price recently broke the $2.07 support, prompting the market to focus on the $2.05–$1.90 demand zone. Despite strong inflows into XRP ETFs, nearly $850 million since launch, short-term price pressure remains. Unless XRP climbs back above $2.07–$2.11, the price is likely to stay under pressure.

The TD Sequential indicator recently issued a buy signal on XRP’s weekly chart, suggesting that selling may be slowing. With whales accumulating and XRP holding above the $2 support, traders are watching for a possible rebound.

Historically, similar conditions in late 2018–early 2019 preceded significant XRP rallies, with whales accumulating during periods of stagnation before a bull cycle.

XRP has been slowly trending down, and overall market sentiment remains neutral to negative. However, several important signs are starting to strengthen. Whale accumulation has reached a 7-year high, institutional inflows through ETFs are growing, and selling pressure is decreasing.

XRP whale holdings will be crucial. If holdings drop sharply, it could signal whales selling into strength. But if accumulation continues alongside price recovery, it suggests strong confidence in XRP’s long-term growth.