PYTH Network’s New Reserve: The Catalyst for an 80% Chainlink-Style Surge?

PYTH Network flips the switch on a new reserve mechanism—and the market holds its breath for a repeat of history.

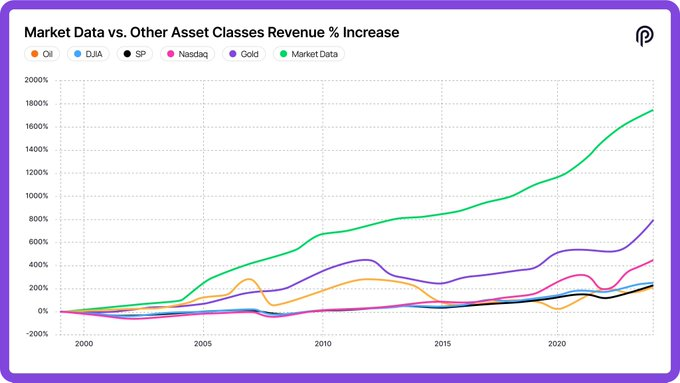

Oracle protocols are the silent engines of DeFi, and their tokenomics can spark explosive moves. The launch of PYTH's reserve isn't just a technical update; it's a potential powder keg for liquidity and validator incentives. Remember Chainlink's 80% rally on similar fundamentals? Traders are circling, wondering if the script is about to play out again.

The Mechanics of Momentum

This isn't about enabling features—it's about strategically locking supply and supercharging network security. The reserve acts as a war chest, funding ecosystem growth and aligning long-term stakeholders. It cuts through inflationary pressures and bypasses the short-term speculation that plagues lesser projects. For a data oracle, credibility is everything, and this move stakes a claim on it.

A Calculated Gamble in a Cynical Market

Let's be real: in crypto, every 'fundamental upgrade' is also a bet on trader psychology. The mere hint of scarcity, even artificial, gets priced in faster than you can say 'token unlock.' An 80% rally isn't just about code; it's about narrative catching fire in a market desperate for the next big thing—proving once again that in finance, the best story often wins, at least until the quarterly report.

So, will history rhyme? The pieces are on the board. PYTH just made its power move.

The latest announcement surrounding the new PYTH Network Reserve has has shed some lights on the crashing Pyth Network price as the project now claims to shift toward a sustainable, revenue-backed value model. With PYTH Network price today hovering near $0.064, the market now weighs whether this structurally reinforced mechanism can catalyze renewed upside momentum similar to past Chainlink reserve-driven 80% rally witnessed in August this year.

PYTH Reserve Introduces a New Value Accrual Engine

The launch of the Pyth Network Reserve marks a substantial shift in how network value is reinforced. Based on the information from X post, under the new mechanism, the ecosystem revenue flows directly into the PYTH DAO treasury, which then conducts systematic monthly open-market purchases of PYTH.

Essentially, this structure aims to convert all real customer revenue into long-term value support for the PYTH Network crypto, which is indeed a significant benefit to PYTH holders.

Introducing the PYTH Reserve: turning real revenue growth into sustainable network value.

Pyth Pro surpassed $1M annualized revenue in its first month, and that revenue now fuels systematic PYTH purchases on the open market.

More adoption. More revenue. More value. Let’s dive… pic.twitter.com/NqodrKfGoK

![]()

Importantly, the reserve is going to purchase, per the data, about one-third of the treasury every month. A somewhat different reserve was announced by chainlink this August. Perhaps the vibe is different here regarding the model, but the idea is to receive similar treatment to the LINK price.

During that period, the Chainlink price surged nearly 80% within 19 days, creating a notable benchmark for market observers assessing how Pyth Network Price chart movements may respond to this development.

Revenue Streams Powering the Reserve

They informed the public that the PYTH Network Reserve is supported by four Core ecosystem revenue streams. Pyth Pro, which surpassed $1 million in annualized revenue in its first month, and Pyth Core, which has been generating recurring on-chain revenue across over 100 chains.

Likewise, they have Entropy, which is also gaining traction in the gaming field, prediction markets, and even L1 integrations. And, Express Relay, that’s solely designed for the purpose of providing low-latency blockspace and competitive execution.

PYTH said, these products collectively FORM the network’s economic engine. This is aligning adoption with treasury growth and, ultimately, with potential buying strength on the open market.

Market Opportunity Supports Long-Term Expansion

Their post also had information about their institutional demand, which remains a central storyline for any deep-diver investor.

They announced that institutions are spending over $50 billion annually on market data, and the PYTH network believes capturing even 1% of that market WOULD reach around $500 million in ARR, and they are pretty confident that they could significantly expand the PYTH Network Reserve.

Moreover, Pyth Pro’s adoption by major financial institutions and active DeFi protocols positions PYTH as one of the fastest-growing data services in recent cycles.

DeFi Activity Declines Add Weight to the Catalyst

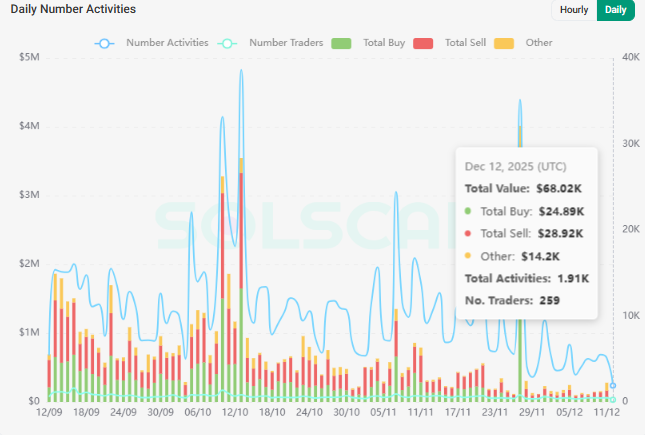

While the narrative is relatively strong, but for now, the onchain activity tells a different story, which appears to be in problem state. Data from visualizing Solscan shows that DeFi activity has steadily declined since mid-September. Daily activity values have fallen from around $2 million range to around $68,000, with active traders sliding from around 1,170 to just 259 by December 12th.

This deterioration highlights why the PYTH Reserve may be well-timed, as the ecosystem appears to need a catalyst capable of reenergizing participation.

Although early excitement resembles the lead-up to the Chainlink reserve rally, whether PYTH Network price USD reacts similarly remains dependent on investor reception and sustained demand.

Watching the $0.064 Zone as the Reserve Activates

With PYTH Network price today trading NEAR $0.064, an 80% rally similar to Chainlink’s move, for instance, could theoretically push it toward $0.12 by year-end.

Additionally, the PYTH Network price forecast suggests that if momentum extends into early 2026, some analysts predict that the target will shift to a price near $0.22. For now, the market will focus on how the PYTH Network Reserve influences supply dynamics and sentiment in the weeks ahead.