XRP Price Primed for 16% Surge – Here’s the Market Catalyst

XRP's chart just flashed a bullish signal traders haven't seen in weeks.

The Technical Setup

A decisive break above a key descending trendline on the daily timeframe is fueling the bullish narrative. This isn't just a minor bounce; it's a potential trend reversal signal that has historically preceded significant moves. The 16% target aligns with the next major resistance zone, a level where sell orders typically cluster.

Liquidity in Play

Market makers are eyeing a pool of liquidity sitting just above current prices. A push to capture those orders could create the momentum needed for the surge. It's classic market mechanics—price often moves to where the money is waiting, whether for execution or stop-loss hunting.

Broader Market Winds

Sentiment across digital assets is shifting. While XRP has its own unique drivers—a nod to its endless regulatory theater—it rarely moves in a vacuum. A rising tide in major cryptocurrencies lifts most boats, even the ones occasionally stuck in legal dry dock.

The Bottom Line

The pattern is clear, the level is defined, and the crowd is getting restless. In a market that rewards those who bet on momentum, this setup is too conspicuous to ignore. Just remember, in crypto, a 'sure thing' is often just a story waiting for a reason to reverse—usually right after the last buyer gets in.

XRP price today is again testing the $2 support level, a zone that has held firm several times this year. Each time XRP slips to this range, buyers step in, and the same behavior is unfolding now.

XRP whales are buying more, ETF inflows are increasing, and the price is moving in a tight range. Top analyst Ali Martinez thinks this could lead to a 16% price jump.

XRP Price Rebounds From $2 Support

XRP price dropped toward $2.00 before bouncing back above $2.08, showing early signs of strength. While the price rise itself was small, something notable happened in the background as the trading volume jumped by 77.5%.

This stood out because Bitcoin, Ethereum, and solana all saw declines in both price and volume at the same time.

Analysts say this kind of split behavior often shows quiet buying during dips, especially by whales looking to build positions before a bigger move.

Institutional & Whale Activity Tightening Supply

Bitnomial’s CFTC approval to offer an XRP/USD spot contract has increased interest from regulated U.S. investors.

At the same time, spot XRP ETFs have already attracted close to $900 million in inflows since launching, pointing to steady demand.

Ripple also drew attention after moving 250 million XRP into an unknown wallet. Shortly after, exchange balances dropped by 2.51%, meaning fewer tokens are sitting on trading platforms. When available supply shrinks like this, it often signals that major players are positioning for a MOVE rather than selling.

XRP Price 16% Breakout Coming

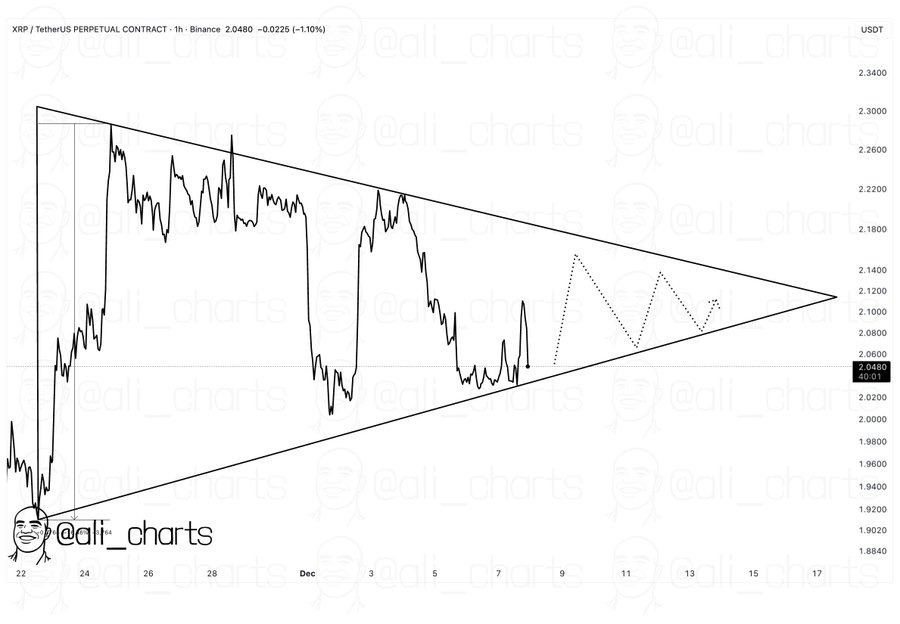

Looking at the chart, Ali Martinez notes that XRP is moving inside a tightening symmetrical triangle, a pattern that often leads to sharp breakouts.

Over the past week, XRP has been squeezed between $2.03 and $2.18, signaling that volatility is compressing. He suggests that when such a squeeze occurs, volatility is compressed, and when it releases, it usually does so quickly.

Therefore, Martinez expects a 16% breakout once XRP escapes the triangle, which WOULD place XRP near $2.40–$2.45 if it breaks the upper trendline.

But if XRP slips below $2.02, traders warn of a possible drop toward $1.85–$1.90.

With whales buying, supply tightening, ETFs pulling fresh inflows, and the chart reaching its final squeeze point, XRP sits at a crossroads.