Crypto Whale Bets $612M on BTC, ETH & SOL—Is This the Signal for a Major Market Rally?

A single entity just placed a staggering $612 million bet on Bitcoin, Ethereum, and Solana. The market is holding its breath.

The Whale's Move: Reading the Tea Leaves

When a whale of this size surfaces, it sends ripples—or waves—through the entire crypto ocean. A position this massive isn't just a trade; it's a statement. It screams conviction that the current prices for these blue-chip and high-performance assets are a bargain. Forget the retail FOMO; this is institutional-grade confidence, or perhaps just a very expensive gamble.

Beyond the Headline: What Triggers a True Rally?

One whale can't pump the entire market alone—but it can light the fuse. For a sustainable rally to ignite, this kind of headline-grabbing capital needs to meet broader momentum. Watch for rising trading volumes across major exchanges, a surge in stablecoin inflows, and positive net flows into spot ETFs. If other large wallets start mirroring this bullish behavior, the dominoes could fall fast.

The Contrarian View: A Cynical Take

Let's not get carried away. In traditional finance, we'd call a concentrated bet this large 'reckless'—but in crypto, it's hailed as 'visionary.' Sometimes, a whale is just a fund with a high risk tolerance and a PR team ready to spin the narrative. Remember, for every buyer, there's a seller who thought it was a great time to cash out.

The signal is flashing. Whether it's a false start or the beginning of the next leg up depends on whether the rest of the market decides to follow the money.

Crypto markets continue to trade in a cautious but steady range, with Bitcoin price holding between $91,500 and $93,800, while bulls attempt to regain control. ethereum price has pushed back toward the $3,250 zone, and Solana price remains firm above $135, hinting at underlying buyer interest even as volatility remains compressed across major assets.

Against this backdrop, one wallet has been aggressively increasing exposure—and the scale of these positions is now drawing the market’s attention.

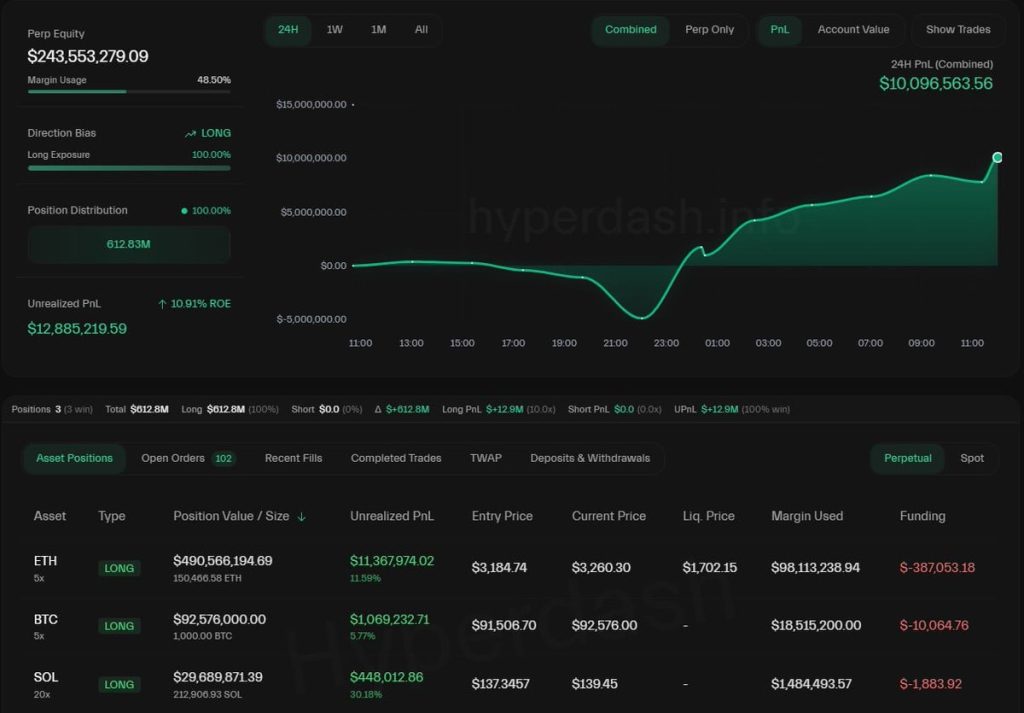

Whale Adds Over $612 Million in Long Exposure

A closely watched crypto whale has ramped up long exposure to more than $612 million, adding heavily to ETH, BTC and SOL positions. The move comes as market volatility tightens, suggesting large players may be positioning early for a potential shift in momentum.

The long positions are distributed across three top assets, Ethereum, Bitcoin and Solana, with $490.5M, $92.5M and $29.8M in long positions, respectively. The account currently shows an unrealised profit of $12.8M, yet instead of scaling out, the whale has continued adding size—a behaviour that typically signals confidence, not hesitation. With 100% long exposure and moderate 5x leverage, the structure of the portfolio reflects a clear directional view: the next meaningful move will be higher.

Does This Accumulation Hint Towards a Major Bullish Move?

This isn’t a random accumulation. The distribution across ETH, BTC, and SOL shows a deliberate, structured strategy. ETH is the highest-conviction play, with nearly half a billion in exposure; BTC acts as the market anchor, offering stability and directional correlation; and SOL provides high-beta upside, capturing momentum during strong alt-led rallies.

Whales don’t add to weakness unless they believe the downside risk has faded. Besides, wave structures across these cryptos are coiling, which aligns with volatility expansion setups. The positioning suggests the markets are preparing for an upside breakout, but not a breakdown.

Here’s What May Come Next!

As the whale’s long exposure grows, market structure is tightening around key levels, and liquidity is clustering on both sides of the price. This setup now points to two potential scenarios depending on how momentum develops in the coming sessions. If the momentum expands from the current levels, the Ethereum price could retest the $3,300 to $3,500 range, the Bitcoin price may challenge $95,000, and the Solana price may revisit the $142 to $145 range.

This isn’t just one trader taking oversized risks—it’s a signal of where conviction capital believes the market is heading. With over $612 million deployed on the long side, smart money is clearly preparing for a broader crypto rally. Therefore, it WOULD be interesting to know how the upcoming trade dynamics unfold.